THE MINISTRY OF INDUSTRY AND TRADE _________ No. 57/2020/TT-BCT | THE SOCIALIST REPUBLIC OF VIETNAM Independence - Freedom - Happiness ________________________ Hanoi, December 31, 2020 |

CIRCULAR

On providing method to determine electricity generation prices and power purchase agreement

_________

Pursuant to the Electricity Law dated December 03, 2004 and the Law Amending and Supplementing a Number of Articles of the Electricity Law dated November 20, 2012;

Pursuant to the Government’s Decree No. 98/2017/ND-CP dated August 18, 2017 defining the functions, tasks, powers and organizational structure of the Ministry of Industry and Trade;

Pursuant to the Government’s Decree No. 137/2013/ND-CP dated October 21, 2013, detailing a number of articles of the Electricity Law and the Law Amending and Supplementing a Number of Articles of the Electricity Law;

At the proposal of the Director of the Electricity Regulatory Authority;

The Minister of Industry and Trade hereby promulgates the Circular on providing method to determine electricity generation prices and sequence to inspect power purchase agreement.

Chapter I

GENERAL PROVISIONS

Article 1. Scope of regulation and subjects of application

1. This Circular provides regulations on:

a) Method to determine the electricity generation prices and power purchase agreements applicable to types of power plants specified in Clause 2 of this Article.

b) Sequence to inspect power purchase agreement.

2. This Circular applies to the following subjects:

a) Power plants connected with the national electric system with the total installed capacity of more than 300MW, power plants with the installed capacity of 300MW or under that volunteer to join the electricity market;

b) Other concerned organizations and individuals;

c) This Circular does not apply to small sized hydroelectric power plants that apply avoidable cost tariffs, multi-target strategic hydroelectric power plants, independent power plants (those were invested in the form of Build - Operate – Transfer (BOT)), power plants that only supply auxiliary services, biomass power plants, wind power plants, solar power plants, waste-to-energy plants and power plants using solid wastes;

For other power plants without a separate mechanism provided by the Prime Minister and the Ministry of Industry and Trade, regulations specified in Article 9 of this Circular shall be complied with.

Article 2. Interpretation of terms

In this Circular, the terms below are construed as follows:

1. Seller means the electric generating unit.

2. Buyers mean the Vietnam Electricity (or representative unit according to decentralization or authorization), the Northern Power Corporation, the Central Power Corporation, the Southern Power Corporation, Hanoi Power Corporation, Ho Chi Minh City Power Corporation, big electricity-using customers or other electricity wholesale buyers in accordance with the electricity market’s regulations.

3. Project owner means an organization or individual directly involved in managing and using capital to invest in power plant projects, invest in power lines and transformer stations to load capacity of power plants.

4. Connection cost means construction investment cost for power lines and transformer stations from the power plant’s distribution yard to the connection point.

5. Typical connection cost means the cost paid by the project owner or allocated to:

a) Build power lines and transformer stations from distribution yards of a number of power plants to load capacity of several power plants to the connection points when being assigned to invest and construct by the competent State agency.

b) Build power lines and transformer stations from distribution yards of the power plants to the connection points as agreed between the project owner and buyer.

6. Connection point means the point connecting equipment, electric grid and power plants to the national electric system. Depending on the structure of electric grid, connection line, the connection point is defined as one of the following:

- With regard to the overhead power line, the connection point is the end point of the insulator string supporting and hanging the feeder line connecting to the disconnector switches of the power station or distribution yard of the power plant.

- With regard to the underground cable, the connection point is the cosse of the disconnector switches’ insulator poles on the feeder side of the power station or distribution yard of the power plant.

In case where the connection point is different from the above-mentioned regulations, the seller shall reach an agreement on the replacing connection point with the electric distributing unit or the electric transmitting unit.

7. Delivered electricity energy means the entire electricity energy delivered to the buyer by the seller in service of the payment between the seller and buyer.

8. Electric generating unit means an organization or individual that owns one or more power plants in accordance with Vietnamese law.

9. National electric system and market operator means the National Load Dispatch Centre or other name depending on the development of the electricity market.

