Circular 08/2024/TT-NHNN management, operation and use of the National Interbank Electronic Payment System

ATTRIBUTE

| Issuing body: | State Bank of Vietnam | Effective date: | Known Please log in to a subscriber account to use this function. Don’t have an account? Register here |

| Official number: | 08/2024/TT-NHNN | Signer: | Pham Tien Dung |

| Type: | Circular | Expiry date: | Updating |

| Issuing date: | 25/06/2024 | Effect status: | Known Please log in to a subscriber account to use this function. Don’t have an account? Register here |

| Fields: | Finance - Banking |

THE STATE BANK OF VIETNAM _____________ No. 08/2024/TT-NHNN | THE SOCIALIST REPUBLIC OF VIETNAM Independence - Freedom - Happiness ____________________ Hanoi, June 25, 2024 |

CIRCULAR

Providing for management, operation and use of the National Interbank Electronic Payment System

___________________

Pursuant to the Law on the State Bank of Vietnam dated June 16, 2010;

Pursuant to the Law on Credit Institutions dated January 18, 2024;

Pursuant to the Law on E-Transactions dated June 22, 2023;

Pursuant to Decree No. 52/2024/ND-CP dated May 15, 2024 of the Government on non-cash payment;

Pursuant to Decree No. 102/2022/ND-CP dated December 12, 2022 of the Government defining the functions, tasks, powers and organizational structure of the State Bank of Vietnam;

At the proposal of the Director of the Payment Department,

The Governor of the State Bank of Vietnam promulgates the Circular providing for the management, operation and use of the National Interbank Electronic Payment System.

Chapter I

GENERAL PROVISIONS

Article 1. Scope of regulation and subjects of application:

1. Scope of regulation

This Circular provides for the management, operation and use of the National Interbank Electronic Payment System to make payments and settlements between units participating in this payment system in Vietnam Dong (VND), US Dollar (USD), common currency of the European Union (EUR) and other foreign currencies decided by the Governor of the State Bank of Vietnam (hereinafter referred to as the State Bank) from time to time.

2. Subjects of application

Members, member units of the National Interbank Electronic Payment System, operator of the National Interbank Electronic Payment System, member in charge of the electronic clearing system, relevant units of the State Bank.

Article 2. Interpretation of terms

In this Circular, the following terms are construed as follows:

1. Net settlement service for other systems (hereinafter referred to as net settlement service) is the service of receiving and processing net settlement results from the automatic clearing system, the bank card clearing system and other clearing systems.

2. High-value payment service means a service provided by the National Interbank Electronic Payment System to process payment orders in Vietnam Dong using the real-time gross settlement method.

3. Low-value payment service means a service provided by the National Interbank Electronic Payment System to process payment orders in Vietnam Dong using the clearing settlement method.

4. Foreign currency payment service means a service provided by the National Interbank Electronic Payment System to process payment orders in foreign currency using the real-time gross settlement method.

5. Payment order-creating unit (hereinafter referred to as the order-creating unit) means the member or member unit that creates and processes a (outgoing) payment order on behalf of its client.

6. Payment order-receiving unit (hereinafter referred to as the order-receiving unit) is the member or member unit that receives and processes (incoming) payment orders on behalf of its client.

7. Member unit means a subsidiary or affiliated unit of a member participating in the National Interbank Electronic Payment System at the request of the member.

8. Operator of the National Interbank Electronic Payment System is the unit directly operating the National Interbank Electronic Payment System.

9. Net debt limit means the maximum value specified for low-value payment transactions participating in clearing settlement.

10. Member's solvency means the member's payment account balance at the State Bank's Transaction Office plus such member's existing overdraft limit at a certain time.

11. Client means the order issuer or the order recipient.

12. Payment order means an electronic message used for making a payment in the National Interbank Electronic Payment System.

13. Credit payment order means a payment order that is created by the order-creating unit to debit a certain amount from a client’s account opened at the order-creating unit and credit the same amount to another client’s account opened at the order-receiving unit.

14. Debit payment order means a payment order that is created by the order-creating unit to debit a certain amount from a client’s account opened at the order-receiving unit and credit the same amount to another client’s account opened at the order-creating unit.

15. Low-value payment order means a payment order in Vietnam Dong using low-value payment service.

16. High-value payment order means a payment order in Vietnam Dong using high-value payment service.

17. Foreign currency payment order means a payment order in foreign currency using foreign currency payment service.

18. Electronic message authentication code means the symbol of electronic information on the status of payment orders in the National Interbank Electronic Payment System.

19. Payment-order approver (hereinafter referred to as the order approver) means the competent person of the member or member unit; in case the member unit is a unit of the State Bank, the order approver shall be its head or his/her authorized person.

20. Payment-order controller (hereinafter referred to as the order controller) means the chief accountant, the person in charge of accounting or the authorized person of the member or member unit that takes charge of controlling payment orders.

21. Payment-order maker (hereinafter referred to as the order maker) means the individual of the member or member unit assigned to create the payment order.

22. Order recipient means an organization or individual that receives a payment order via a member or member unit.

23. Order issuer means an organization or individual who requests to create a payment order via a member or member unit.

24. Settlement means the determination and payment of the final value between related members to complete payment obligations.

25. Settlement of low-value clearing results (hereinafter referred to as clearing settlement) means the fulfillment of payment obligations between parties participating in payment by direct clearing after balancing the total receivables and total payables.

26. Real-time gross settlement is the real-time settlement of each payment order to fulfill payment obligations between members or member units.

27. Interbank electronic payment means the process of processing inter-bank payment transactions by computer network from the creation of payment order until completion of payment order.

28. Member presiding over the electronic clearing system (hereinafter referred to as the electronic clearing presiding member) means an intermediary payment service provider licensed by the State Bank to provide financial switching services, electronic clearing services and to make direct connection to the National Interbank Electronic Payment System to perform electronic clearing settlement operations.

29. Members include the State Bank, banks, foreign bank branches, and the State Treasuries participating in the National Interbank Electronic Payment System.

30. Electronic message means the electronic information on the content of a payment order or notification related to payment transaction to be performed and is transmitted via a computer network among units participating in the National Interbank Electronic Payment System.

31. National Interbank Electronic Payment Service Center (hereinafter referred to as the National Payment Service Center - NPSC) means a system of technical equipment located at the Information Technology Department to perform the functions of the high-value payment module, foreign currency payment module, low-value payment module, payment account processing and data verification module.

32. Backup National Interbank Electronic Payment Service Center (hereinafter referred to as the Backup National Payment Service Center - BNPSC) means a system of technical equipment located at the backup data center to perform the backup function for the National Payment Service Center.

33. Margin ratio means the percentage (%) of the net debt limit that is deposited with the value of deposited valuable papers or money.

Article 3. Primary modules and functions of the National Interbank Electronic Payment System

1. The National Interbank Electronic Payment System is a comprehensive system including: National Payment Service Center; Backup National Payment Service Center; software installed at members and member units to process payment orders.

2. Processing modules include: high-value payment module; foreign currency payment module; low-value payment module; payment account processing and data verification module.

