Official Dispatch No. 6644/TCHQ-GSQL dated November 13, 2018 of the General Department of Vietnam Customs on guiding guidance on managing, monitoring and implementing customs procedures for import of waste into Vietnam

ATTRIBUTE

| Issuing body: | General Department of Customs | Effective date: | Known Please log in to a subscriber account to use this function. Don’t have an account? Register here |

| Official number: | 6644/TCHQ-GSQL | Signer: | Mai Xuan Thanh |

| Type: | Official Dispatch | Expiry date: | Known Please log in to a subscriber account to use this function. Don’t have an account? Register here |

| Issuing date: | 13/11/2018 | Effect status: | Known Please log in to a subscriber account to use this function. Don’t have an account? Register here |

| Fields: | Export - Import |

MINISTRY OF FINANCE

GENERAL DEPARTMENT OF VIETNAM CUSTOMS

Official Dispatch No. 6644/TCHQ-GSQL dated November 13, 2018 of the General Department of Vietnam Customs on guiding guidance on managing, monitoring and implementing customs procedures for import of waste into Vietnam

To: Departments of Customs of provinces and cities

For the purpose of implementing Directive No.27/CT-TTg dated September 17, 2018 of the Prime Minister on certain urgent solutions for strengthening management of import and use of waste for production purpose and Circular No.08/2018/TT-BTNMT, Circular No.09/2018/TT-BTNMT dated September 14, 2018 of the Ministry of Natural Resources and Environment and following Official Dispatch No.4202/TCHQ-PC dated July 17, 2018 regarding guidance on managing, monitoring and implementing customs procedures for import of waste into Vietnam, below are instructions given by the General Department of Vietnam Customs.

I. Receiving, checking and handling waste discharged at the port

1. Imported waste may be discharged from the vehicle at the port only if the following requirements are met:

a) The consignee on the E-Manifest system shall possess an unexpired certificate of environment safety of waste import (hereinafter referred to as “certificate of environment safety”).

b) The consignee on the E-Manifest system shall possess a certificate of import deposit for waste provided on the E-Manifest system.

c) The quantity of waste discharged at the port must not exceed the remaining waste quantity for import provided in the certificate of environment safety (the remaining waste quantity for import is equal to the import quantity provided in the certificate of environment safety minus the waste quantity imported in reality (including the waste quantity discharged at the port not granted customs clearance and those with granted customs clearance.))

2. Implementation procedures

Receipt, inspection and handling of shipments of waste discharged from the vehicle entering the port shall comply with the guidance provided by the Ministry of Finance in Official Dispatch No.13151/BTC-TCHQ dated October 26, 2018 regarding adoption of measures to prevent and not allow discharge of waste not eligible for import. For the purpose of complying with the guidance of the Prime Minister provided in Directive No.27/CT-TTg and enabling importers to determine the remaining waste quantity permitted for import to gain initiative in business and giving customs authorities a basis for monitoring and deduction of import quantity, the General Department of Vietnam Customs has established a software for management of waste imported (hereinafter referred to as “the waste management software”) and provide instructions as follows:

a) Checking information about the waste expected to be discharged at the port:

a.1) According to the information about the waste shipment expected to be discharged at the port and the certificate of import deposit for waste provided in the waste management software, before the vehicle enters the port of Vietnam, the Customs Sub-Department of the place where the entrance procedure for vehicles is carried out shall collate the information on the E-Manifest system (name of the consignee, tax code, name and quantity of products, number and issuance date of the certificate of environment safety and certificate of import deposit for waste) and take actions as follows:

- If all of the requirements prescribed in clause 1 this section are satisfied, the waste shipment shall be claimed to be discharged at the port on the waste management software to notify the importer, shipping line/shipping agent or port operator that they are allowed to discharge such shipment at the port. The waste quantity for discharge shall be deducted automatically on the software.

- If any of the requirements prescribed in clause 1 this section is not satisfied, explanation and update on the list of containers not permitted to be discharged at the port shall be provided on the waste management software in order to notify the importer, shipping line/shipping agent and port operator that they are not permitted to discharge the waste shipment at the port and require such shipping line/shipping agent to move such shipment out of the Vietnamese territory.

a.2) In case no information about the waste shipment expected to be discharged at the port is available on the waste management software, the Customs Sub-Department which carries out the entry procedure for the vehicle shall collate shipment information declared on the E-Manifest system and take actions as follows:

- If all of the requirements prescribed in clause 1 this section are satisfied, the list of goods permitted to be discharged at the port shall be uploaded to the waste management software in order to notify the shipping line/shipping agent and operator of the port in which the waste shipment is expected to be discharged that they are allowed to discharge the waste shipment at the port.

- If any of the requirements prescribed in clause 1 this section is not satisfied, explanation and update on the list of goods not permitted to be discharged at the port shall be provided on the waste management software in order to notify the importer, shipping line/shipping agent and port operator that they are not permitted to discharge the waste shipment at the port and require such shipping line/shipping agent to move such shipment out of the Vietnamese territory.

b) Updating the waste quantity discharged from the incoming vehicle at the port:

After the waste is discharged at the port, the port operator shall confirm such discharge on the waste management software to notify the importer of the goods discharge to carry out following procedures.

The guidance provided in Section I hereof will replace Section II of Official Dispatch No.4202/TCHQ-PC dated July 17, 2018 of the General Department of Vietnam Customs.

II. Guidelines for following customs procedures for waste import

1. Customs declaration registration:

The customs authority shall not make registration of the customs declaration of waste in case the importer fails to provide the information about the certificate of environment safety or provides certificate of environment safety that is unexpired and fails to provide documents attached to the customs dossier under the guidance provided in Clause 2 below through the customs electronic data processing system (hereinafter referred to as “the e-system”).

2. Inspection of customs dossier:

Before checking the customs dossier provided by the customs declarant, the customs officer who is assigned to manage the account for access to the waste management software shall check and update information about the declaration of waste import according to the Appendix providing instructions for use of the waste management software issued together with this Official Dispatch on such software to check the remaining quantity permitted for import.

The customs dossier on imported waste shall comply with provisions of the Customs Law, Decree No.38/2015/ND-CP, Circular No.39/2018/TT-BTC, Circular No.08/2018/TT-BTNMT and Circular No.09/2018/TT-BTNMT and shall include the following information:

- Import declaration;

- A copy of the commercial invoice;

- A copy of the bill of lading;

- A true certified copy of the certificate of payment of deposit for waste import;

- A copy of the authorization contract (in case of import under authorization);

- The original of the notice of results of state inspection of imported waste quality (this paper shall be provided after being granted by the Department of Resources and Environment of the place where the production facility or factory using waste is located.)