10. The two parties mean the seller and buyer in the power purchase agreement.

11. Agreement of liquefied natural gas storage, recycling, and distribution (LNG) means agreements between an electric generating unit or a fuel trading unit and an LNG warehouse investing and managing unit for storing, recycling, distributing and supplying gas fuel for power plants, signed under current regulations, ensuring competitive and transparent prices.

12. Power purchase agreement (PPA) means an agreement used for the electricity sale and purchase of each power plant as specified in Appendix 3 of this Circular.

13. Gas sale and purchase agreement (GSPA) means a gas purchase contract between the gas seller and the field owner to buy domestically exploited natural gas and supply to the gas buyer (downstream gas consumers).

14. Gas sale agreement (GSA) means a contract to sell gas between gas sellers and downstream gas consumers.

15. Agreement for sale and purchase of fuel (coal, natural gas, LNG) means agreements between the electric generating unit and the fuel trading unit to supply fuel for the power plant, signed under the current regulations, ensuring the legal source of fuel, competitive and transparent prices.

16. Agreement for transportation of fuel (coal, natural gas, LNG) means agreements between the electric generating unit or the fuel trading unit and a fuel transporter in order to transport fuel for the power plant, signed under the current regulations, ensuring the competitive and transparent prices.

17. Base year means the year of approving the total investment or total investment adjusting the project used to calculate the electricity generation price.

18. Other power plants are power plants other than those specified at Points a and c, Clause 2, Article 1 of this Circular.

19. New power plant means a power plant without a power purchase agreement signed for the first time.

20. Date of commencement of construction of works means the date on which the seller satisfies conditions for commencement of construction of works in accordance with the Construction Law.

21. Net heat loss rate means the amount of heat consumed to produce one kWh of electricity energy at the delivery point (BTU/kWh or kJ/kWh or kcal/kWh).

22. Total investment amount includes all construction investment costs of a project determined according to current law provisions, compliance with the basic design and other contents of the construction investment feasibility study report. The contents of total construction investment amount include compensation, support and resettlement expenses (if any); costs of construction, equipment, project management, construction investment consultancy, other costs and provisional amounts for arising volumes and inflation.

23. Adjustment of construction investment projects means the total investment amount that takes effect at the time of electricity price negotiation, in which the total investment value adjusted for calculation of electricity price when adjusting construction investment projects in the following cases:

+ Being affected by natural disasters, environmental incidents, enemy sabotage, fires or other force majeure factors;

+ Appearance of factors likely to bring about higher efficiency for the project when the project owner has proved the financial and socio-economic efficiency brought about by the project adjustment;

+ Change of construction planning which directly affects the project;

+ When the construction price index promulgated by the Ministry of Construction or the provincial-level People’s Committee during the project implementation is higher than the construction price index used for calculation of inflation in the approved total investment amount of the project;

+ When adjusting investment policies, resulting in the adjustment of the project.

24. Settled investment capital means the entire lawful expenses used in the investment process in order to put the project into operation. Lawful expense means the one used within the scope of approved project, design and estimates; construction agreements signed in accordance with law provisions; including adjustments and supplements approved in compliance with regulations and competence. Settled investment capital must be within the total investment limit approved (or revised) in accordance with law provisions.

25. Circular No. 56/2014/TT-BCT referred to as the Circular No. 56/2014/TT-BCT dated December 19, 2014 of the Minister of Industry and Trade on method to determine electricity generation prices and sequence to inspect power purchase agreement.

Chapter II

METHODS TO DETERMINE ELECTRICITY GENERATION PRICES

Section 1

METHOD TO DETERMINE ELECTRICITY GENERATION PRICES FOR NEW POWER PLANTS

Article 3. Principles of determination of electricity generation prices

1. Electricity generation prices of a power plant shall be determined on a basis of:

a) Rational expenses of the project owner during the entire economic life of the project;

b) The financial internal rate of return (IRR) does not exceed 12%.

2. The electricity generation price of a power plant include the following components:

a) Power purchase agreement price: As agreed by both parties; this price is determined according to the method specified in Article 4 of this Circular;

b) Typical connection costs: As agreed by both parties; this cost is determined according to the method specified in Article 8 of this Circular.