3. The high-value payment module performs real-time gross settlement of payment orders in Vietnamese Dong using the high-value payment service.

4. The foreign currency payment module performs real-time gross settlement of payment orders in foreign currency using the foreign currency payment service.

5. The low-value payment module performs payment of low-value payment orders using the low-value payment service.

6. The payment account processing and data verification module performs verification and account for high-value payment orders, foreign currency payment orders, processes low-value clearing results and net settlement results from other systems.

Article 4. Operations of the National Payment Service Center

1. Receive and check the validity of electronic documents.

2. Process valid payment orders and valid cancellation orders of payment orders; notify payment orders and payment order processing results to members and member units related to such payment order as required.

3. Compare payment orders with members and member units in the National Interbank Electronic Payment System.

4. Refuse to make payment of invalid payment orders, invalid cancellation orders of payment orders, payment orders sent after the National Interbank Electronic Payment System’s prescribed payment order reception time.

5. Refuse to make payment of high-value payment orders or payment orders in foreign currency for members whose account balances in corresponding currencies are not sufficient.

6. Notify the status of payment order to the order-creating unit after the cut-off time for receipt of payment orders.

7. Automatically send electronic messages of low-value clearing results to the payment account processing and data verification module to account for members participating in low-value clearing settlement on the same day.

8. Process net settlement results from other systems in accordance with Article 21 of this Circular.

Article 5. Operations of the Backup National Payment Service Center

1. The National Payment Service Center operates as a replacement for the National Payment Service Center when the National Payment Service Center is unable to operate normally or due to a planned conversion to ensure operational readiness of the National Interbank Electronic Payment System or operates under Active-Active service provision mechanism with the National Payment Service Center.

2. During the Backup National Payment Service Center operates to replace the National Payment Service Center, the Backup National Payment Service Center has the operating functions as prescribed in Article 4 of this Circular.

3. All data and processing results at the Backup National Payment Service Center have the same legal value as those of the National Payment Service Center.

Article 6. Documents used in interbank electronic payment

1. The documents used in the interbank electronic payment are paper documents or electronic documents according to current laws on accounting documents.

2. The basis for making a payment order is the documents used in the interbank electronic payment.

3. The payment orders are made in the form of electronic documents according to the correct form, meeting the data standards decided by the Governor of the State Bank.

Article 7. Retention of electronic transaction data

1. The electronic data to be retained includes:

a) Electronic data on transaction requests and electronic messages containing results which will be retained by each member or member unit;

b) Electronic data on electronic messages of transactions, accounting transactions, comparison data and processing results which will be retained by the National Payment Service Center.

2. The management of electronic documents and data is carried out in accordance with the law on archives.

Article 8. Issuance, management and use of electronic signature certificates and electronic signatures on the National Interbank Electronic Payment System

1. Electronic signatures are divided into 3 types:

a) Electronic signature of the order maker;

b) Electronic signature of the order controller;

c) Electronic signature of the order approver.

2. The decentralization of order makers, order controllers and order approvers at members and member units is regulated by the unit's competent person, as long as the order makers are independent of the order controllers and the order approvers.

3. The State Bank issues electronic signature certificates to the order approvers and electronic signature certificates to authenticate the connection (connection certificate) between software programs installed at the member units and between the member units and the National Payment Service Center.

4. The issuance, management, and use of electronic signature certificates for the order approvers and electronic signature certificates to authenticate connection to the National Interbank Electronic Payment System shall comply with the provisions of the State bank.

Article 9. Debt payment in the National Interbank Electronic Payment System

1. A prior authorization contract is required for debt payment made between members that are not units of the State Bank.

2. A prior written agreement is required for debt payment made between members that are units of the State Bank and members that are not units of the State Bank.

3. The authorization contract or written agreement on debt payment among members must include at least the following contents:

a) Daily maximum limit for debit payment among the members;

b) Maximum limit of a debt payment order without debt confirmation;

c) Effective period of the authorization contract or written agreement.

Article 10. Regulations on use of payment services

1. The payment orders in Vietnam Dong with a value of VND 500,000,000 (five hundred million dong) or more must use high-value payment services.

2. The payment orders in Vietnam Dong with a value of less than VND 500,000,000 (five hundred million dong) can use high-value payment services or low-value payment services.

3. The payment orders in foreign currency must use foreign currency payment services.

Article 11. Costs and service charges in interbank electronic payment

1. The costs for formulation, installation, maintenance, development and upgrading of the operation of the National Interbank Electronic Payment System are paid by the State Bank. The costs for formulation, installation, maintenance, development and upgrading of the operation of other systems of members and member units to serve the operation of their interbank electronic payment shall be paid by such member and member units.

2. When participating in using services on the National Interbank Electronic Payment System, members and member units must pay service charges to participate in the National Interbank Electronic Payment System and annual charges and domestic payment service charges according to the State Bank's regulations on schedule of charges for payment services rendered via the State Bank.

Chapter II

PAYMENT ORDER IN INTERBANK ELECTRONIC PAYMENT

Article 12. Payment order creation process

1. For payment orders created from paper documents

a) The order maker creates the payment order via the following steps:

(i) Check the validity and legality of the client’s payment transaction documents;

(ii) Identify and classify the payment orders for processing;

(iii) Compare and check the client’s account balances;

(iv) Enter the following basic information: order-creating unit (name, bank code), amount, name, address, account (if any), identity card number or personal identification number or passport number of the order issuer or business code (for the order issuer as an enterprise), the unit serving the order issuer, the order-receiving unit (name, bank code), name, address, account (if any), identity card number or personal identification number or passport number, date of issue and place of issue of identity card number or personal identification number or passport number of the order recipient or business code (for the order recipient as an enterprise), the unit serving the order recipient, content of bank transfer and other contents related to transactions on the interbank market, transactions on remittance to state budget, transactions on purchase of Government bonds and other types of transactions (if any) under the Form No. TTLNH-04 in the Appendix attached to this Circular;

(v) Verify the entered data and add the electronic signature to the payment order;

(vi) Sign on documents, transfer the entered data and documents to the order controller;

b) The order controller

(i) Based on the content of relevant documents, verify the order-receiving unit, the unit serving the order issuer, the unit serving the order recipient, the amount to check the data entered by the order maker, the payment content;

(ii) In case an error is detected: return the order to the order maker;

(iii) In case the data is correct: Add electronic signature to the payment order, sign on the document and send it to the order approver;

c) The order approver

(i) Check the consistency between data on original documents and data on the system;

(ii) In case an error is detected: return the order to the order maker or the order controller;

(iii) In case the data is correct: Add signature on documents, add electronic signature on payment orders to transfer.

2. For payment orders created from electronic documents

In case the payment order is created from electronic documents from the internal systems of members and member units, it must comply with regulations on data structure and format decided by the Governor of the State Bank and ensure the following requirements:

a) If the electronic document is valid but does not contain adequate information as prescribed at Point a, Clause 1 of this Article: The order maker shall provide additional information according to regulations on creation of payment orders; the order controller and the order approver shall carry out data verification in the same manner as paper documents to ensure their accuracy, and add their electronic signatures to the payment order;

b) If the electronic document is valid, contains adequate information as prescribed at Point a, Clause 1 of this Article and bear the specialized electronic signature of the member, the electronic signatures will be added manually or automatically to each payment order at the discretion of relevant units;

c) If the electronic document is valid, contain adequate information as prescribed at Point a, Clause 1 of this Article and satisfy data security, safety, accuracy requirements, the competent persons of relevant units will decide whether only the order approver needs to append his/her electronic signature to the payment order, and will assume legal responsibility for their decision.