The customs officer shall collate the information provided in the customs declaration with that in documents provided in the customs dossier submitted on the e-system by the importer and verify the validity of the following papers: the certificate of payment of deposit for waste import and notice of results of state inspection of imported waste quality issued by the Department of Resources and Environment of the place where the production facility or factory using waste is located. Scope of inspection:

a) Verifying information about the certificate of environment safety:

- According to the number of the certificate of environment safety provided in the customs declaration, the customs officers shall collate such information with the information provided on the website of the Ministry of Natural Resources and Environment and national single-window system, if available then continue to carry out the next procedure; If the information about the certificate of environment safety is not available on the website of the Ministry of Natural Resources and Environment or national single-window system, such customs officer must conduct a verification under the guidance provided in Clause 4 of Official Dispatch No.13151/BTC-TCHQ dated October 26, 2018 of the Ministry of Finance as a basis for carrying out the following procedure and send a report to the General Department of Vietnam Customs (through the Customs Management and Supervision Department) for consideration and information update on the waste management software.

- Collate the following information: name of the organization/individual using waste for production purpose/name of the importer of waste under the authorization contract; name and address of the facility using waste for production purpose/address of waste storage warehouse; name of waste, HS code and weight of waste permitted for import and effective period of the certificate of environment safety.

- In case of import under the authorization contract, check the copy of the authorization contract signed with the organization/individual using waste for production purpose that is granted the certificate of environment safety. Customs authorities no longer carry out customs procedures for importers of waste under authorization contracts that are granted the certificate of environment safety from September 17, 2018.

b) Checking the certificate of import deposit for waste under regulations specified in Article 58 and 59 of Decree No.38/2015/ND-CP dated April 24, 2015 of the Government on waste management:

- The certificate of payment of deposit for waste import shall be granted by Vietnam Environmental Protection Fund or the commercial bank at which the import deposit for waste is made and must be the true certified copy.

- The deposit shall be made 15 working days before the procedures for customs clearance of imported waste is adopted.

- The deposit shall comply with the following regulations:

+ For import volume less than 500 tonnes of iron or steel waste, the deposit shall be equal to 10% of total value of the shipment;

+ For import volume of from 500 to less than 1000 tonnes of iron or steel waste, the deposit shall be equal to 15% of total value of the shipment;

+ For import volume of at least 1.000 tonnes of iron or steel waste, the deposit shall be equal to 20% of total value of the shipment;

+ For import volume of less than 100 tonnes of paper waste and plastic waste, the deposit shall be equal to 15% of total value of the shipment;

+ For import volume of from 100 to less than 500 tonnes of paper and plastic waste, the deposit shall be equal to 18% of total value of the shipment;

+ For import volume of at least 500 tonnes of paper and plastic waste, the deposit shall be equal to 20% of total value of the shipment;

+ For types of waste other than the aforesaid waste, the deposit shall be equal to 10% of total value of the shipment.

c) Collate the data (quantity and HS code) on waste import provided in the customs dossier (customs declaration and relevant documents) with the information provided in the certificate of environment safety, certificate of payment of deposit for waste import and the notice of the result of state inspection of imported waste quality.

d) Checking the notice of results of state inspection of imported waste quality:

According to the notice of results of state inspection of imported waste quality issued by the Department of Resources and Environment of the area where the production facility or factory using waste is located uploaded to the national single-window system or the original copy provided by the customs declarant, the customs officer shall collate the information provided in aforementioned announcement with that in the customs declaration, customs dossier and the result of physical inspection provided by the customs authority as the basis for clearance decision.

dd) Handling dossier inspection results:

- If the customs dossier satisfies the requirements, the customs procedure shall be carried on as regulated.

- The certificate of environment safety shall be rejected if it has expired (more than 2 years from the issuance date for those granted before October 01, 2018 under regulations in Circular No.41/2015/TT-BTNMT or more than 3 years from the issuance date for those granted from October 01, 2018 onwards as regulated in Circular No.03/2018/TT-BTNMT) by the Ministry of Natural Resources and Environment.

- If no certificate of environment safety is available or such certificate is expired or has no remaining quantity for import, the customs authority shall not carry out the customs procedure for the customs declaration of waste import provided by the custom declarant and shall ask for re-export of goods and take actions under regulations of laws. The goods shall be re-exported at the checkpoint of import.

- For the case in which the goods quantity provided in the customs declaration exceeds the import quota, the customs declarant is required to amend the customs declaration as regulated and the customs authority shall carry out the customs procedure for the goods quantity within the import quota. The goods quantity that exceeds the import quota shall be re-exported by the customs declarant and handled as per law provisions. The goods shall be re-exported at the checkpoint of import.

- If the deposit is not sufficient as specified in Decree No.38/2015/ND-CP, additional deposit shall be made as regulated.

- The customs clearance procedure shall not be carried out if the deposit is made less than 15 working days.

3. Sampling and physical inspection:

a) The customs authority shall conduct physical inspection and supervision of sampling of all shipments declared as waste. The level of physical inspection of goods shall comply with the guidance provided on the system.

b) Before presenting the goods for inspection and sampling purpose, the customs declarant shall notify, in writing or via the national single-window system, time and place for inspection and sampling to the Sub-Department of Customs of the place where the goods is stored, the appointed assessment agency, authority in charge if state inspection of the imported waste quality (the Department of Resources and Environment of the place where the production facility or factory using waste is located).

c) Place of sampling and inspection:

The physical inspection of goods shall be conducted at the checkpoint of import Customs Sub-Department.

If the customs declaration is registered at the Customs Sub-Department other than the Customs Sub-Department of the checkpoint of import, such Custom Sub-Department shall notify the Customs Sub-Department of the checkpoint of import in writing or by fax of cooperation with the Customs Inspection Authority in charge in physical inspection.

For the case in which the checkpoint of import is equipped with a surveillance camera system, the physical inspection of goods shall be conducted at the area under supervision of the camera.

d) After receiving the notification of goods presentation for physical inspection purpose from the customs declarant, the Customs Sub-Department of the checkpoint of import where the goods is stored shall send a written request for cooperation in physical inspection to the Customs Inspection Authority in charge of such place directly or by fax (according to Form No.01/PYCPHKT/2018 issued thereto).

The Customs Inspection Authority in charge shall allocate staff and technical equipment for cooperation in physical inspection after receiving such written request or fax.

dd) Form, level and method of inspection

The inspection for verifying the accuracy of information provided in the customs declaration and information about goods imported in reality shall be conducted by the customs officers of the Customs Sub-Department of the checkpoint of import and staff of the Customs Inspection Authority.

dd.1) Visual inspection or other on-site physical inspection carried out by using analysis equipment shall be carried out by the Customs Inspection Authority and entry checkpoint Customs Sub-department according to Decision No.73/2014/QD-TTg dated December 19, 2014 of the Prime Minister and national technical regulations on environment specified in Circular No.08/2018/TT-BTNMT and Circular No.09/2018/TT-BTNMT. If having sufficient grounds for determining the imported waste shipment fails to conform to provisions of the customs laws and the Law on Environmental Protection, the above-mentioned Department shall take actions accepted by Laws.

dd.2) In case results of visual inspection and on-site physical inspection carried out by using analysis equipment fails to determine whether the imported waste shipment is conformable to provisions of the customs law and the Law on Environmental Protection, the Customs Inspection Authority shall cooperate with the Customs Sub-department of the checkpoint of import in collecting typical samples for analysis and assessment purpose. The sampling shall comply with regulations in Circular No.08/2018/TT-BTNMT and Circular No.09/2018/TT-BTNMT.

