On July 12, 2022, the General Department of Taxation issues the Official Dispatch No. 2455/TCT-DNNCN regarding the implementation and use of electronic invoices and documents.

The General Department of Taxation guides the use of e-receipts as follows:

Although, in accordance with the Decree No. 123/2020/ND-CP, from July 01, 2022, organizations may use e-receipt. However, the standard format of e-receipts and implementation procedures.

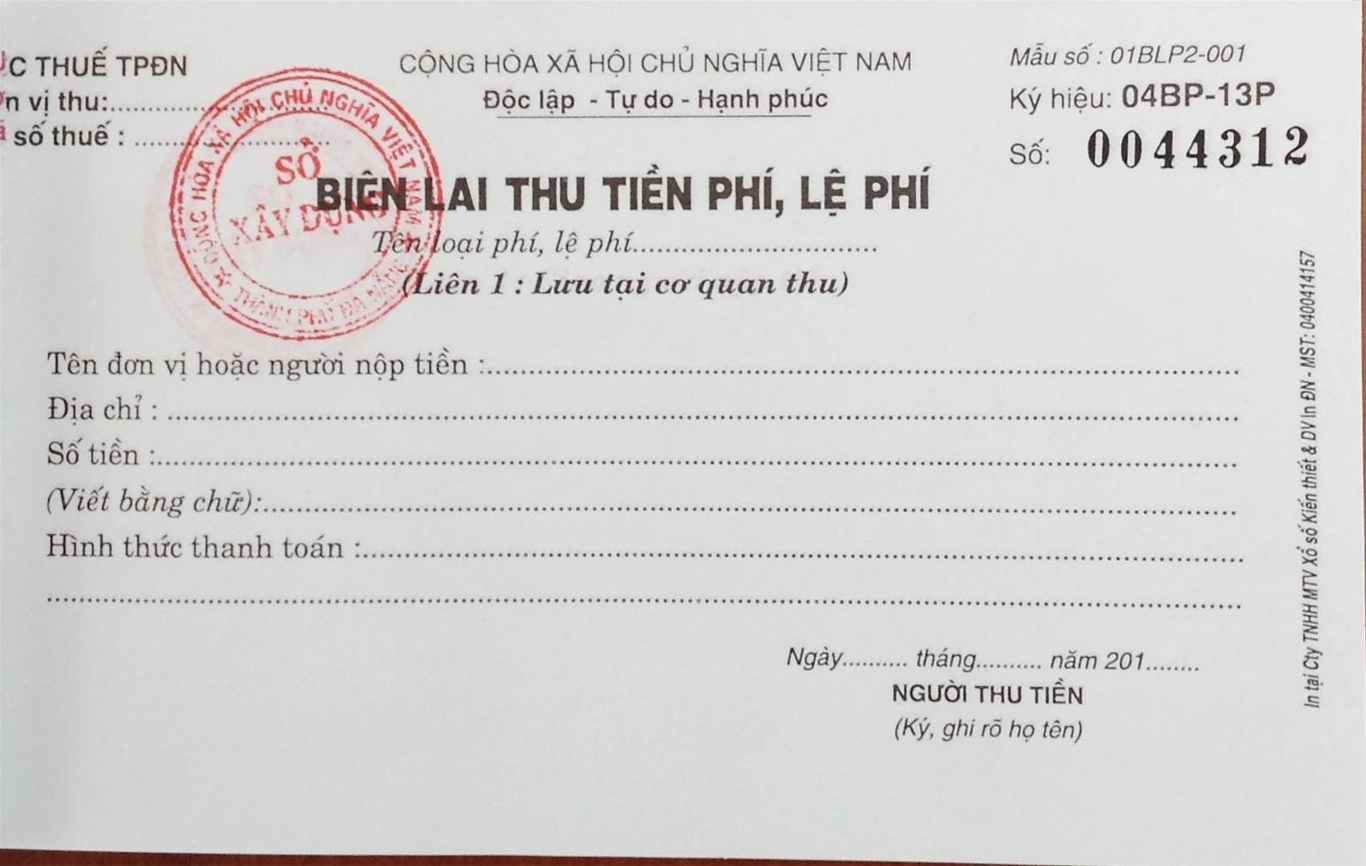

Therefore, organizations, including organizations authorized to collect taxes, shall continue to use paper receipts printed on order or self-printed or purchased from tax offices, or use e-receipts under Circular No. 32/2011/TT-BTC.

Regarding the use of electronic personal income tax (PIT) withholding documents:

Pursuant to Article 33 of Decree No. 123/2020/ND-CP, tax-withholding organizations are not required to register or notify the issuance, or transfer of e-data to tax offices when using electronic PIT withholding documents. They shall develop a software system themselves to ensure that the used e-documents.

While pending the use of electronic PIT withholding documents, organizations and enterprises may use self-issued PIT withholding documents.

From July 01, 2022, tax offices shall stop selling PIT withholding documents printed on tax offices’ orders. Unused withholding documents that have already been purchased from tax offices shall continue to be used.