3. Electricity generation price does not include value-added tax, water resource tax, royalty for exploitation of water resources, forest environment service charge, environmental protection charge applicable to solid wastes and industrial wastewater (applicable to thermal power plants) and other taxes, charges and payables in cash according to the State’s regulations (except for taxes and charges already included in the electricity generation price plan).

4. Power purchase agreement price is used to compare with the electricity generation price bracket in the base year

The electricity generation price must be within the electricity generation price bracket in the base year of the power plant that is issued by the Minister of Industry and Trade. In which, the power purchase agreement price of a thermal power plant used to compare with the electricity generation price bracket in the base year shall be calculated on a basis of cost components corresponding to the components of costs used to calculated the electricity generation price bracket.

Article 4. Method to determine the power purchase agreement price in the base year for power plants

Power purchase agreement price in the base year PC (VND/kWh) shall be determined according to the following formula:

PC = PCD + PBD

1. PCD (VND/kWh) is the fixed cost in the base year, determined according to the following formula:

PCD = FC + FOMCb

In which:

FC: Average fixed cost determined under Article 5 of this Circular (VND/kWh);

FOMCb: Operation and maintenance price in the base year shall be determined according to Article 6 of this Circular (VND/kWh);

2. PBD (VND/kWh) is the variable cost in the base year.

a) With regard to the thermal power plant, PBD shall be determined according to the following formula:

In which:

: Components of variable cost adjusted according to changes to cost of main fuel (coal, natural gas, LNG) of the power plant in the base year shall be determined according to the method specified in Clause 1, Article 7 of this Circular (VND/kWh);

: Components of variable cost adjusted according to changes to cost of main fuel (coal, natural gas, LNG) of the power plant in the base year shall be determined according to the method specified in Clause 1, Article 7 of this Circular (VND/kWh);

: Components of variable cost adjusted according to changes to cost of secondary fuel (oil) of the power plant in the base year shall be determined according to the method specified in Clause 2, Article 7 of this Circular (VND/kWh);

: Components of variable cost adjusted according to changes to cost of secondary fuel (oil) of the power plant in the base year shall be determined according to the method specified in Clause 2, Article 7 of this Circular (VND/kWh);

: Components of variable cost adjusted according to other changes of the power plant in the base year shall be determined according to the method specified in Clause 3, Article 7 of this Circular (VND/kWh);

: Components of variable cost adjusted according to other changes of the power plant in the base year shall be determined according to the method specified in Clause 3, Article 7 of this Circular (VND/kWh);

: Price for transport of main fuel for electricity generation in the base year shall be determined according to the method specified in Clause 4, Article 7 of this Circular (VND/kWh);

: Price for transport of main fuel for electricity generation in the base year shall be determined according to the method specified in Clause 4, Article 7 of this Circular (VND/kWh);

b) With regard to the hydroelectric power plant, regularly cost for repair and maintenance in the base year is included in the cost for operation and maintenance by major repair cost and other expenses of the base year, so PBD is zero (0).

3. Cost for testing, trial operation and acceptance of power plants:

a) With regard to costs for testing, trial operation and acceptance arising before the date of commercial operation: The payment for such costs shall be agreed by both parties on the basis of the approved total project investment amount;

b) With regard to cost for trial operation arising in the course operation of the power plant: As agreed by the two parties.

Article 5. Method to determine the average fixed cost for power plants

1. Average fixed cost (FC) for power plants shall be determined on the basis of financial analysis of projects according to Forms 1 and 2 specified in Appendix 2 attached to this Circular. Input parameters for the construction of average fixed cost (FC) for power plants shall be determined according to instructions provided in Clause 2 of this Article.