Physical inspection and sampling of goods (if any) by the Customs Sub-Department of the checkpoint of import and Customs Inspection Authority shall be carried out in conjunction with the inspection and sampling (if any) by the assessment body as specified in Circular No.08/2018/TT-BTNMT and Circular No.09/2018/TT-BTNMT.

dd.3) During the physical inspection and typical sampling of goods, the customs officer shall take photos of inspection points, collect samples of imported goods, and video the whole inspection and sampling process, from the opening of goods container (with regard to containerized goods) or the commencement of inspection of goods (with regard to bulk cargos) to the completion of inspection and sampling. For shipments requiring extra time for inspection, only photos showing inspection contents and methods as well as real conditions of goods for inspection, handling complaints or filing of a lawsuit shall be taken. Photos of inspection and sampling points shall be sent to the mail box at the address [email protected] while the video of the inspection and sampling is deposited with the Customs Sub-department of the checkpoint of import for the purpose of inspection, handing complaints or filing of a lawsuit.

dd.4) At the end of the physical inspection of goods, the in-charge customs inspector shall write an inspection result report according to form no.06/PGKQKT/GSQL issued together with Circular No.38/2015/TT-BTC (which is amended in Circular No.39/2018/TT-BTC). The inspectors of Customs Sub-Department of the checkpoint of import and Customs Inspection Authority shall sign for certification at item no.4 in the part “manual inspection” in section II of the inspection result report.

For goods claimed as waste that are present in the list provided in Decision No.73/2014/QD-TTg but do not have any national technical regulation on environment, the customs authority shall determine that there are not enough grounds for clearance of those goods.

dd.5) For goods of which typical sampling is required, at the end of the sampling, the customs inspector shall make a written document certifying such sampling according to form no.02/BBLM-PL issued together with Official Dispatch No.4202/TCHQ-PC dated July 17, 2018 of the General Department of Vietnam Customs which is endorsed by the customs declarant, customs officers of the Customs Sub-Department of the checkpoint of import and staff of the Customs Inspection Authority and representative of the appointed assessment body. The written document certifying the sampling must specify the sampling time and position (samples may be collected in a container or from a shipment), sampling method and the quantity of sample (quantity and weight of samples conforming to regulations in Circular No.08/2018/TT-BTNMT and Circular No.09/2018/TT-BTNMT) and serial number of the container or vehicle carrying waste goods.

dd.6) The customs officer must apply security seals to the samples after sampling. One sample shall be sent to the Customs Inspection Authority for its inspection and assessment of compliance with provisions of the customs law and the law on environmental protection. One sample shall be sent to the appointed certification body. One sample shall be kept at the Custom Sub-department of the checkpoint of import. Sample storage time shall be subject to the Circular No.14/2015/TT-BTC dated January 30, 2015 of the Ministry of Finance.

dd.7) In case results of visual inspection are claimed to be conformable to the National technical regulations on environmental protection by the inspection authority (Department of Natural Resources and Environment of the place where the production facility or factory using waste for production purpose is located); however, the customs authority doubts that such results fail to provide sufficient grounds for concluding that the goods imported are eligible for customs clearance, such customs authority shall carry out typical sampling under the guidance provided in point dd.5 and dd.6 mentioned above.

e) The visual inspection of goods and on-site inspection by using testing equipment shall be done within 8 working hours starting from the customs declarant’s presentation of all goods for inspection. In case of goods imported in large quantities, of various kinds or complicated inspection, physical inspection duration shall be done within 2 working days.

g) The officer of the Customs Inspection Authority shall provide additional result of physical inspection of waste shipment in the Form No.06/PGKQKT/GSQL which specifies whether the waste shipment is eligible for import and take responsibility for such inspection result within 2 working days from the day on which the typical sample is collected.

The Customs Inspection Authority shall send a consolidated report to the General Department of Vietnam Customs on goods requiring extra time for analysis.

h) Handling inspection results provided by customs authorities (entry checkpoint Customs Sub-Department and Customs Inspection Authority):

h.1) In case the inspection result shows that the imported waste conforms to provisions of the customs law and the law on environmental protection, the customs authority shall carry out the customs procedure as regulated;

h.2) In case the inspection result shows that the imported waste shipment fails to conform to provisions of the customs law and the law on environmental protection, the customs authority shall take actions as regulated.

4. Waste shipments imported pending results of state inspection of imported waste quality provided by the Department of Natural Resources and Environment and inspection results provided by the Customs Inspection Authority shall be kept at the checkpoint of import and must not be returned to the warehouse for maintenance purpose.

5. As for waste shipments arriving at the entry checkpoint, the customs authority shall take actions under the guidance of the Ministry of Finance provided in Official Dispatch No.12957/BTC-TCHQ dated October 22, 2018 which is sent to the Prime Minister:"Waste shipments that are not received within 90 days from the day on which they arrive at the entry checkpoint shall be handled like backlogged goods or the customs authority shall carry out customs procedures as prescribed in legislative documents that come into force before October 29, 2018 if their receiver shows up. Waste shipments that are received within 90 days from the day on which they arrive at the entry checkpoint shall be handled under technical standards and regulations specified in Circular No.08/2018/TT-BTNMT and Circular No.09/2018/TT-BTNMT dated September 14, 2018 of the Ministry of Natural Resources and Environment and the customs authority shall carry out the customs clearance procedure as regulated.”

6. With regard to implementation of Official Dispatch No.5943/BTNMT-TCMT dated October 26, 2018 of the Ministry of Natural Resources and Environment:

a) Pursuant to the guidance provided in Clause 2 Appendix 1 issued together with Official Dispatch No.5943/BTNMT-TCMT, as for shipments declared to be imported before October 29, 2018 by the General Department of Environment, the importer may use the written announcement provided by the General Department of Environment as the basis for carrying out the customs clearance procedure that the checkpoint. However, Circular No.08/2018/TT-BTNMT and Circular No.09/2018/TT-BTNMT (that comes into force from October 29, 2018) have annulled Article 10 of Circular No.41/2015/TT-BTNMT. As for that reason, the customs clearance dossier shall not include the announcement of waste import.

b) Pursuant to Point 3.2 Appendix 1 issued together with Official Dispatch No.5943/BTNMT-TCMT regarding guidelines for implementation of Circular No.08/2018/TT-BTNMT and Circular No.09/2018/TT-BTNMT, the Department of Natural Resources and Environment shall take charge and cooperate with the customs authority and the appointed assessment body in inspection and sampling in order to assess the quality of waste shipments imported. For the purpose of ensuring consistency in implementation and preventing problems posed for the importers, the General Department of Vietnam Customs has sent the Ministry of Natural Resources and Environment a proposal of combined inspection and sampling assigned to the Department of Natural Resources and Environment of the checkpoint of import or the Department of Natural Resources and Environment in place where the production facility or factory is located and according to the result of conformity assessment provided by the appointed assessment body and the application for inspection of goods quality submitted by the enterprise, such Department shall issue the notice of results of inspection of imported goods quality under regulations in Clause 2c Article 3 of Decree No.132/2008/ND-CP dated December 31, 2008 of the Government providing for elaboration of a number articles of the Law on Quality of Goods and Products (which is amended by Clause 3 Article 1 of Decree No.74/2018/ND-CP dated May 15, 2018). Further instructions shall be provided after opinions from the Ministry of Natural Resources and Environment are received.