3. After the payment order is sent and the status is successful, it may be printed to paper documents upon request.

4. A payment order will be processed and recorded by the National Interbank Electronic Payment System using the member’s payment account with the same currency as that on the payment order opened at the State Bank's Transaction Office (hereinafter referred to as the Transaction Office).

Article 13. Inspection on the validity of the payment order

During use, the members and member units are responsible for the legality of documents used to create payment orders at such units. The members and member units shall inspect the validity of payment orders. The information to be inspected includes:

1. Types and formats of data.

2. Eligibility (authority) of the order maker, the order controller, and the order approver.

3. Date.

4. Uniqueness.

5. Required elements of payment orders.

6. Electronic message authentication code.

7. Participating unit code, terminal code and order approver code.

Article 14. Accounting at members and member units

The members and member units shall account for payment orders in accordance with the current law.

Article 15. Processing and verification of payment orders at the State Bank

The payment orders are processed at the National Payment Service Center and the results are sent to the payment account processing and data verification module for accounting to members and units of the State Bank.

The Transaction Office shall, based on the statements prepared daily using electronic data according to the Form No. TTLNH-10, the Form No. TTLNH-11, the Form No. TTLNH-12, the Form No. TTLNH-13, the Form No. TTLNH-14, the Form No. TTLNH-15 in the Appendix attached to this Circular, execute and compare with the results of payment order accounting and retain such payment orders.

Chapter III

CLEARING SETTLEMENT AMONG MEMBERS AND NET SETTLEMENT RESULTS FROM OTHER SYSTEMS

Article 16. Net debt limit

1. Setting of the net debt limit

a) When participating in the low-value payment service for the first time, the members participating in the low-value payment service shall establish a net debt limit equal to the value of deposited valuable papers or money and deposits to set the member's net debt limit;

b) The net debt limit shall be set every 6 months during the first 5 working days of January and July every year. The net debt limit set on the National Interbank Electronic Payment System and notified in writing to members shall remain valid until the first 5th working day of the next net debt limit setting period;

c) The members participating in the low-value payment service calculate their net debt limit at the beginning of the period and send a request to set a net debt limit to the Transaction Office within the first 5 working days of the net debt limit setting period.

Each member's net debt limit at the beginning of period is calculated on the basis of the highest (payable - receivable) difference in the member's low-value payment in the 6 consecutive months preceding the period of establishing the net debt limit and ensuring the margin ratio according to regulations;

In case the net debt limit at the beginning of the calculation period is zero or negative number, it shall be set according to the net debit limit of the previous period and must ensure the margin ratio as prescribed;

In case the member participates in low-value payment services for less than 6 months, that member's net debt limit is set equal to the value of deposited valuable papers or money to set the net debt limit of the member;

The member shall be responsible for the data to calculate the net debt limit at the beginning of the period. The Transaction Office sets the net debt limit based on the member's requests, valuable papers, and deposits of the member to set the net debt limit for the member, ensuring the margin ratio as prescribed, then, notify the results to the member for implementation;

In case the member does not request to set a periodic net debt limit within the first 5 working days of the net debt limit setting period, the member's net debt limit is set to zero. In case the member requests to set a net debt limit after the first 05 working days of the net debt limit setting period, the minimum margin ratio as prescribed shall be applied (except for the members of the following cases specified at Points b and c, Clause 3, Article 17 of this Circular);

In case a member requests to set a net debt limit higher than the net debt limit at the beginning of the period, the increased value of the net debt limit compared to the net debt limit at the beginning of the period shall be applied with the corresponding margin ratio as prescribed at Point a(i), Clause 2 of this Article.

d) The members participating in low-value payment services make deposits to set the net debt limit as prescribed in Article 17 of this Circular.

2. Adjustment of the net debt limit

a) During the period of setting the net debt limit, each member can request the Transaction Office to adjust the net debt limit on the basis of such member's valuable papers, deposits and estimated payment demands.

(i) In case a member needs to increase the net debt limit, the Transaction Office considers applying a 100% margin ratio for the increase in net debt limit value exceeding 150% of the net debt limit value at the beginning of the period; the increase in net debt limit value does not exceed 150% of the net debt limit value at the beginning of the period to which the minimum margin ratio according to regulations is applied;

(ii) In case the member needs to reduce the net debt limit, the decreased net debt limit value shall be applied with a margin ratio corresponding to the previously applied ratios;

b) The Transaction Office decreases the net debt limit to zero when the member has outstanding loan balance to be cleared at the Transaction Office.

3. Adjustment of temporary intraday net debt limit

a) During a working day, if a member requests an increase in the temporary intraday net debt limit, such temporary intraday increase of the net debt limit shall be applied with the corresponding margin ratio as prescribed at Point a(i) Clause 2 of this Article.

In case a member uses valuable papers or deposits to request an increase in the net debt limit, the member must make deposits of valuable papers and additional cash deposits. In case a member uses the payment account balance to request an increase in the net debt limit, the Transaction Office deducts money from (debits) such member's payment account to make an additional deposit. If the required additional margin is not sufficiently provided, this request will be rejected;

After completing the intraday low-value clearing settlement, the Transaction Office returns valuable papers and additional deposits upon the member's request; at the same time, the temporary intraday net debt limit is adjusted to equal to the net debt limit. The temporary intraday net debt limit is determined as follows:

Temporary intraday net debt limit = the net debt limit + the temporary intraday increase in value of the net debt limit;

b) In case the member needs to decrease the temporary intraday net debt limit to ensure the member's solvency, the Transaction Office adjusts to decrease the temporary intraday net debt limit upon the member's request and ensure the margin ratio as prescribed, the decreased net debt limit value shall be applied with a margin ratio corresponding to the previously applied ratios. After completing the low-value clearing settlement, the temporary net debt limit is adjusted to equal to the net debt limit. The temporary intraday net debt limit is determined as follows:

Temporary intraday net debt limit = the net debt limit - the temporary intraday decrease in value of the net debt limit.

4. Management of the current net debt limit

Current net debt limit = temporary intraday net debt limit + total receivables of low-value payment orders from the beginning of the day to the present - total amounts payable of low-value payment orders calculated from the beginning of the day to the present;

At the beginning of the working day, the members participating in the low-value payment service are granted a net debt limit. At any time during the working day, the current net debt limit may change (increase or decrease) depending on the low-value payment transaction activities of the members and the member units. The current net debt limit is the basis for implementing low-value payment services of the members and the member units.

5. To get information on the current net debt limit, the members can search on the National Interbank Electronic Payment System.