2. Main input parameters shall be used for calculation of average fixed cost (FC) for thermal power plants.

a) Total investment amount:

Total investment amount means the total investment amount that takes effect at the time of negotiation of the electricity price used for calculating the electricity price, including entire expenses under the investment responsibilities of the seller to the connection point of the power plant, comprising the following items:

- Power plants;

- Infrastructure, wharves for power plants, LNG import warehouses (for power plants using LNG fuel), other related costs and costs allocated to the project (if any);

Particularly, the typical connection expenses item used to calculate the typical connection costs shall comply with Article 8 of this Circular.

b) Economic life shall comply with the regulations as specified in Appendix 1 attached to this Circular, unless otherwise provided in other documents of the State agency competent to approve the economic life of the project (year);

c) Average electricity energy generated over years at terminals:

- With regard to thermal power plants: It shall be determined according to approved design terminal capacity and the number of hours of operation of the power plant at average maximum capacity over years (Tmax). Tmax of the power plant is determined according to the approved design but must not lower than the Tmax provided in Appendix 1 attached to this Circular, except for the case of obtaining written approval from the competent State agency. The rate of power loss is averaged over the entire economic life of the power plant as agreed by the two parties on the basis of the equipment manufacturer’s technical documents (kWh);

- With regard to hydroelectric power plants: It shall be determined according to the approved basic design or written approval of the competent agency (kWh).

d) Proportion of electricity self-consumed and lost in the power plant’s booster transformers, line losses from the power plant's booster transformers to the connection point (if any): Is a value lower than the value determined according to the approved basic design of the power plant or the equipment manufacturer’s technical documents (%);

dd) Time for depreciation of each group of main fixed assets: is determined according to average time for depreciation of each group of main fixed assets in accordance with time frame of depreciation under the Ministry of Finance’s regulations in each period or documents of the State agency competent to permit depreciation which are different from the Ministry of Finance’s regulations (if any) (year);

e) Proportion of equity and loan capital in total investments and investment capital phasing in total investment amount:

Is determined according to the decision on approving investment projects and the actual capital mobilization for the project at the time of negotiation, in compliance with regulations promulgated by the competent State agency. Proportion of equity at least equal to 15% of the total investment amount of the project;

g) Loan interest rate and time for payment of loan during the operation time: Is based on the loan agreement, documents and files between the project owner and lending credit institutions and banks;

h) Enterprise income tax rate; other types of taxes and charges: Are determined in accordance with relevant law provisions.

Article 6. Method to determine the cost for operation and maintenance of power plants

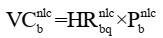

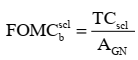

Cost for operation and maintenance in the base year FOMCb (VND/kWh) is determined according to the following formula:

In which:

: Cost for operation and maintenance according to major repair cost and other expenses in the base year is determined according to Clause 1 of this Article (VND/kWh);

: Cost for operation and maintenance according to major repair cost and other expenses in the base year is determined according to Clause 1 of this Article (VND/kWh);

: Cost for operation and maintenance according to workforce cost in the base year is determined according to Clause 2 of this Article (VND/kWh).

: Cost for operation and maintenance according to workforce cost in the base year is determined according to Clause 2 of this Article (VND/kWh).

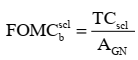

1. Cost for operation and maintenance according to major repair cost and other expenses in the base year  (VND/kWh) is determined according to the following formula:

(VND/kWh) is determined according to the following formula:

(VND/kWh)

(VND/kWh)

In which:

: Total major repair cost and other expenses in the base year consist of major repair cost, expenses for secondary materials, outside services, and others (VND).

: Total major repair cost and other expenses in the base year consist of major repair cost, expenses for secondary materials, outside services, and others (VND).

In case of failing to determine the total major repair cost and other expenses according to the formula specified in this Article, the method to calculate the total major repair cost and other expenses Tcscl in the base year shall be applied according to the following formula:

TCscl =VDTXD+TB x kscl

In which:

VDTXD+TB: Total construction costs and equipment costs, determined on a basis of total investment amount specified at Point a, Clause 2, Article 5 of this Circular (VND);

kscl: Proportion of major repair cost and other expenses (%) of the power plant is agreed by the two parties, not exceeding the proportion specified in Appendix 1 of this Circular;

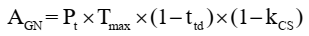

AGN: Average electricity energy generated in multiple years at the delivery point between the seller and buyer (kWh), calculated as follows:

- With regard to thermal power plants:

In which:

Pt: Output power at the generator’s terminals according to the approved design (kW);

Tmax: Number of hours of operation at average maximum capacity over years, determined according to Point c, Clause 2, Article 5 of this Circular (hour);

ttd: Proportion of electricity self-consumed and lost in the plant’s booster transformers, line losses from the power plant's booster transformers to the connection point with the national electric system, determined according to Point d, Clause 2, Article 5 of this Circular (%);

kCS: The rate of power attenuation averaged over the entire economic life of the power plant, determined according to Point c, Clause 2, Article 5 of this Circular (%).

