Land price is one of the most important problems that many people take great care of. Accordingly, what is the charge for the Land price database from August 01, 2024? The following post will explain this problem more.

1. Charge for Land price database from August 01, 2024

In accordance with Section IV, Appendix I issued with Circular No. 56/2024/TT-BTC, the charge for the land price database from the National Land Information System is as follows:

IV | Document type | Unit | Rate (VND) | Note: |

1 | Land price tables (year): | Scanning document page (scan) or digital document page | 8,200 | The charge applying to the first 05 pages of the document. From the 6th page onwards, the charge rate is 900 VND/page |

2 | The land price data layer according to the land price list issued to each land parcel, standard land parcel layer, value zone layer by year | Commune-level map | 400,000 | |

3 | Land price (specific price; market transfer price; price collected through surveys; price according to the land price list; price according to the results of a land use rights auction) | Parcel | 10,000 |

The Ministry of Natural Resources and Environment shall be responsible for the management, operation, maintenance and improvement of software for the national information system on land so that people can believe in the accuracy of the land database.

2. Cases of applying the land price lists from August 01, 2024

In accordance with Clause 1, Article 159 of the Land Law 2024, the land price lists shall apply to:

- Calculation of land use levy when the State recognizes the land use rights of households and individuals; or changes the land use purposes of households and individuals;

- Calculation of land rental when the State leases land with annual rental payment;

- Calculation of land use tax;

- Calculation of income tax from the transfer of land use rights for households and individuals;

- Calculation of fees in land administration and use;

- Calculation of fines for administrative violations against land regulations;

- Calculation of indemnification paid to the State for damage caused during land administration and use;

- Calculation of land use levy and land rental when the State recognizes the land use rights in the form of allocating land with land use levy or leasing land with one-off rental payment for the entire lease period to households and individuals;

- Calculation of the starting price for auction of land use rights when the State allocates or leases land in the cases where on the land parcel or land area technical infrastructure has already been constructed in accordance with the detailed construction master plans;

- Calculation of land use levy in cases where land is allocated without auction of land use rights to households and individuals;

- Calculation of land use levy in cases where State-owned houses are sold to tenants.

3. When are the land price lists public?

Besides, provincial-level People’s Committees shall formulate and submit initial land price lists to same-level People’s Councils for decision, announcement and application from January 1, 2026.

Every year, provincial-level People’s Committees shall submit adjustments, modifications and supplements to land price lists to provincial-level People’s Councils for decision, announcement and application from January 1 of the following year.

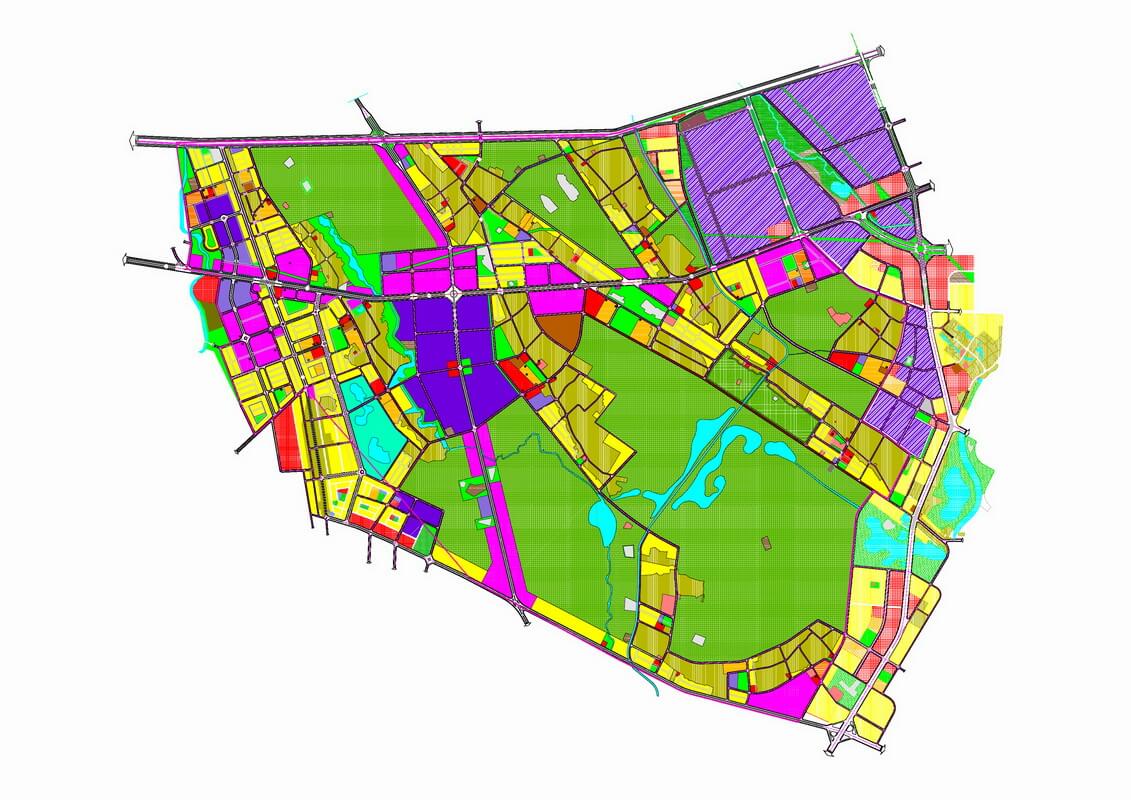

Land price lists shall be made based on areas and locations. For areas with digital cadastral maps and land price databases, land price lists shall be formulated for separate land parcels based on value zones and standard land parcels.

In the case where it is necessary to adjust, amend and supplement the land price list during the year, the provincial-level People's Committee shall be responsible for submitting it to the provincial-level People's Council for decision.

The land price list shall be built for each zone and location. In zones for which digital cadastral maps and land price database have been developed, the land price lists shall be detailed to each land parcel based on valued zones and standard land parcels.

If the land price list needs to be adjusted, amended, or supplemented during the year, the provincial-level People's Committee is responsible for submitting it to the provincial-level People's Council for decision.