Article 17. Regulations on margin to set net debt limits

1. The valuable papers used as margin (hereinafter referred to as deposited valuable papers) to set net debt limits in low-value payments are valuable papers used in overdraft and overnight lending in the interbank electronic payment. The value of deposited valuable papers is determined according to the State Bank's regulations on overdraft and overnight lending in the interbank electronic payment.

2. The deposit to set the net debt limit in low-value payments is the money in the member’s margin account opened at the Transaction Office to set the net debt limit.

3. Margin ratio

a) The members participating in low-value payments shall provide the margin using valuable papers and money in their accounts at the Transaction Office. The minimum margin ratio to set the net debt limit is implemented according to the Decision of the Governor of the State Bank in each period;

b) If the member's account balance is not sufficient to make clearing settlement at the cut-off time for receipt of high-value payment orders 02 times or more in a month or 03 times or more in a period during which the net debit limit is maintained, the Transaction Office shall report to the Governor of the State Bank to consider and decide to reduce the member's net debt limit by the value of valuable papers, deposits and maintain such member’s margin ratio of 100 % at the Transaction Office within 06 months from the date of the Decision of the Governor of the State Bank;

c) In order to ensure the safe operation of the system, the Governor of the State Bank shall decide on a separate minimum margin ratio for specific members.

4. Time to deposit valuable papers or money

a) In case of increase in temporary intraday net debt limit: immediately after receiving all deposited valuable papers or money, the Transaction Office shall set a temporary intraday net debt limit and notify such member;

b) In case of setting net debt limit for the first time: the members participating in the low-value payment service shall deposit valuable papers or money and submit a written request to set a net debt limit to the Transaction Office. Within 07 working days from the date the Transaction Office receives deposited valuable papers or money and a written request to set a net debt limit, the Transaction Office shall set the net debt limit and notify the members in writing.

5. Refund and replacement of deposited valuable papers or money

a) The return and replacement of deposited valuable papers to set the net debt limit shall be carried out in accordance with the State Bank's regulations on the deposit and use of valuable papers at the State Bank;

b) Within 03 working days from the date the State Bank's web portal posts information on the member's cessation of participation in the low-value payment service and the member has fulfilled its obligations to the State Bank on the National Interbank Electronic Payment System, the Transaction Office refunds the deposit to set the net debt limit for such member.

Article 18. Processing of the lack of net debt limit in low-value payments

In case the amount on the payment order exceeds the current net debt limit, the processing is carried out as follows:

1. The system automatically notifies the members to increase the net debt limit as prescribed in Clause 3, Article 16 of this Circular to process payment orders.

2. When the member’s current net debit cap is sufficient, the payment orders will be processed on a first in, first out (FIFO) basis.

3. By the time the National Interbank Electronic Payment System stops accepting low-value payment orders, the payment orders exceeding the current net debt limit shall be canceled. The members and member units make inquiries to check the status of these payment orders.

Article 19. Clearing settlement

The National Payment Service Center performs clearing settlement as follows:

1. Stop accepting low-value payment orders throughout the system.

2. Check and calculate the current net debt limit for low-value payment orders for which current net debit limit is not available.

3. Reject and return the low-value payment orders to the members and the member units with current net debt limit shortage.

4. Based on low-value payment orders with sufficient current net debt limit, calculate the difference between receivables and payables of each member.

5. The low-value clearing results are automatically accounted for by the payment account processing and data verification module.

Article 20. Monitoring and notification of the status of clearing settlement

The Transaction Office monitors the status of clearing settlement through the National Interbank Electronic Payment System in the following order:

1. Monitor the member's solvency compared to the difference between the net debt limit and the current net debt limit.

2. In case the member’s funds are insufficient, notify the member of such insufficiency and request them to take measures to increase their funds; monitor the addition of money to the member’s payment account as notified.

3. If the clearing settlement is still unsuccessful after the cut-off time for receipt of high-value payment orders because of the member's insufficient balance, the Transaction Office shall prepare a report on the member's insufficient balance using the Form No. TTLNH-25 in the Appendix enclosed herewith, and notify the operator of the National Interbank Electronic Payment System and such member.

Article 21. Processing of net settlement results from other systems

1. The National Interbank Electronic Payment System is allowed to receive and process net settlement results from the automatic clearing system, the bank card clearing system and other clearing systems.

2. The processing of net settlement results is carried out by batch-based processing (batch settlement) on the basis of sufficient payment account balances of members participating in net settlement. The electronic clearing presiding member monitors the settlement status on the National Interbank Electronic Payment System to update the clearing limit for settlement members.

a) In case at least one member settles with insufficient balance upon settlement, the processing order is as follows:

(i) The settlement member performs an overdraft within the overdraft limit according to the State Bank's regulations on overdraft and overnight lending in the interbank electronic payment to process the net settlement results;

(ii) If the settlement member’s payment account balance is still insufficient for the net settlement when their overdraft limit is reached, the net settlement result shall be moved to the settlement queue. When the balance is sufficient, the processing of the net settlement result shall be resumed;

(iii) The electronic clearing presiding member shall make inquiries on the National Interbank Electronic Payment System to check the status of processing net settlement results in the queue; at the same time, notify and request the settlement member with insufficient balance, upon net settlement, to take timely measures to increase the balance on the payment account from their own funds or through monetary market transactions or mutual lending on the interbank market as prescribed by the State Bank for making net settlement;

(iv) At the time of stopping receiving low-value payment orders on the National Interbank Electronic Payment System, in case the settlement member’s account balances are not sufficient, the Transaction Office shall deduct (debit) the deposit to set the electronic clearing limit of the settlement member (if any) to make the net settlement. Immediately after deducting (debiting) the deposit to set the settlement member's electronic payment limit, the Transaction Office notifies the electronic clearing presiding member in case the National Interbank Electronic Payment System does not have the function to support the electronic clearing presiding member to access for self-monitoring. The electronic clearing presiding member shall reduce the deposit settlement limit based on the value of valuable papers or the remaining deposit of such settlement member;

(v) If the settlement member’s account balance is insufficient for settlement at the time of stopping receiving high-value payment orders on the National Interbank Electronic Payment System, the Transaction Office shall prepare a report on the member's insufficient balance using the Form No. TTLNH-25 in the Appendix attached to this Circular, and send it to the electronic clearing presiding member and such member.