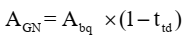

- With regard to hydroelectric power plants:

In which:

Abq: Average electricity energy generated over years at the terminals is determined according to Point c, Clause 2, Article 5 of this Circular (kWh);

ttd : Proportion of electricity self-consumed and lost in the plant’s booster transformers, line losses from the plant's booster transformers to the connection point with the national electric system, determined according to Point d, Clause 2, Article 5 of this Circular (%).

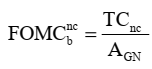

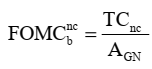

2. Cost for operation and maintenance according to workforce cost in the base year  (VND/kWh) is determined according to the following formula:

(VND/kWh) is determined according to the following formula:

(VND/kWh)

(VND/kWh)

In which:

TCnc: Total workforce cost in the base year including payroll, social insurance cost, health insurance cost, union funds and other attached allowances (VND);

Total workforce cost TCnc in the base year is determined on a basis of the total workforce cost of the plant and calculated and converted to the base year as follows:

- In case where the salary applicable to calculation of the plant’s workforce cost by the region-based minimum wage in the year of commercial operation: The rate converted to the base year is determined by the region-based minimum wage;

- In case of failing to determine total workforce cost according to the above-mentioned case: Applying the method to calculate total workforce cost TCnc in the base year according to the following formula:

TCnc =VDTXD+TB x knc

In which:

VDTXD+TB: Total construction costs and equipment costs, determined on a basis of total investment amount specified at Point a, Clause 2, Article 5 of this Circular (VND);

knc: Proportion of workforce cost (%) of the power plant is agreed by the two parties, not exceeding the proportion specified in Appendix 1 of this Circular;

AGN: Average electricity energy generated in multiple years at the delivery point between the seller and buyer, calculated according to Clause 1 of this Article (kWh);

Article 7. Method to determine the variable cost of thermal power plants

Variable cost of a thermal power plant in the base year PBD (VND/kWh) is determined according to the following formula:

In which:

: Components of variable cost adjusted according to changes to cost of main fuel of the power plant in the base year, determined according to the method specified in Clause 1 of this Article (VND/kWh);

: Components of variable cost adjusted according to changes to cost of main fuel of the power plant in the base year, determined according to the method specified in Clause 1 of this Article (VND/kWh);

: Components of variable cost adjusted according to changes to cost of secondary fuel (oil) of the power plant in the base year, determined according to the method specified in Clause 2 of this Article (VND/kWh);

: Components of variable cost adjusted according to changes to cost of secondary fuel (oil) of the power plant in the base year, determined according to the method specified in Clause 2 of this Article (VND/kWh);

: Components of variable cost adjusted according to other changes of the power plant in the base year, determined according to the method specified in Clause 3 of this Article (VND/kWh);

: Components of variable cost adjusted according to other changes of the power plant in the base year, determined according to the method specified in Clause 3 of this Article (VND/kWh);

: Price for transport of main fuel for electricity generation in the base year shall be determined according to the method specified in Clause 4 of this Article (VND/kWh).

: Price for transport of main fuel for electricity generation in the base year shall be determined according to the method specified in Clause 4 of this Article (VND/kWh).

1. Components of variable cost adjusted according to changes to cost of main fuel of the power plant in the base year , determined according to the following formula:

, determined according to the following formula:

(VND/kWh)

(VND/kWh)

In which:

: Average net heat loss rate of main fuel shall be agreed by the two parties, not exceeding the basic design/technical design corresponding to total investment amount used to calculate electricity price or parameter of the equipment manufacturer, that is calculated corresponding to the loading level provided in Appendix 1 of this Circular;

: Average net heat loss rate of main fuel shall be agreed by the two parties, not exceeding the basic design/technical design corresponding to total investment amount used to calculate electricity price or parameter of the equipment manufacturer, that is calculated corresponding to the loading level provided in Appendix 1 of this Circular;

: Price of main fuel in the base year is regulated as follows:

: Price of main fuel in the base year is regulated as follows:

Price of main fuel in the base year is calculated by the weighted average of agreements for sale and purchase of fuel or other agreements (excluding value-added tax), unit in VND/kcal or VND/kJ or VND BTU.

