THE STATE BANK OF VIETNAM ________ No. 1809/QD-NHNN | THE SOCIALIST REPUBLIC OF VIETNAM Independence - Freedom - Happiness ________________________ Hanoi, October 24, 2022 |

DECISION

On the refinancing interest rate, re-discount interest rate, overnight lending interest rate in inter-bank electronic payment and lending to offset the capital shortage in the clearing of the State Bank of Vietnam for credit institutions, foreign bank branches

________

THE GOVERNOR OF THE STATE BANK OF VIETNAM

Pursuant to the Law No. 46/2010/QH12 on the State Bank of Vietnam dated June 16, 2010;

Pursuant to the Government’s Decree No. 16/2017/ND-CP dated February 17, 2017, defining the functions, tasks, powers and organizational structure of the State Bank of Vietnam;

At the proposal of the Director of the Monetary Policy Department.

DECIDES:

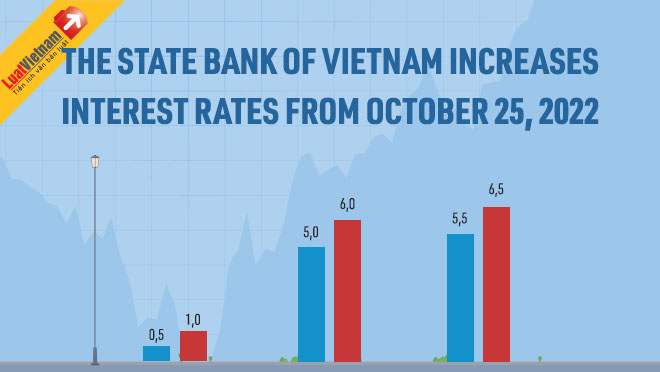

Article 1. To prescribe the interest rates of the State Bank of Vietnam as follows:

1. The refinancing interest rate: 6.0 per annum.

2. The re-discount interest rate: 4.5% per annum.

3. The overnight lending interest rate in inter-bank electronic payment and lending to offset the capital shortage in the clearing of the State Bank of Vietnam for credit institutions, foreign bank branches: 7.0% per annum.

Article 2. The Decision takes effect on October 25, 2022 and replaces the Decision No. 1606/QD-NHNN dated September 22, 2022 of the Governor of the State Bank of Vietnam on the refinancing interest rate, re-discount interest rate, overnight lending interest rate in inter-bank electronic payment and lending to offset the capital shortage in the clearing of the State Bank of Vietnam for credit institutions, foreign bank branches.

Article 3. Chief of Office, Director of the Monetary Policy Department and heads of units of the State Bank of Vietnam, credit institutions, foreign bank branches shall be responsible for the implementation of this Decision./.

| FOR THE GOVERNOR THE DEPUTY GOVERNOR Pham Thanh Ha |

Decision 1809/QĐ-NHNN PDF (Original)

Decision 1809/QĐ-NHNN PDF (Original) Decision 1809/QĐ-NHNN DOC (Word)

Decision 1809/QĐ-NHNN DOC (Word)