THE STATE BANK OF VIETNAM _______ No. 1813/QD-NHNN | THE SOCIALIST REPUBLIC OF VIETNAM Independence - Freedom - Happiness ________________________ Hanoi, October 24, 2022 |

DECISION

On the maximum short-term loan interest rate in Vietnamese dong of credit institutions and foreign bank branches for borrowers to meet the capital demand in service of a number of economic sectors and industries as prescribed in Circular No. 39/2016/TT-NHNN dated December 30, 2016

______

THE GOVERNOR OF THE STATE BANK OF VIETNAM

Pursuant to the Law on State Bank of Vietnam No. 46/2010/QH12 dated June 16, 2010;

Pursuant to the Law on Credit Institutions No. 47/2010/QH12 dated June 16, 2010, and the Law Amending and Supplementing a Number of Articles of the Law on Credit Institutions No. 17/2017/QH14 dated November 20, 2017;

Pursuant to the Government’s Decree No. 16/2017/ND-CP dated February 17, 2017, on defining the functions, tasks, powers and organizational structure of the State Bank of Vietnam;

Pursuant to the Circular 39/2016/TT-NHNN dated December 12, 2016, of the Governor of the State Bank of Vietnam, prescribing the provision of loans by credit institutions and foreign bank branches to clients;

At the proposal of the Director of the Monetary Policy Department.

DECISION

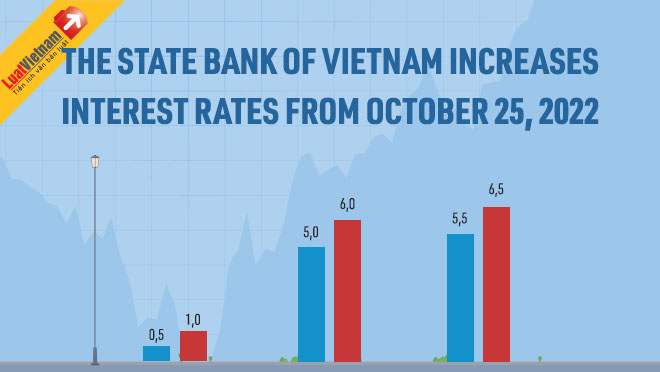

Article 1. The maximum short-term loan interest rate in VND as prescribed in Clause 2 Article 13 of Circular No. 39/2016/TT-NHNN dated December 30, 2016 is prescribed as follows:

1. Credit institutions and foreign bank branches (except for people’s credit funds and micro financial institutions) shall apply the maximum short-term loan interest rate in VND which is 5.5% per annum.

2. People’s credit funds and micro financial institutions shall apply the maximum short-term loan interest rate in VND which is 6.5% per annum.

Article 2.

1. This Decision takes effect on October 25, 2022, and replaces Decision No. 1730/QD-NHNN dated September 30, 2020, of the Governor of the State Bank, on maximum short-term loan interest rate in Vietnamese dong of credit institutions, foreign bank branches for borrowers to meet the capital demand in service of a number of economic sectors and industries as prescribed in Circular No. 39/2016/TT-NHNN dated December 30, 2016.

2. The interest rate applied to credit contracts and loan agreements signed before the effective date of this Decision shall continue to be implemented under the signed credit contracts and loan agreements in accordance with the law at the time of contract and agreement signing.

Article 3. The Chief of Office, Director of the Monetary Policy Department, heads of units affiliated to the State Bank of Vietnam; credit institutions and foreign bank branches shall be responsible for the implementation of this Decision/.

| FOR THE GOVERNOR THE DEPUTY GOVERNOR Pham Thanh Ha |

Decision 1813/QĐ-NHNN PDF (Original)

Decision 1813/QĐ-NHNN PDF (Original) Decision 1813/QĐ-NHNN DOC (Word)

Decision 1813/QĐ-NHNN DOC (Word)