2. Components of variable cost adjusted according to changes to cost of secondary fuel of the power plant in the base year , determined according to the following formula:

, determined according to the following formula:

(VND/kWh)

(VND/kWh)

In which:

: Average net fuel loss rate of secondary fuel (oil) shall be as agreed by the two parties (kg/kWh);

: Average net fuel loss rate of secondary fuel (oil) shall be as agreed by the two parties (kg/kWh);

: Price of secondary fuel in the base year, including transport charges to the plant and other charges as prescribed (excluding value-added tax) (VND/kg).

: Price of secondary fuel in the base year, including transport charges to the plant and other charges as prescribed (excluding value-added tax) (VND/kg).

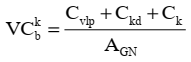

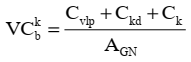

3. Components of variable cost adjusted according to other changes in the base year  is determined according to the following formula:

is determined according to the following formula:

(VND/kWh)

(VND/kWh)

In which:

Cvlp: Total annual cost of secondary materials of the power plant is determined according to quantity and unit price of secondary materials used for generation of electricity in the base year (VND);

Ckd: Total cost for starting operation consists of fuel cost and other costs (VND); permissible number of starts shall be negotiated by the two parties on the basis of demand for electric system and operation characteristic of the power plant;

Ck: Annual cost for repair and maintenance including regular cost for repair and maintenance is calculated on the basis of total investment capital for construction and equipment of the power plant; the rate of regular repair cost is agreed by the two parties, but not exceeding the rate prescribed in Appendix 1 of this Circular and expenses for dredging channels into ports are as agreed by the two parties (if any) (VND);

AGN: Average electricity energy generated in multiple years at the delivery point between the seller and buyer, calculated according to Clause 1, Article 6 of this Circular (kWh).

4. Main fuel transport price of a power plant in the base year  is determined according to the following formula:

is determined according to the following formula:

(VND/kWh)

(VND/kWh)

In which:

: Average net heat loss rate is determined according Clause 1, Article 7 of this Circular.

: Average net heat loss rate is determined according Clause 1, Article 7 of this Circular.

: Price for transportation of main fuel for electricity generation in the base year (excluding value-added tax), unit used in calculating fuel transport price is VND/kcal or VND/kJ or VND/BTU and determined as follows:

: Price for transportation of main fuel for electricity generation in the base year (excluding value-added tax), unit used in calculating fuel transport price is VND/kcal or VND/kJ or VND/BTU and determined as follows:

- With regard to coal-fired power plants: Equal to the weighted average under transportation agreements or other agreements;

- With regard to natural gas power plants: Equal to the weighted average according to charges for collection, transportation and distribution of gas approved by the competent State agency or according to regulations or agreements.

- With regard to thermal power plants using LNG: Equal to the weighted average under the agreements for transportation of LNG, agreements of LNG storage, recycling, and distribution (if any) and other agreements.

With regard to an agreement for sale and purchase of fuel in which the main fuel price already includes charges for transportation of main fuel, collection, transportation, distribution, storage and recycling, then the corresponding main fuel transportation price is zero (0).

Article 8. Method to determine the typical connection costs for power plants

1. Typical connection costs (PDT) for recovering typical construction expenses spent for construction investment by the power plant’s project owner or allocated and agreed with the buyer on the basis of typical connection expenses, structure of investment capital and loan interest during the operation under a loan agreement, expenses for management, operation, maintenance and other factors as agreed by two parties to ensure the recovering of expenses for construction, management, operation and maintenance by the power plant’s project owner in accordance with law provisions. Unit used to determine such typical connection costs is VND/kWh or VND/kW or VND/month.

