On June 20, 2022, the Government issues the Decree No. 41/2022/ND-CP on amending and supplementing a number of articles of the Government's Decree No. 123/2020/ND-CP on invoices and documents and the Government's Decree No. 15/2022/ND-CP providing tax exemption and reduction policies under the National Assembly’s Resolution No. 43/2022/QH15.

Previously, in accordance with the Clause 4, Article 1 of the Decree No. 15/2022, the business establishments must have separate invoices for goods and services for VAT deduction.

However, this regulation is amended totally in the Decree 41/2022 of the Government, accordingly:

- A business establishment shall, when selling goods or providing services, write the reduced amount in the sale invoice, must write separate goods and services in accordance with law provisions.

In case a business establishment has issued an invoice and declared tax at the VAT rate or the percentage, the seller and buyer shall make a record reduced amount in accordance with law provisions.

Therefore, the amended contents prescribed in the Decree 41 have no regulations for enterprises to make separate invoices for VAT deduction in accordance with the on fiscal and monetary policies prescribed in the Resolution No. 43/2022/QH15

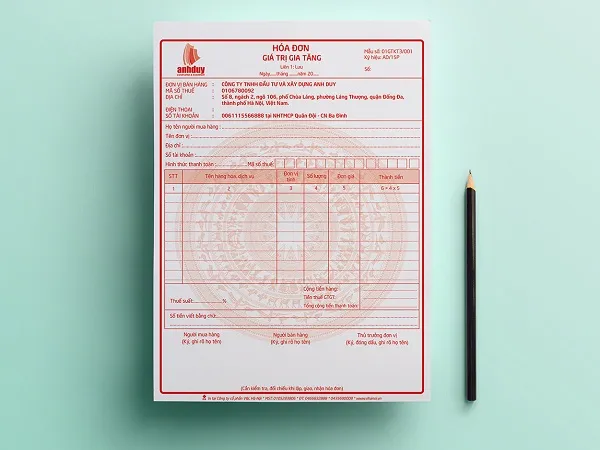

Besides, the Decree 41/2022 also promulgates together with this Decree the Notice on receipt and result of handling wrongly issued e-invoices according to Form No. 01/TB-HDSS, replacing Form No. 01/TB-SSDT provided in Appendix IB to the Government’s Decree No. 123/2020/ND-CP.

The Decree 41/2022 takes effect on June 20, 2022.