7. Reports and proposals regarding exemption from state inspection of the quality of potentially unsafe goods (group 2 commodities) that are imported for processing purpose for overseas traders or producing exports under regulations in Decree No.74/2018/ND-CP dated May 15, 2018 (which amends Decree No.132/2008/ND-CP) have been sent to competent authorities by the General Department of Vietnam Customs so far. Therefore, the General Department of Vietnam Customs requires entities not to claim exemption from state inspection of goods quality for imported waste.

8. Managing risks incurred during sampling and physical inspection of goods:

The customs authority shall manage risks incurred in sampling of goods for the purpose of reducing the clearance time to enable enterprises to comply with law provisions on customs.

9. Preventing smuggling and fraud in waste import:

Anti-smuggling forces of various levels shall prepare plans for regular patrol and control, and closely cooperate with other competent authorities, fight against and promptly detect as well as take actions against illegal import of waste to Vietnam. The Anti-Smuggling and Investigation Department shall cooperate with and assist Customs Authorities of bordering provinces in preparing plans for preventing and fighting against smuggling and illegal transport of waste through the border.

Customs authorities of provinces and cities and professional consultancy affiliated to the General Department of Vietnam Customs shall prepare and implement plans for fighting against intentional misdeclaration of names of goods with the aim of transporting waste that fails to conform to regulations to Vietnam. If any violation is found, such customs authorities shall transfer the case files to an investigation agency for prosecution as per law provisions.

Customs authorities of provinces and cities shall, on their own initiative, establish regulations and cooperate with provincial and city competent authorities in order to prevent and take action against violations of waste import.

The guidance provided in Section II hereof will replace Point 1 Section III of Official Dispatch No.4202/TCHQ-PC dated July 17, 2018 of the General Department of Vietnam Customs.

III. Waste management software

For the purpose of enabling importing enterprises to determine the remaining waste quantity permitted for import to gain initiative in business and giving grounds for customs authorities to perform management and deduction of import quantity, the General Department of Vietnam Customs has establish a waste management software and provide instructions as follows:

1. Instructions on downloading, installation and use of waste management software for customs authorities:

a) The waste management software shall be uploaded to the website of customs authorities at the address: http://ptsw.customs.gov.vn/vnaccs/QLHNPL/eScrap.rar

b) Customs Sub-Departments shall download the waste management software and install it in computers connected to their local area network. Each Customs Sub-Department may be granted 3 accounts for use by 3 following groups of divisions: Division in charge of entry procedures for vehicles; monitoring division and customs dossier inspection division.

c) After receiving password of each account, the sub-department shall transfer the account to one customs officer who take charge of monitoring imported waste (the transfer minutes is provided) for access to and use of waste management software. Information on the account granted shall be provided in the following format:

+ XXXX_DK: used by the customs dossier inspection division.

+ XXXX_GS: used by the monitoring division.

+ XXXX_TT: used by the division in charge of entry procedures for vehicles.

Where, XXXX refers to the code of the Customs Sub-Department (e.g. 51C1, 03EE, 23CI, etc.). The Customs Sub-Department may use only one or all of three accounts mentioned above depending on the reality.

d) Customs Sub-Departments shall conduct a study on the waste management software and use such software under the detailed instructions for use provided in the Appendix issued thereto. Should any question or technical error arise during implementation, entities shall directly inform the General Department of Vietnam Customs at the email address [email protected] or the email address of technician provided in the instructions for use of waste management software for timely handling.

2. Instructions on downloading, installation and use of waste management software for waste importers and port operators:

a) For port operators:

- The entry checkpoint Customs Sub-Department shall notify port operators in the area under management of use of waste management software.

- The account used for access to such software shall be granted to all port operators throughout the country by the General Department of Vietnam Customs in the following format:

+ XXXXX, where XXXXX is the port code in use provided on the VNACCS system (e.g.VNTCI VNTTC, etc.)

+ The password of such account shall comply with the guidance provided in Clause 3 hereinafter.

b) For importers of waste:

- The General Department of Vietnam Customs shall grant accounts for access to the waste management software to importers on the list of enterprises published by the Ministry of Natural Resources and Environment on its website or the national single-window system.

- The user account is the tax code of the enterprise. The importer may get access to the waste management software to check the remaining waste quantity for import under permission. Such waste management software may be used for sending the Customs Sub-Department the request for permission to discharge waste carried by ships that is about to arrive at the port.

3. Password:

- The General Department of Vietnam Customs shall send passwords of user accounts in format mentioned in Clause 2 above to Customs Departments of provinces and cities by confidential documents.

- Such Customs Departments shall inform port operators and waste importers of accounts and passwords of such accounts. The format of such accounts shall comply with the guidance provided in Clause 2 and the passwords given shall have the same structure of those granted to customs authorities.

- Users will be asked to change their password for security assurance at the first login.

- In case the users forget their password or fails to identify their account, the customs authority, port operator and waste importer shall contact the General Department of Vietnam Customs (Customs Management and Supervision Department) to have their password reset.

4. Monitoring waste quantity discharged at the port or imported

- The customs authority shall monitor the waste quantity discharged at the port, remaining quantity to be discharged, quantity imported and remaining quantity to be imported while the importer may use the waste management software to monitor their remaining waste quantity to be discharged at the port or imported.

- If the quantity recorded is inconsistent with the quantity discharged or imported in reality, the customs officer shall send a report to the Director of the Customs Sub-Department and make adjustment to such quantity by updating an adjustment note on the waste management software after obtaining approval from the Director of the Customs Sub-Department.

- The custom officer may increase or decrease the remaining quantity of goods to be discharged at the port or to be imported on the adjustment note.

- The adjustment note may be changed when it is updated if it is still opened. For the case in which the adjustment note has been closed by the time discovering the mistake therein, the custom officer must create a new one to adjust the wrong information.

- The adjustment note must specify the reason for adjustment.

5. Updating data on waste imported and discharged at the port

- At the moment, the data on waste imported by enterprises updated on the waste management software of the General Department of Vietnam Customs up to 5 PM on October 24, 2018 is used to determine the remaining waste quantity permitted for import and discharge by enterprises.

This data may be insufficient at the first update on information about the waste shipment discharged at the port by the enterprise at the Customs Sub-Department to the waste management software. As for that reason, Customs Departments of provinces and cities are required to review waste shipments discharged at the port in the area under management that do not undergo import procedures or undergo import procedures from after 17:00 on October 24, 2018 to the date of first update on information about waste shipments discharged at the port by enterprises at the Customs Sub-Departments to the waste management software and update the data on the aforesaid waste shipments to the waste management software to deduct the remaining quantity of waste permitted for discharge or import by enterprises.

For example: The certificate of environment safety No.01/GXN-BTNMT dated January 01, 2018 granted to Company A specifies that it has 10,000 tonnes of paper; 5,000 of them have been imported by 5 pm on October 24, 2018 and 1,000 tonnes of papers imported have been discharged at the yard but not undergo import procedures and after 5 pm on the same day, import procedures have been carried out for 500 tonnes of paper discharged.