The settlement member whose account balance is insufficient must make a certificate of clearing loan indebtedness using the Form No. TTLNH-28 in the Appendix attached to this Circular, and send it to the Transaction Office for making the net settlement at the interest rate on overnight loans in interbank electronic payment and loans for making clearing settlement imposed by the Governor of the State Bank in each period. The Transaction Office shall grant loan and send a notification thereof to the electronic clearing presiding member for decreasing the electronic clearing limit of the settlement member that incurs clearing loan debt to zero until the debt is fully recovered by the Transaction Office, and provide information on that member to the Payment Department for monitoring; after the debt has been fully recovered, the Transaction Office shall give notification to the electronic clearing presiding member and the Payment Department;

b) In case at least one settlement member must obtain loan for making net settlement, the processing order is as follows:

(i) At the beginning of the working day following the day on which the settlement member gets a loan for making net settlement and before the net settlement result is sent by the electronic clearing presiding member, the borrowing member must pay both principal and interest to the State Bank. In case the borrowing member fails to complete debt repayment, the Transaction Office shall proactively collect debt (including principal and interest) by withdrawing money from (debiting) that member's payment account in Vietnam Dong opened at the Transaction Office on the principal first, interest later basis;

(ii) At the end of the working day following the day on which the settlement member gets a loan for making net settlement, if the debt is still not yet collected in full after the debt collection measure has been taken as prescribed at Point b(i) of this Clause, the Transaction Office shall record the entire unpaid outstanding debt as overdue debt; the interest rates on overdue principal and late interest payment shall be those on overdue principal and late interest payment of overnight loans imposed according to the State Bank’s regulations on overdraft and overnight lending in interbank electronic payment; the Transaction Office shall inform the electronic clearing presiding member of total outstanding debt (including principal and interest) to be paid by the borrowing member.

The electronic clearing presiding member shall allocate risk-sharing obligations to other settlement members to repay debt to the Transaction Office as prescribed at Point c of this Clause;

c) Allocation of risk-sharing obligations in case a settlement member that has got loan for making net settlement (borrowing member) is incapable of repaying loan debt (including principal and interest):

(i) On the working day following the day on which the Transaction Office informs the electronic clearing presiding member of its failure to fully collect debts arising from the loan granted for making net settlement and total debt amount (including principal and interest) that borrowing members have to repay to the State Bank as prescribed at Point b(ii) of this Clause, the electronic clearing presiding member shall distribute risk-sharing obligations to other members involved in the net settlement using the following formula:

Di

Ai = x M

D – D(x)

In which:

Ai: Amount of money that the ith settlement member must pay to the State Bank as repayment of loan debt (including principal and interest) in order to share risks posed to the borrowing member that is incapable of repaying loan debt (including principal and interest);

Di: Difference between total amount payable by the borrowing members and the amount payable by the ith member in the settlement session;

D: Difference between total amount payable by the borrowing members and total amount payable by other members in the settlement session;

D(x): Difference between the amount payable by the borrowing member that is incapable of repaying loan debt and total amount payable by other borrowing members;

M: Total loan debt (including principal and interest) that borrowing members have to repay to the State Bank;

(ii) After calculating and determining the amount of money that each member involved in the net settlement is obliged to repay as a way to share risks, the electronic clearing presiding member shall inform it to the Transaction Office to withdraw money from (debit) that member's payment account opened at the Transaction Office to collect loan debts (including principal and interest) of borrowing members; concurrently, inform settlement members of such event;

(iii) If there is at least a member’s payment account balance is not sufficient (credit balance) for fulfillment of risk-sharing obligation, the Transaction Office shall inform the situation to the electronic clearing presiding member and that member to take measures to increase their payment account balance; in addition, the Transaction Office shall monitor the balance on that member’s payment account opened at the Transaction Office to continue deducting (debiting) until the amount of money to be paid by that member to share risks is collected in full;

(iv) By the end of the working day on which the electronic clearing presiding member calculates and informs each settlement member of their risk-sharing obligations, if any settlement member's payment account balance is insufficient (credit balance) for fulfillment of risk-sharing obligation, the Transaction Office shall inform the situation to the electronic clearing presiding member and that member to calculate and decrease that member’s electronic clearing limit; in addition, the Transaction Office shall collect the unpaid amount by proactively deduct (debit) the margin account for setting electronic clearing limit (if any) of that member. If a member's risk-sharing obligation is still not yet fulfilled after deducting (debit) that member's margin account for setting electronic clearing limit, the Transaction Office shall notify the electronic clearing presiding member to consider suspending the provision of payment services through the electronic clearing system to that member;

d) Reimbursement of amounts that settlement members pay as a way to share risks:

(i) Within 05 working days from the date the electronic clearing presiding member notifies the settlement members of the risk-sharing obligation, the borrowing member that is incapable of repaying loan debt (including principal and interest) is obliged to take measures to fully repay the loan amount (including principal and interest) to the State Bank;

On the working day following such 05-working day period, if the loan debt (including principal and interest) is not yet fully repaid, the Transaction Office shall proactively withdraw money from (debit) that member’s payment account opened at the Transaction Office to collect debt, and inform the electronic clearing presiding member of the collected amount;

On the next working day, if the loan debt (including principal and interest) is not yet collected in full after withdrawing money from (debiting) the borrowing member’s payment account, the Transaction Office shall request the valuable papers depository to transfer the ownership of valuable papers which are deposited to set the electronic clearing limit from that member to the State Bank (in case these valuable papers are deposited at the valuable papers depository) or proactively transfer the ownership of such valuable papers from that member to the State Bank (in case these valuable papers are deposited directly at the Transaction Office);

The processing of deposited valuable papers for debt collection is carried out in accordance with the regulations of the State Bank;

(ii) Based on the amount collected according to the notice of the Transaction Office and the ratio (%) of the amount of money to be paid by each settlement member as a way to share risks to total loan debt payable (including principal and interest), the electronic clearing presiding member shall calculate the specific reimbursement to each member that has fulfilled risk-sharing obligations, and inform it to the Transaction Office to remit money to (credit) that member's payment account; concurrently, shall inform that member of this;

(iii) If the borrowing member goes bankrupt, the State Bank is entitled to receive debt repayments as prescribed by the Law on bankruptcy and reimburse settlement members that have fulfilled risk-sharing obligations according to the set distribution rate within the extent of collected debt amount.

3. Whenever batch settlement demand arises, the electronic clearing presiding member shall create a batch settlement request using the Form No. TTLNH-30 in the Appendix enclosed herewith, append its electronic signature thereto and send it to the National Payment Service Center for processing.

4. The electronic clearing presiding member is allowed to cancel the unsuccessful settlement batch which has been sent to the National Payment Service Center for managing the order of priority and matching the account balance of each member involved in the settlement batch.

5. Whenever the settlement batch is successfully processed and recorded by the National Payment Service Center, the National Interbank Electronic Payment System shall automatically create and send batch settlement transactions to members and member units involved in the settlement batch. The members and member units shall receive, control and print out such batch settlement transactions and keep record of them in accordance with the current law.

6. After data verification is completed by the National Interbank Electronic Payment System, relevant units shall print out and verify data about batch settlement transactions within the same day to ensure data matching on the National Interbank Electronic Payment System. Specifically as follows:

a) For the Transaction Office

(i) The verification sheet of settlement batch results received from the National Payment Service Center under the Form No. TTLNH-31 in the Appendix enclosed herewith;

(ii) The report on verification of settlement batch results under the Form No. TTLNH-32 in the Appendix enclosed herewith;

b) For the electronic clearing presiding member

(i) The summary report on batch settlement results sent to the National Payment Service Center under the Form No. TTLNH-33 in the Appendix enclosed herewith;

(ii) The verification sheet of settlement batch results received from the National Payment Service Center under the Form No. TTLNH-31 in the Appendix enclosed herewith;

c) For members and member units involved in the settlement batch: the verification sheet of settlement batch results under the Form No. TTLNH-34 in the Appendix enclosed herewith.

