Shareholders shall pay attention to shares and dividends when purchasing shares. Within that, the dividend is generated from the company’s profits after finishing other obligations, the remained profits shall be divided among shareholders.

- 1. What is a dividend?

- 2. What is the percentage of dividend payments?

- 3. What are the types of dividends?

- 3.2 For dividend of preferred shares

- 3.2 For dividend of ordinary shares

- 4. How is the dividend paid in the joint stock companies?

- 4.1 Form of dividend payment

- 4.2 Procedure of profit payment

- 4.3 Term of payment of dividend

- 4.4 Notice of payment of dividend

- 5. Must shareholders pay personal income tax when receiving dividends?

1. What is a dividend?

The dividend is the popular definition in the joint stock company. Within that, Clause 5, Article 4 of the Law on Enterprise 2020 points out clearly that:

5. Dividend means a distribution of net profit in cash or in another asset per share.

The net profit of the enterprise is the difference between total revenue subtracted from costs, including taxes. Therefore, the net profit is the after-tax profit of the enterprise.

In accordance with Article 135, Law on Enterprise 2020, dividends paid for ordinary shares shall be determined on the basis of the net profit realized and the payment for dividends shall be sourced from profits retained by the company. A joint stock company may only pay dividends of ordinary shares when fully satisfying the following conditions:

- The company has fulfilled its tax obligations and other financial obligations in accordance with law;

- The company has set aside all funds of the company and fully offset previous losses in accordance with law and the company charter;

- Right after making full payment of all intended dividends, the company still ensures the full payment of its debts and other property obligations which become due.

At the time time, a joint stock company may have preference shares.

2. What is the percentage of dividend payments?

In accordance with Clause 3, Article 135, Law on Enterprise 2020, dividends may be paid in cash or by shares of the company or other assets as specified in the company charter. In case payment is made in cash, it shall be made in Vietnam dong or other means of payment in accordance with the law.

The percentage of dividend payment is the total payment paid to shareholders by the company on the basis of net income. Therefore, this can be the percentage of income in the form of dividends that is used for paying the shareholder.

The formula of the percentage of dividend payment is as follows:

Percentage of dividend payment = annual dividend/share Profit/share = dividend: Net income

Or: Percentage of dividend = 1 - Retention ratio

3. What are the types of dividends?

Dividend includes 02 types: preferred shares and ordinary shares Within that:

3.2 For dividend of preferred shares

- A dividend preferred share means a share for which dividends shall be paid at a rate higher than that paid for an ordinary share or at an annual fixed rate. Annually paid dividends include fixed dividends and bonus dividends. Fixed dividends do not depend on the business results of the company.

- A specific rate of fixed dividend and method of determining bonus dividends shall be stated in dividend preferred share certificates (Clause 1, Article 117, Law on Enterprise 2020).

3.2 For dividend of ordinary shares

Within that, pursuant to the Clause 2, Article 135, Law on Enterprise 2020, dividends paid for ordinary shares shall be determined on the basis of the net profit realized and the payment for dividends shall be sourced from profits retained by the company.

4. How is the dividend paid in the joint stock companies?

4.1 Form of dividend payment

In accordance with Clause 3, Article 135, Law on Enterprise 2020, dividends may be paid in cash or by shares of the company or other assets as specified in the company charter. In case payment is made in cash, it shall be made in Vietnam dong or other means of payment in accordance with the law.

Therefore, the dividend can be paid in cash, by asset, or by shares (share is the certificate issued by the issuing company for share ownership certification).