As mentioned above, before the first update on the waste shipment discharged at the port by the enterprise at the Custom Sub-Department to the waste management software, the remaining quantity of paper to be discharged and imported by Company A shown on the software is (10,000 – 5,000) = 5,000 tonnes.

The customs officer in charge of monitoring the remaining quantity of waste to be discharged at the port shall update the information on 1,000 tonnes of paper discharged at the port that do not undergo import procedures to deduct: 5,000 - 1,000 tonnes = 4,000 tonnes. (Note: information shall be updated at the indicator of discharge adjustment.)

The customs officer in charge of monitoring the remaining quantity of waste permitted for import shall update information on 500 tonnes of papers undergoing import procedures to deduct: 5,000 – 500 tonnes = 4,500 tonnes of paper. (Note: information shall be updated at the indicator of import adjustment.)

The Customs Sub-Department at which the customs declaration is registered shall take responsibility to update the quantity of waste imported and the Customs Sub-Department managing the waste discharged shall update the quantity of the waste discharged at the port to the waste management software.

Customs Departments of provinces and cities are requested to notify this Official Dispatch to port operators in provinces and cities and waste importers, and publish such official dispatch at places where customs procedures are carried out. Should any question above authority arise, entities concerned shall send a consolidated to the General Department of Vietnam Customs (Customs Management and Supervision Department) for further instructions./.

For the Director General

Deputy Of Director General

Mai Xuan Thanh

Form No.01/PYCPHKT/2018

GENERAL DEPARTMENT OF VIETNAM CUSTOMS | SOCIALIST REPUBLIC OF VIETNAM |

|

No………/……… | (Location and date) |

|

INSPECTION REQUESTING NOTE

(Issued together with Official Dispatch No.6644/TCHQ-GSQL dated November 13, 2018 of the General Department of Vietnam Customs)

To: ………………………..

1. Name of goods declared: .....................................................................

2. HS code declared: .......................................................................

3. Customs declaration no………. dated ………….........................

4. Importer/Exporter: .....................................................................

5. Enclosure: ...................................................................................

(a) Customs declaration (copy) | : Yes * No * |

(b) Commercial contract (copy) | : Yes * No * |

(c ) Relevant technical documents (copies) | : Yes * No * |

(d) Inspection certificate (copy, if any) | : Yes * No * |

(e) C/O (if any) | : Yes * No * |

(f) Results of physical inspection of goods (copy) | : Yes * No * |

(g) Documents relating to specialized inspection (specify the type of document, if any):

6. Proposed time of cooperation in physical inspection: ................

7. Place of physical inspection: .......................................................

8. Requested inspection: tick the appropriate checkbox and give required details of each requested inspection

(a) Inspection of HS code | * |

(b) Inspection for identification of name/type of precursor or prohibited substance: clearly specify name and type of prohibited substance | * |

(c) Specialized inspection in respect of ............ (specify the extent of the inspection) For instance: food safety and quality and quarantine in accordance with regulations in ………………………..(name of the document) | * |

(d) Other inspection matters (clearly specify where applicable): ……………………………….. |

|

CUSTOMS OFFICER | DIRECTOR |

Note:

APPENDIX

INSTRUCTIONS FOR USE OF WASTE MANAGEMENT SOFTWARE

(Issued together with Official Dispatch No.6644/TCHQ-GSQL dated November 13, 2018 of the General Department of Vietnam Customs)

A. Entities eligible to use the software

1. Customs officers of the checkpoint Customs Sub-Department where entry procedures for vehicles are carried out or where the waste is stored and customs declaration is registered.

2. Operators of ports where ships carrying waste (including both goods carried by containers and bulk cargo) arrive.

3. Shipping lines and representatives of shipping lines for waste transport

4. Importers of waste granted certificate of conformity to environmental protection regulations in waste import by the Ministry of Natural Resources and Environment/Department of Natural Resources and Environment.

B. Software downloading and installation

1. 1. Software downloading

- The software is uploaded to the Customs website at the address http://ptsw.customs.gov.vn/vnaccs/QLHNPL/eScrap.rar

- The software may be downloaded once and used by 3 following groups: importers, customs authorities and port operators.

- The new version will be automatically and downloaded and updated.

2. Software installation

- The software downloaded can be put in use immediately without environment installation.

- For the purpose of facilitating use of the software, the software downloaded shall be stored in disk D:\HAIQUAN\ on the computer.

- In case the software is upgraded with additional functions such as viewing reports, new applications for laboratory downloading for viewing reports will be available on the software.

3. Data connection configuration

- In order to use the software, at first, the user must set up the data collection as follows:

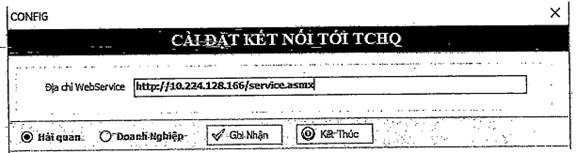

+ As for customs authorities, the connection address is: http://10.224.128.166/service.asmx

+ As for importers and port operators: the address is http://103.248.160.42/eScrapService/service.asmx

- In case of first opening of the software or failure to connect to the server, a table for connection will appear on the software for the user to enter the connection address. The user just needs to click the "Customs" or "Enterprise" item to have the aforementioned address automatically completed or manually type such address as shown in Picture 1.

Picture 1: Setting up address to connect to the data server

C. Using instructions

I. Common functions

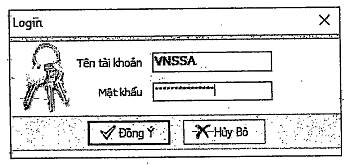

1. Login

- Purpose of design:

Protect data through use authority given to each type of user

- Interface:

- Implementation steps:

Step 1: Enter the user account

Step 2: Click the button “Đồng Ý” (“Agree”) to log in to the software

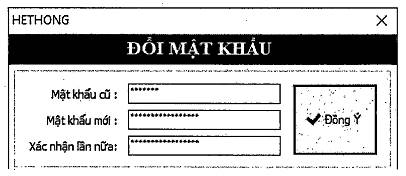

2. Changing password

- Purpose of design:

Allow users to change their password to secure their accounts, especially change default password. The user is requested to change the default password at the first login.

- Interface:

- Implementation steps:

Step 1: Go to function 1.2

Step 2: Enter the old password then new password twice

Step 3: Click the button “Đồng Ý” (”Agree”) to finish the change

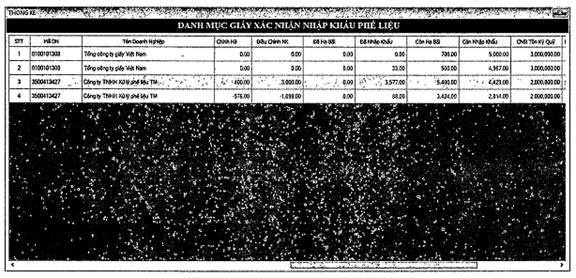

3. Viewing statistical data

- Purpose of design:

Allow users to view all information on waste quantity discharged, imported and the remaining quantity to be discharged or imported shown on each certificate of environment safety of each importer.