7. Handling of erroneous batch settlement reports

The relevant units shall contact and cooperate with the operator of National Interbank Electronic Payment System in considering and dealing with errors found in reports or during data verification of batch settlement.

Chapter IV

HANDLING OF FUND INSUFFICIENCY IN INTERBANK ELECTRONIC PAYMENT

Article 22. Principles for processing payment orders, queue, settlement and release

1. Handling principles

a) Payment orders via the National Interbank Electronic Payment System shall be processed in the following order of priority: low-value clearing results, net settlement results from other systems, high-value payment orders and foreign currency payment orders;

b) Payment orders for which funds are not sufficient shall be moved to the queue and processed according to Clause 2 of this Article;

c) In case low-value clearing results and net settlement results from other systems are already in the queue, the high-value payment orders of banks with insufficient funds that join the queue later will have to wait.

2. Handling of settlement queues

In case a member's account balance is insufficient for payment, the National Payment Service Center shall:

a) Retain high-value payment orders or low-value clearing results or net settlement results from other systems in the settlement queue for payments in Vietnam Dong;

b) Retain foreign currency payment orders for payments in the corresponding foreign currency;

c) When the funds are added to the payment account of the corresponding currency of that borrowing member, the National Payment Service Center shall process the payment orders on a first in, first out (FIFO) basis. In case the payment order has an amount exceeding the balance in the member's payment account, causing a bottleneck in processing other payment orders in the settlement queue, the National Payment Service Center may transfer (change the queue) the payment orders in the settlement queue with an amount less than or equal to the balance in the member's payment account to be processed in prior on a first in, first out (FIFO) basis, but in compliance with the principles stated in Clause 1 of this Article. The members and member units make inquiries to check the status of payment orders in the settlement queue;

d) The management of settlement queue is implemented as follows:

(i) Check the balance of payment accounts periodically;

(ii) Make settlement in the following order: low-value clearing results, net settlement results from other systems, high-value payment orders and foreign currency payment orders if the payment account balance in the corresponding currency is sufficient;

(iii) Process payment order cancellation requests on a FIFO basis.

3. The members and member units may only cancel high-value payment orders and foreign currency payment orders in the settlement queue, and low-value payment orders in the processing queue at the National Payment Service Center;

a) When receiving a cancellation order from the order-creating unit, the National Payment Service Center shall check the validity of the payment order cancellation order according to the logbook;

b) If the payment order cancellation order is valid and the payment order to be canceled is standing in the settlement queue (for high-value payment orders and foreign currency payment orders) or in the processing queue (for low-value payment orders) at the National Payment Service Center, the cancellation process is carried out; the cancellation result will be notified to the order-creating unit. In case the payment order to be canceled is not standing in the queue, its status will be sent by the system to the order-creating unit.

Article 23. Processing in case of the payment account balance insufficiency to make payment and settlement

1. For the high-value payment orders in Vietnam Dong

a) The members (except the State Treasury) shall perform an overdraft within the granted overdraft limit according to the State Bank's regulations on overdraft and overnight lending in the interbank electronic payment to process the high-value payment orders;

b) In case the State Treasury’s payment account balance is not sufficient for making payment or the member has reached the overdraft limit granted by the State Bank but their payment account balance is still insufficient for making payment, their payment order will be moved to the settlement queue and processed when the State Treasury or that member’s payment account balance is sufficient;

c) The member may proactively increase their payment account balance from their own funds or the member (except the State Treasury) increases the payment account balance through monetary market transactions or mutual lending on the interbank market as prescribed by State Bank’s regulations on lending and borrowing activities, purchase and sale of valuable papers on a definite term among credit institutions and foreign bank branches;

d) At the cut-off time for receipt of high-value payment orders, if the member’s payment account balance is insufficient for making settlement, their high-value payment orders in the settlement queue will be automatically canceled. The members and member units make inquiries to check the status of these payment orders.

2. For foreign currency payment orders

a) The member may proactively increase their payment account balance from their own funds or the member (except the State Treasury) get loans from other member as prescribed by State Bank’s regulations on lending and borrowing activities, purchase and sale of valuable papers on a definite term among credit institutions and foreign bank branches;

b) At the cut-off time for receipt of foreign currency payment orders, if the balance on a member’s payment account in the corresponding currency is insufficient for making settlement, their foreign currency payment orders in the settlement queue will be automatically canceled. The members and member units make inquiries to check the status of these payment orders.

3. For the low-value clearing results

a) The members (except the State Treasury) shall perform an overdraft within the granted overdraft limit according to the State Bank's regulations on overdraft and overnight lending in the interbank electronic payment to settle the clearing results;

b) The member may proactively increase their payment account balance from their own funds or the member (except the State Treasury) increases the payment account balance through monetary market transactions or mutual lending on the interbank market as prescribed by State Bank’s regulations on lending and borrowing activities, purchase and sale of valuable papers on a definite term among credit institutions and foreign bank branches;

c) In case the member is unable to pay net payables at the cut-off time for receipt of high-value payment orders, after withdrawing money from (debiting) the margin account for setting the member’s net debit limit (if any) but the settlement balance is still insufficient, the Transaction Office shall make a report on the member's fund insufficiency according to the Form No. TTLNH-25 in the Appendix attached to this Circular and notify such member. The member (except the State Treasury) whose account balance is insufficient must make a certificate of clearing loan indebtedness using the Form No. TTLNH-28 in the Appendix attached to this Circular, and send it to the Transaction Office for making the settlement of the low-value clearing results at the interest rate on overnight loans in interbank electronic payment and loans for making clearing settlement imposed by the Governor of the State Bank in each period. The Transaction Office makes loans and adjusts the net debt limit to zero for members with clearing loans until debt collection is completed; at the same time, send information on clearing loan members to the Payment Department for supervision;

d) After withdrawing money from (debiting) the margin account for setting the net debit limit of the State Treasury, if the State Treasury’s payment account balance is still insufficient for making settlement, the Transaction Office shall notify the State Treasury of such insufficient balance for making the low-value clearing settlement.

After receiving notice of its insufficient balance from the Transaction Office, the State Treasury must take measures for increasing its account balance within the day to process clearing results. In case the State Treasury is unable to increase its account balance within the day, the Transaction Office shall temporarily record the arrears as receivables from the State Treasury. The Transaction Office shall remove such receivables after it fully collect such arrears by withdrawing money from (debiting) the payment account of the State Treasury or such arrears are fully repaid by the State Treasury. The State Treasury is subject to the consideration and processing as prescribed at Point a, Clause 4, Article 37 of this Circular.

4. The net settlement results from other systems shall be processed in accordance with Clause 2, Article 21 of this Circular.

Article 24. Processing of overdue clearing loan balances of the members

1. On the working day following the day on which a member gets a clearing loan, the Transaction Office shall proactively withdraw money from (debit) the member’s payment account in Vietnam Dong opened at the Transaction Office for debt collection.