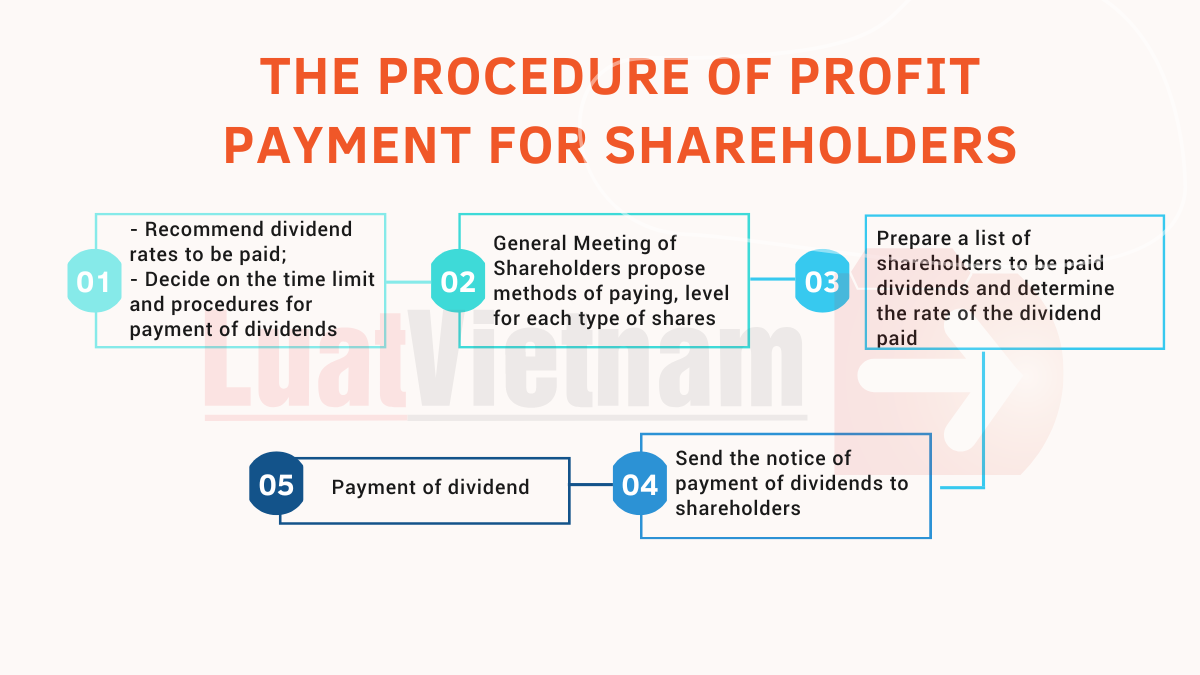

4.2 Procedure of profit payment

In accordance with Point b, Clause 2, Article 138, Law on Enterprise 2020, The General Meeting of Shareholders decides on types of shares and the total number of shares of each type that may be offered. However, the General Meeting of Shareholders to decide on the rate of annual dividends for each type of share.

Pursuant to Clause 4, Article 135, Law on Enterprise 2020, the procedure of profit payment for shareholders is as follows:

Step 1: To recommend dividend rates to be paid; to decide on the time limit and procedures for payment of dividends.

Step 2: The General Meeting of Shareholders proposes methods of paying, decides the dividend level for each type of share.

Step 3: After deciding the time of dividend payment, the Board of Directors shall prepare a list of shareholders to be paid dividends and determine the rate of the dividend paid for each share and the time limit, and the method of payment no later than 30 days prior to each payment of dividends.

Step 4: Send the notice of payment of dividends to shareholders The notice of payment of dividends shall be sent by a method that guarantees relevant information to reach shareholders at their addresses as registered in the register of shareholders no later than 15 days prior to the actual payment of dividends.

Note:

- In case a shareholder transfers its/his/her shares at a time between the time of completion of the list of shareholders and the time of payment of dividends, the transferor shall receive dividends from the company.

- In the case of payment of dividends by shares, the company is not required to carry out the procedures for the share offering. However, the company shall register an increase in charter capital equivalent to the total par value of shares used to pay dividends within 10 days after completing the payment of the dividends.

4.3 Term of payment of dividend

Pursuant to Clause 4, Article 135, Law on Enterprise 2020, Dividends shall be fully paid within 6 months after the annual General Meeting of Shareholders is concluded if dividends may be paid in cash.

4.4 Notice of payment of dividend

Also in accordance with Clause 4, Article 135, Law on Enterprise, the notice of payment of dividends shall be sent to reach shareholders at their addresses no later than 15 days prior to the actual payment of dividends. The notice must at least include:

- Name and head office address of the company;

- Full name, and contact address of the shareholder.

- Time and method for the payment of dividends.

- The number of shares of each type held by the shareholder; dividend rate for each type of share and total dividends to be paid to the shareholder.

- Signatures of the chairperson of the Board of Directors and the at-law representative of the company

5. Must shareholders pay personal income tax when receiving dividends?

In accordance with Clause 3, Article 2, Circular incomes from the capital investment are those earned in the following forms:

a) Loan interests received from providing loans to organizations, enterprises, households, business individuals or groups of business individuals under loan contracts or agreements, except deposit interests received from credit institutions or foreign bank branches under Item g.1, Point g, Clause 1, Article 3 of this Circular.

b) Dividends received for equity contribution and share purchase.

Pursuant to Clause 2, 4, Article 10, Circular No. 111/2013/TT-BTC, the tax rate for income from dividends is 5% over the income value from dividends.

Here are the contents relating to the dividend.

![[Update now] Personal income tax policies 2026: 05 major changes](https://image3.luatvietnam.vn/uploaded/500x285twebp/images/original/2026/02/25/update-now-personal-income-tax-policies-2026-five-major-changes_2502135544.jpg)