This function is used to determine the remaining quantity of waste permitted for imported and the quantity imported and discharged previously.

- Interface:

- Implementation steps:

Step 1: Go to function 6.1

Step 2: Right click each certificate of environment safety for details

II. For enterprises importing waste (importers)

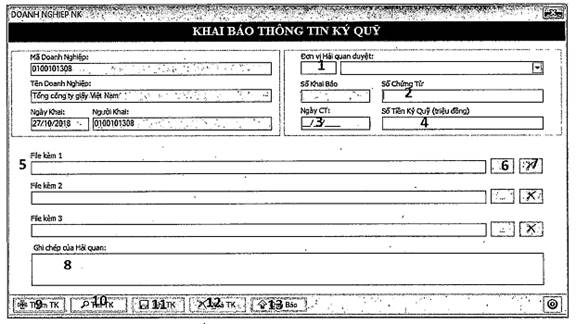

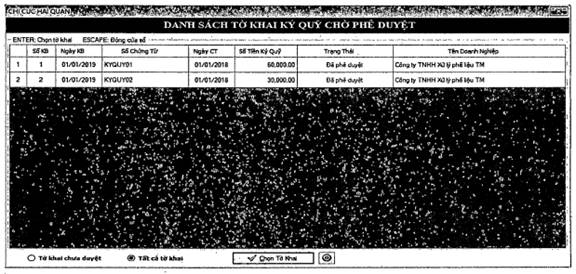

1. Declaration of import deposit

- Purpose of design:

The importer shall provide deposit information for the customs authority and port operator before discharge of waste.

The importer shall provide information about the deposit amount for the purpose of deduction of import quantity.

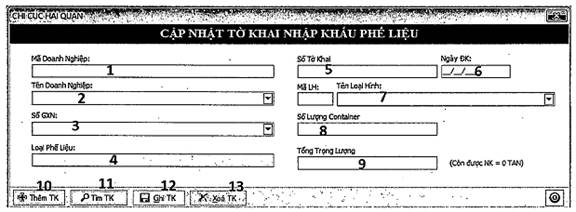

- Interface:

- Implementation steps:

Step 1: Go to function 3.1

Step 2: Enter relevant information, including

(1) the customs authority to which the information is sent

(2) number of deposit certificate

(3) issuance date

(4) deposit amount

(5) view the attached file

(6) select the attached file

(7) delete the attached file

(8) information rejected by the customs authority

(9) add a new declaration

(10) find the previous declaration

(11) fill in the declaration

(12) delete the declaration (not approved by the customs authority)

(13) send the declaration to the customs authority

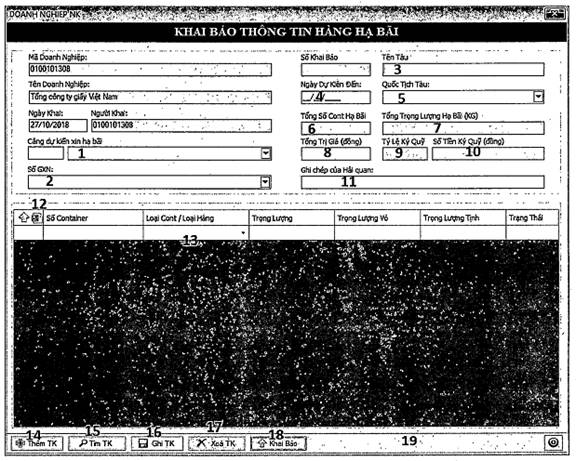

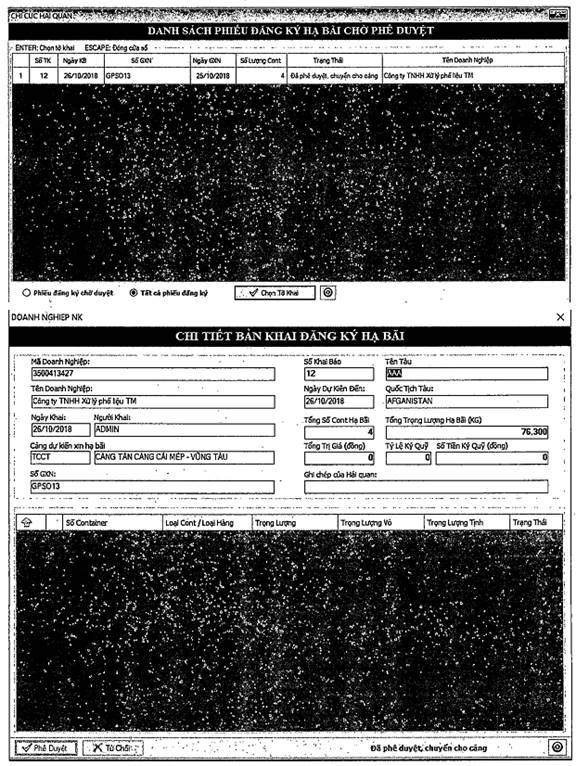

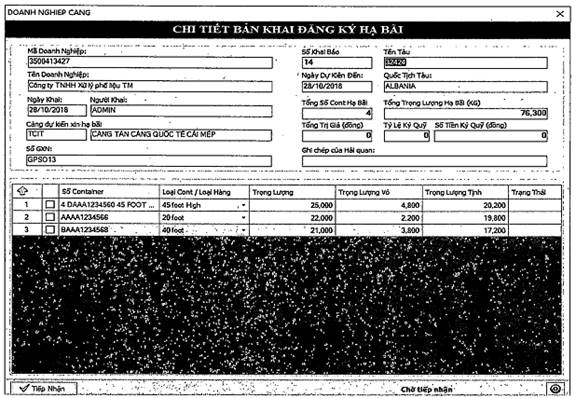

2. Registering the list of waste expected to be discharged

- Purpose of design:

Send the list of waste container to the customs authority to notify the plan for discharge of waste imported before the ship arrives at the port.

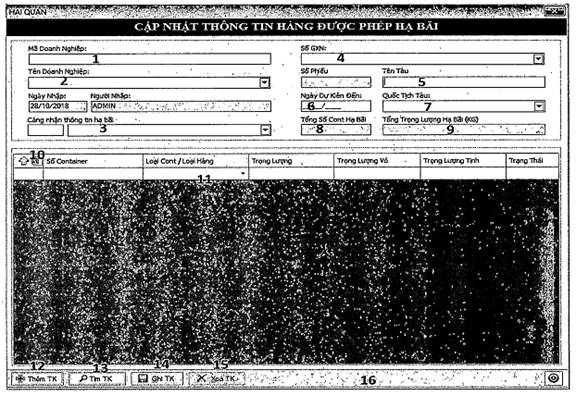

- Interface:

- Implementation steps:

Step 1: Go to function 3.2

Step 2: Enter information required, to be specific:

(1) expected arrival port

(2) license no.