At the end of the working day following the day on which the member gets a clearing loan, if the member fails to fully repay the loan debt (including principal and interest), the Transaction Office shall record the unpaid outstanding debt as overdue debt; the interest rates on overdue principal and late interest payment shall be those on overdue principal and late interest payment of overnight loans imposed according to State Bank’s regulations on overdraft and overnight lending in interbank electronic payment.

2. On the working day following the day on which the clearing loan debt is recorded as overdue, the Transaction Office shall withdraw money from (debit) the member’s payment account in Vietnam Dong opened at the Transaction Office for collecting overdue debt (including overdue principal, overdue interest, penalty interest on late payment of principal, and interest on overdue interest) on the principal first, interest later basis, and notify such debt collection to the member.

At the end of the working day, if the overdue debt is not yet collected in full after withdrawing money from (debiting) the member’s payment account in Vietnam Dong opened at the Transaction Office, the Transaction Office shall share the remaining overdue debt among other members engaged in the clearing settlement session (except for the State Treasury) and notify the amount to be contributed by each member (hereinafter referred to as contribution). The contribution of each member participating in the remaining clearing settlement is determined according to the formula:

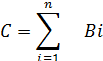

Contribution of the ith member = ![]()

In which:

A: Total remaining overdue debt to be shared to members.

Bi: The average low-value payment made by the ith member within 20 working days before the clearing loan is granted.

C: Total average low-value payment made by all members among whom the remaining overdue debt will be shared within 20 working days before the clearing loan is granted.

n: Number of members among which the remaining overdue debt is shared.

i: from 1 to n.

If a member has used low-value payment services on the National Interbank Electronic Payment System for a period of less than 20 working days, the number of working days for which that member has participated in the National Interbank Electronic Payment System shall apply.

3. Procedures for sharing the remaining overdue debt to members engaged in the clearing settlement.

On the working day following the day on which the Transaction Office notifies the contribution by each member, the Transaction Office shall withdraw money from (debit) that member’s payment account and transfer such withdrawn amount to the Transaction Office's account;

In case a member's account balance is insufficient to deduct the debt on time, the Transaction Office shall report to the Governor of the State Bank to consider temporarily suspending the use of low-value payment services by that member until the next working day after the date the member deposits the full amount allocated to the Transaction Office. At the same time, the Transaction Office monitors the balance of that member's payment account opened at the Transaction Office and continues to deduct (debit) the full amount of unpaid allocation plus interest at an interest rate equal to the interest rate applied to overdue overnight lending balances according to the State Bank's regulations on overdraft and overnight lending in the interbank electronic payment.

4. Reimbursement of contributions to members

a) Within 05 working days from the day on which the Transaction Office notifies each member of their contribution, the member that took the loan (borrowing member) shall take all necessary measures for fully repaying the loan debt (including principal and interest). On the working day following the 05-working day period from the day on which the Transaction Office notifies each member of their contribution, if the loan debt is not fully repaid, the Transaction Office shall proactively withdraw money from (debit) the borrowing member’s payment account opened at the Transaction Office to collect and transfer the arrears to the Transaction Office's account;

On the next working day, if the arrears are still not collected in full after withdrawing money from (debiting) the borrowing member’s payment account, the Transaction Office shall request the valuable papers depository to transfer the ownership of valuable papers which are deposited to set the net debit limit from that member to the State Bank (in case these valuable papers are deposited at the valuable papers depository) or proactively transfer the ownership of such valuable papers from that member to the State Bank (in case these valuable papers are deposited directly at the Transaction Office), for valuable papers deposited by that member at the Transaction Office to setting the net debt limit;

The processing of deposited valuable papers for debt collection is carried out in accordance with the regulations of the State Bank;

b) After receiving full repayment of the loan debt as prescribed at Point a of this Clause, the Transaction Office shall, based on the received amount, and ratio (%) of the contribution by each member to total overdue debt to be shared, calculate and make reimbursement (including principal and interest as determined at Point a of this Clause) to each member according to the previously shared ratio.

5. If the borrowing member goes bankrupt, the State Bank is entitled to receive debt repayments as prescribed by the Law on bankruptcy and make reimbursement to the members that have made contributions according to the set contribution ratio within the extent of collected debt amount.

Chapter V

HANDLING OF ERRORS IN INTERBANK ELECTRONIC PAYMENT

Article 25. Principles for correction of errors in the National Interbank Electronic Payment System

1. Ensure data consistency among the order-creating unit, the order-receiving unit and the National Payment Service Center. Errors arising at any stage shall be corrected at such stage until the end of the payment process.

2. Errors must be corrected immediately upon detection without causing delay to the payment process. Errors are corrected under principles and methods for correction of errors in accounting.

3. Units and individuals that make errors or violate error correction principles or methods must be responsible for the errors caused to relevant parties.

Article 26. Cancellation and return of payment orders at members and member units

1. Principles

a) The payment orders can only be canceled in the following cases:

(i) The payment order is created at the order-creating unit but yet to be sent. In this case, the payment order may be canceled by the order-creating unit;

(ii) The payment order has been sent to the National Payment Service Center and is still in the settlement queue for high-value payment orders and foreign currency payment orders; or in the processing queue (for low-value payment orders). In this case, the instructions at Point b, Clause 1, Article 29 of this Circular shall apply;

b) The payment orders will only be returned in the following cases:

(i) Debit payment order may only be returned when the order-creating unit has not yet credited the client’s account or has credited the client’s account but has successfully recovered the credited amount;

(ii) Credit payment order may only be returned when the order-receiving unit has not yet credited the client’s account or has credited the client’s account but has successfully recovered the credited amount.

2. Documents on cancellation and return of payment orders

a) Documents on cancellation of payment orders include:

(i) The order for cancellation of the debit payment order: which is valid as a credit payment order, created by the order-creating unit and sent to the order-receiving unit to cancel the erroneous debit payment order (to return the amount in full);

(ii) The order for cancellation of the credit payment order: which is created by the order-creating unit to cancel its credit payment order in the queue;

b) Documents on return of payment orders include:

(i) Request for return of payment order: which is created and sent by the order-creating unit to request the order-receiving unit to return the erroneous credit order, specifies whether the error is made by the order-creating unit or the client, and is used as the basis for the order-receiving unit to create a credit payment order to return money to the order-creating unit if the money has been fully recovered;

(ii) Notification of refusal of request for return of payment order: which is created and sent by the order-receiving unit to reject the order-creating unit’s request for return of credit payment order because the money cannot be recovered from the client.

3. The member units shall process cancellation and return of payment orders in the same manner as high-value payment orders.

Article 27. Handling of errors arising from members or member units at the order-creating unit

1. Correction of errors before sending payment orders

a) If a payment order is found erroneous before the order approver adds his/her electronic signature for sending, the order approver and the order controller shall refuse to approve the payment order, and the order maker shall correct it according to original documents;

b) In case an error in the payment order is discovered after the order approver adds his/her electronic signature for sending, it is mandatory to make the minutes of cancellation of the erroneous payment order which must clearly specify the order symbol, time and date of cancellation, and bear the signatures of the order approver, the order controller and the order maker who are involved in such erroneous payment order. Such minutes shall be saved in a separate file for preservation, and then, the order approver shall refuse to approve the payment order and transfer it to the order maker who shall correct it according to original documents.