(3) name of the incoming ship

(4) proposed arrival date

(5) ship’s nationality (for ship identification)

(6) total number of container (automatically count the list of container in item (13))

(7) total net weight (sum of weights specified in item (13)). Calculation unit: KG Such weight will be divided by 1000 to be converted to tonne when the software verifies the stock.

(8) total value of the shipment

(9) deposit ratio (determined through item (2) and (7))

(10) deposit amount (total value multiplied by the deposit ratio)

(11) explanations for refusal of the customs authority

(12) enter the list of container (information retrieved from the Excel file)....

(13) the list of containers and types thereof In case of bulk cargo, the user may select the box "Type of container/bulk cargo". If the cargo is carried by containers, the software will automatically determine the weight of container's shell based upon container types under international standards. The user is only required to enter total weight of the container (including the shell's weight) in the item "Weight"

(14) add a new declaration

(15) find the declaration recorded in the list. Only the declaration made by the user is shown.

(16) save the declaration

(17) delete the declaration

(18) send the declaration to the customs authority

Such declaration shall be transferred to the port specified in item (1) after being approved by the customs authority.

III. For Customs Sub-Departments

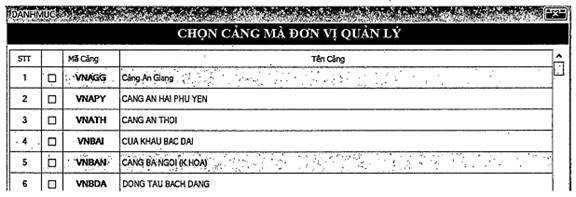

1. Setting up the port list

- Purpose of design:

Each Customs Sub-Department has to manage certain ports. The port list configuration will help to reduce the time finding ports for information sending purpose.

Before using functions intended for customs officers, such customs officers must set up this port list.

- Interface:

- Implementation steps:

Step 1: Go to function 2.6

Step 2: Select ports under management

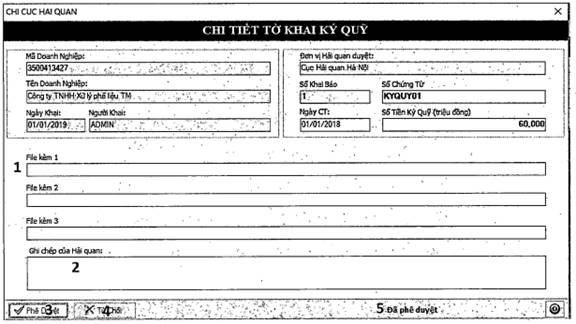

2. Approving deposit declaration provided by importers

- Purpose of design:

Check information about import deposit by importers

Approve and include deposit amounts in total credit balance of deposit of the importer

- Interface:

- Implementation steps:

Step 1: Go to function 4.1

Step 2: Select the declaration to be checked by double click such declaration or click the button "Chọn Bản Khai” (“Select declaration").

Step 3: Check information and take actions as follows:

(1) view attached files (if any)

(2) enter information sent to the importer, especially explanation for refusal

(3) grant approval

(4) refuse to approve the declaration

(5) status of the declaration

The declaration approved cannot be adjusted. The deposit shall be included in the credit balance of deposit of the importer.

3. Approving registration of discharge of waste

- Purpose of design:

Verify the goods discharge request of the importer to see whether the waste imported is eligible to be discharged.

Transfer the registration of goods discharge to the port operator for supervision and discharge purpose.

- Interface:

- Implementation steps:

- Implementation steps:

Step 1: Go to function 4.2

Step 2: Select the registration declaration from the list by double- click such declaration or click the button “Chọn Bản Khai” (“Select declaration”).

Step 3: Check and approve declaration of goods discharge registration like deposit declaration mentioned above

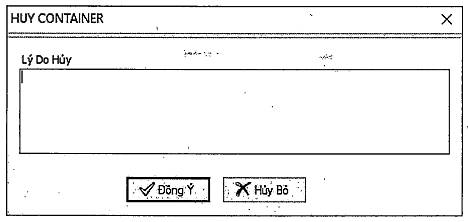

The weight shall be accumulated depending on the container list and calculated by KG. Such weight will be divided by 1000 to be converted to tonne when the software verifies the stock.

Step 4: Cancel the container in the list if requested by the importer due to misdeclaration. To cancel the container, the custom officer shall open the declaration, click the square box placed before each line of container and right click the mouse to open the cancellation function.

If the declaration is received by the port operator, such cancellation shall be made by the port operator as only such port operator can verify whether the waste carried by the container to be cancelled on request is discharged at the port or not. The cancellation cannot be made if the waste is claimed to have been discharged at the port by the port operator. Containers cancelled due to misdeclaration shall be re-declared.

4. Updating declaration of waste import

- Purpose of design:

The customs officer shall update information on the declaration of waste import to the software to verify whether the declaration of waste import with import quantity recorded on the VNACCS system exceeds the import quota.

The customs authority shall provide update to deduct the import quantity under each import license (certificate of environment safety) for each type of waste.

- Interface:

- Implementation steps:

Step 1: Open function 4.3

Step 2: Update information and take actions as follows:

(1) select the enterprise code -> name of enterprise will automatically appear in item (2)

(2) select name of the enterprise -> the enterprise code will automatically appear in item (1)

(3) select the license number (according to the enterprise selected in item (1) and (2))

(4) type of waste (automatically shown on the item when the license is selected)

(5) enter the number of the registration declaration on the VNACCS, select the first number

If such declaration is adjusted that leads to the change in the last digit of the declaration number, the first number will be still selected.

(6) Enter the date of declaration registration

(7) Select the code of declaration type

(8) Enter total number of containers registered or enter 1 in case of bulk cargo

(9) Enter total weight registered

The remaining quantity permitted for import is provided in red next to this item.

(10) Add a new declaration

(11) Find the declaration recorded previously in the list

(12) Fill in the declaration

(13) Delete the declaration

The user may delete any declaration updated previously. Such deletion may cause effects on the remaining quantity permitted for import of the enterprise.

5. Updating the list of waste permitted for discharge

- Purpose of design:

The customs officers shall, on their own, make and send the list of waste containers eligible to be discharged to the port operator.

This function is performed in case the importer fails to declare registration of waste expected to be discharged or fails to perform the declaration duty of an importer.

This function is replaced the process of making and sending the list to the customs authority for approval.

- Implementation steps:

Step 1: Open function 4.4

Step 2: Enter information and take actions as follows:

(1) enter the enterprise code determined on the E-Manifest system

(2) enter name of enterprise

(3) enter the expected arrival port for discharge purpose

(4) select the number of the license (certificate) of the enterprise shown in item (1) and (2))

(5) enter the ship’s name for identification purpose

(6) enter the proposed arrival date

(7) enter the ship’s nationality for distinguishing purpose

(8) total container automatically calculated according to the list of containers in item (11)

(9) total waste weight automatically calculated according to the list of containers in item (11)

(10) enter the list of containers (information retrieved from the Excel file)

excel file may be downloaded from the item (10) in this function.

(11) the list of containers

Containers with wrong information will be shown in red. The user just needs to enter the weight of container. The weight of container’s shell and net weight of waste shall be automatically calculated by the software according to the type of container selected.