2. Correction of errors after a payment order is sent

When an error such as incorrect amount (excess or shortage) or confusion between credit account and debit account is found, the order-creating unit shall promptly notify the order-receiving unit for taking appropriate error correction measure. The order-creating unit shall make a record according to the Form No. TTLNH-23 in the Appendix attached to this Circular and take the following steps:

a) In case of insufficient amount:

Based on the minutes, the order-creating unit shall create and send an additional payment order to the order-receiving unit to make up for the difference. This additional payment order must clearly specify the text “the amount is added to the debit (or credit) order No………… dated……….. with an amount of…………” and be recorded in accordance with current regulations of law;

b) In case of excess amount

(i) For the credit payment order containing an excess amount:

Based on the minutes, the order-creating unit shall make and send a request for return of the credit payment order to the order-receiving unit; make a transfer note, record and monitor the process in accordance with current regulations of law. The content of the reason field in the payment order refund request message clearly states that the error is made by the credit payment order-creating unit;

In case of receiving a refund order from the order-receiving unit, the order-creating unit will transfer the above amount to the client; at the same time, clearly record the results of the settlement in the logbook;

In case the request for return of credit order is refused by the order-receiving unit because the excess amount cannot be recovered from the client, the order-creating unit shall establish a council to determine accountability and damages to be paid by the error maker;

(ii) For the debit order containing an excess amount:

Based on the minutes, an order for cancellation of debit order is created and sent to the order-receiving unit in order to cancel the excess amount on the debit order; the process will be recorded in accordance with the current law. In case the money has been transferred to the client but the client’s account balance is insufficient for processing the order for cancellation of the debit order containing the excess amount, the order-creating unit shall record the excess amount as an amount receivable (from account of the error maker), and then take all necessary measures for recovering the excess amount, including cooperation with the order-receiving unit and competent authorities. If the excess amount cannot be recovered, the order-creating unit shall establish a council to determine accountability and damages to be paid by the error maker. Upon receiving a notification of return of money from the client, the order-creating unit shall process and record it in accordance with the current law;

c) In case of confusion between credit account and debit account:

The order-creating unit shall make the minutes and create an order for cancellation of debit payment order (if confusion between credit account and debit account is found in a credit payment order) or a request for return of credit payment order (if confusion between credit account and debit account is found in a debit order) to completely cancel the erroneous order, and then create and send a correct payment order to the order-receiving unit; concurrently, record the process in accordance with the current law. In case the confusion between credit account and debit account is found in a debit payment order, when receiving a credit order from the order-receiving unit to return the wrongly transferred amount, the order-creating unit shall record the received amount in accordance with the current law.

Article 28. Handling of errors arising from members or member units at the order-receiving unit

1. In case a payment order is found erroneous because of a technical error or fraud before the time of accounting, the order-receiving unit shall record the received order but cooperate with the order-creating unit and the National Interbank Electronic Payment System operator in handling the case.

2. For the payment order containing insufficient amount:

When receiving an additional payment order from the order-creating unit, the order-receiving unit shall compare it with the erroneous payment order before accounting.

3. For the payment order containing excess amount:

a) In case the error is found before money is transferred to the client

In case the order-receiving unit receives the request for return of the excess amount before it receives the erroneous payment order, the order-receiving unit shall log such erroneous payment order for further processing. When receiving the erroneous payment order, the order-receiving unit shall compare it with the received request for return of the excess amount, and, if data is matched, record the payment in accordance with the current law;

(i) For the credit payment order containing an excess amount: When receiving the request for return of the excess amount, the order-receiving unit shall create a credit order to return the excess amount to the order-creating unit;

(ii) For the debit order containing an excess amount: The order-receiving unit shall monitor and process the order for cancellation of debit payment order received from the order-creating unit;

b) In case the request for return of the excess amount is received from the order-creating unit after the money has been transferred to the client, the order-receiving unit shall log the erroneous payment order and take the following steps:

For the credit payment order containing an excess amount, when receiving a valid request for return of the credit payment order containing the excess amount from the order-creating unit, the order-receiving unit shall:

(i) In case the client’s payment account balance is sufficient: The order-receiving unit shall, based on the request for return of the credit order, freeze/recover the excess amount to create a credit payment order according to provisions of the Circular prescribing opening and use of payment accounts at payment service providers. Within 01 working day from the receipt of the request for return of credit payment order, the order-receiving unit shall return the excess amount to the order-creating unit;

(ii) In case the client’s payment account balance is insufficient, the order-receiving unit shall log the unprocessed request, freeze the client’s account and request the client to deposit money in order to fulfill the request (the amount frozen shall not exceed the requested excess amount). When the client deposits money or the client's account balance is sufficient, the accountant shall remove the unprocessed request in the logbook, make and send a credit payment order to the order-creating unit;

(iii) In case the client is insolvent or the client's residence cannot be found, the order-receiving unit shall play the leading role and cooperate with the order-creating unit and competent authorities in implementing measures for recovering money. If the money cannot be recovered or cannot be fully recovered, the order-receiving unit shall refuse the request for return of credit payment order; issue a notice of refusal in which reasons for refusal must be clearly stated; return the recovered amount of money (if any) to the order-creating unit; and remove the unprocessed request for return of credit order in the logbook.

4. Correction of other errors

If a payment order contains incorrect type number, transaction number or currency, or the unit serving the order recipient is not the order-receiving unit or its affiliated unit, the following actions shall be taken:

a) If a credit/debit payment order has been received but yet to be recorded by the order-receiving unit, the order-receiving unit shall record it as payable/receivable, and create a payment order and send it to the order-creating unit. The order-receiving unit does not make further money transfers;

b) For processed payment orders, the order-receiving unit shall process them similarly as specified at Point b, Clause 3 of this Article.

Article 29. Cancellation and return of payment orders at request of clients

1. Processing by the order-creating unit

When receiving a request for cancellation of a credit payment order or debit payment order from a client, the order-creating unit shall check validity of documents and compare them with the payment order to be canceled. In case the documents are invalid, the order-creating unit will return them to the client and give reasons for such return. In case the documents are valid, the order-creating unit shall follow the following steps:

a) If the payment order has not been processed or sent, it will be canceled by the order-creating unit in accordance with Article 26 of this Circular; the order-creating unit shall issue a notice of acceptance of the client’s cancellation request and will not process such payment order;

b) If a high-value payment order, foreign currency payment order or debit payment order has been executed and sent but is still in the settlement queue (because the payment account balance in the corresponding currency is insufficient) or a low-value payment order has been executed and sent but is still in the processing queue at the National Payment Service Center, it will be canceled as follows:

(i) For request for cancellation of a credit order:

Based on the client's valid request to cancel the payment order, the order maker supplements the necessary elements and creates a cancellation order according to the Form No. TTLNH-05 in the Appendix attached to this Circular, and signs the cancellation order electronically;

The order approver must check to ensure the accuracy and the consistency of information on the cancellation order made by the order maker and that on the client’s request. If they are consistent, the order approver shall add his/her electronic signature to the cancellation order and send it;