(12) Add a new declaration

(13) Find the declaration entered previously

(14) Fill in the declaration

The declaration that is successfully made will be automatically transferred to the port operator specified in item (3).

(15) Delete the declaration

Only the declaration that is not received by the port operator can be deleted. In case of receipt of wrong container, the port operator shall cancel the wrong container that will be re-declared afterward. The function of container cancellation may be applied in case of misdeclaration by the enterprise and request for cancellation. If the declaration is received by the port operator, such cancellation shall be made by the port operator as only the port operator can verify whether the waste carried by the container to be cancelled on request is discharged at the port or not.

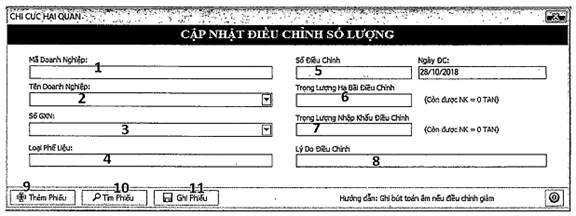

6. Updating quantity adjustment note

- Purpose of design:

Allow customs authorities to make positive or negative adjustments to the remaining quantity permitted for discharge or import.

The adjustment made cannot be changed but adjusted by another adjustment.

Select increase (+) or decrease (-) to change the quantity.

- Interface:

- Implementation steps:

Step 1: Open function 4.5

Step 2: Enter the following information:

(1) code of the enterprise

(2) name of the enterprise

(3) the number of the certificate of the enterprise shown in item (1) and (2))

(4) type of waste (automatically shown on the item when the license is selected)

(5) adjusted quantity and adjustment date

(6) adjusted weight of waste discharged

(7) adjusted weight of waste imported Positive adjustment (+) is made to increase the remaining quantity permitted for import. In contrast, negative adjustment (-) is made to reduce the remaining quantity permitted for import. Calculation unit is TONNE.

(8) Reasons for adjustments

(9) Provide additional adjustment note

(10) Find the adjustment note updated previously Only the adjustment updated by the user is shown on the screen. Adjustments updated by other users shall not appear on the screen. The detailed list of adjustment can be found in the section of information aggregation in function 6.1.

(11) Provide the result. The user may make correction if any mistake is found by the time making the adjustment. Correction is not allowed if the window tab is closed. Change can be made only by another additional adjustment.

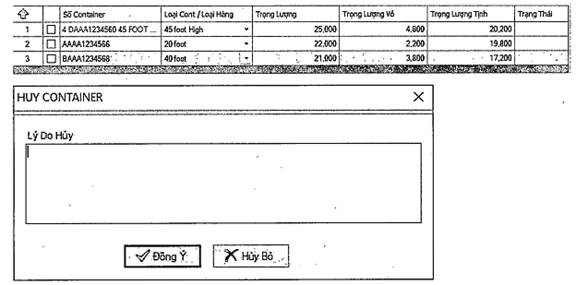

IV. For port operators

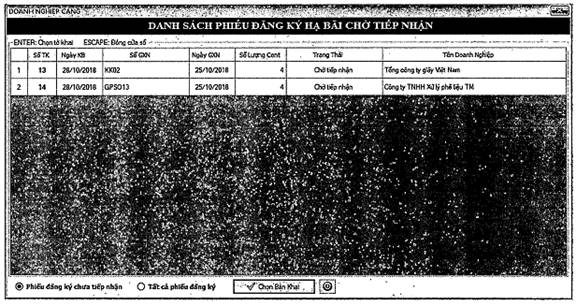

1. Receiving registration form for discharge of waste

- Purpose of design:

As a basis for the enterprise and customs authority to know whether the port operator receives the declaration.

In order to decide whether the responsibility for cancelling containers is assigned to the customs authority or the port operator depending on the status of the declaration.

- Interface:

- Implementation steps:

Step 1: Open function 5.1

Step 2: Click the button “Tiếp Nhận” (“Receive”) to receive the declaration

Step 3: Select one line on the list of containers, press the F12 key to covert the list to the Excel file for the purpose of serving the management of containers of waste discharged at the port.

Step 4. If any discrepancy between the quantity discharged declared and the one discharged in reality, cancel containers declared by select the square box at the beginning of each line and right click the mouse then select "Hủy container đang chọn” (cancel the container selected”). Enter the reason for cancellation and click the button "Đồng Ý” (“Agree”) to cancel the container

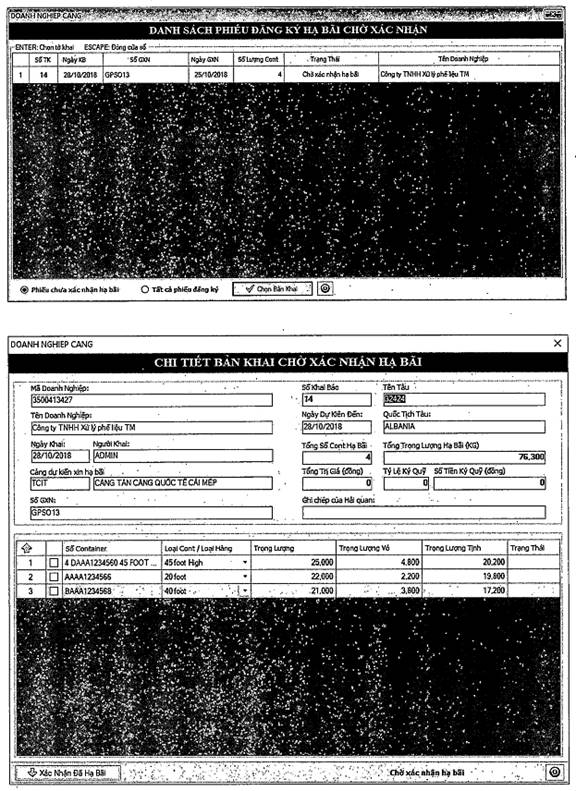

2. Confirming discharge of waste

- Purpose of design:

Notify the customs authority and enterprise that the container is discharged.

Confirm that no adjustment to the declaration is allowed as the container is already discharged in reality.

- Interface:

- Implementation steps:

Step 1: Open function 5.2

Step 2: Verify the list of container discharged

Step 3: Select containers not discharged in reality for cancellation purpose. The weight of waste carried by the container cancelled shall be automatically deducted. The importer shall make a new declaration providing accurate information about the number of containers if founding that the containers fails to be discharged due to misdeclaration. The procedure continues to be carried as mentioned above.

Step 4: Cancel containers selected.

Step 5: Confirm the discharge on the registration form.

VIETNAMESE DOCUMENTS

Official Dispatch 6644/TCHQ-GSQL PDF (Original)

Official Dispatch 6644/TCHQ-GSQL PDF (Original)This utility is available to subscribers only. Please log in to a subscriber account to download. Don’t have an account? Register here

ENGLISH DOCUMENTS

Official Dispatch 6644/TCHQ-GSQL DOC (Word)

Official Dispatch 6644/TCHQ-GSQL DOC (Word)This utility is available to subscribers only. Please log in to a subscriber account to download. Don’t have an account? Register here