2. After settling the typical connection expenses, both parties shall re-calculated typical connection costs according to the method specified in Clause 1 of this Article.

3. Typical connection expenses shall be regarded as a rational and legal expenses, included in costs for power purchase in the calculation of the plan for the average retail price of electricity by the Vietnam Electricity.

Article 9. Method to determine electricity generation prices for other power plants

With regard to other power plants, the buyer and seller shall, based on the principles of determination of electricity generation prices specified in Section 1 of this Chapter, formulation of a plan on electricity generation prices and power purchase agreements suitable to practical status of the power plants, submit to the Electricity Regulatory Authority for inspecting and reporting the Ministry of Industry and Trade for consideration and decision.

Section 2

METHODS TO DETERMINE ELECTRICITY GENERATION PRICES FOR POWER PLANTS ALREADY PUT INTO COMMERCIAL OPERATION

Article 10. Method to determine electricity generation prices for power plants with power purchase agreement expired but economic life unexpired

For power plants with power purchase agreement expired but economic life unexpired: The electricity generation price stated in the current power purchase agreement shall continue to be applied for the next years until the expiration of the economic life.

Article 11. Methods to determine electricity generation prices for power plants with economic life expired

1. Fixed costs of a power plant with economic life expired shall be determined according to the principle of ensuring that the power plant recovers expenses serving electricity production and business activities, the time for calculating the price according to the major repair cycle of main equipment and reasonable profit agreement. In case the time for calculating price is approved in writing by the competent state agencies, such written approval of the competent state agencies shall be applied.

2. Variable cost of thermal power plant with economic life expired is determined according to Article 7 of this Circular.

3. In case the power plant has reached the end of its economic life and has invested in upgrading the power plant, the two parties shall reach an agreement on and negotiate the power purchase agreement price of the power plant according to Articles 4, 5, 6 and 7 of this Circular and consistent with the depreciation time of the main equipment to be upgraded.

Article 12. Method to determine electricity generation prices for power plants re-negotiating according to settled investment capital

For the power plants for which the parties have the right to request for re-negotiation of electricity prices according to the settled investment capital under Clause 2, Article 28 of this Circular: After the settled investment capital is determined, the seller shall send to the buyer dossiers related to the settled investment capital. Both parties shall re-negotiate electricity prices according to the following principles:

1. Method to determine power purchase agreement prices according to Article 4 of this Circular.

2. Parameters for calculation of power purchase agreement price are specified in Article 4 of this Circular and input parameters are updated at the same time as the settled investment capital is determined.

3. The power purchase agreement price to compare with the electricity generation price bracket must be within the electricity generation price bracket of the year of approval for the settled investment capital.

4. Electricity generation price shall be applied from the date of commercial operation of the plants; the fixed price for every year shall comply with Article 13 of this Circular and the annual fixed price shall not be adjusted before both parties sign in the agreement on amending and supplementing the power purchase agreement according to the electricity price determined on the basis of settled investment capital.

Section 3

METHOD TO DETERMINE THE POWER PURCHASE AGREEMENT PRICE BY YEAR IN THE POWER PURCHASE AGREEMENT

Article 13. Principles for determination of fixed prices for each year in the power purchase agreement

1. The two parties have the right to apply average fixed price agreed in years during the power purchase agreement.

In case the two parties agree to convert average fixed price as agreed into the fixed price for each year, the determination of these fixed prices must conform to the principles specified in Clause 2 of this Article.

2. Based on conditions for actual loans and project's financial capability, the two parties shall reach an agreement on converting the power plant's average fixed prices into fixed prices for each year (FCj fixed price for year j), provided that the average fixed price remains unchanged in comparison with the price agreed by the two parties and conforms to the following principles:

a) Financial discount rate in the calculation of fixed price for each year as agreed by the two parties according to the financial internal rate of return (IRR) of the power plant;

b) The project owner shall pay loans for investing in construction of power plants according to the time limit for loan capital payment.

Article 14. Principles for revision of fixed price for each year in the power purchase agreement

1. Components of price for operation and maintenance of the power plant is revised according to the following principles:

a) Components of price for operation and maintenance by major repair expenses and other expenses are revised according to the average cost slippage rate specified in Appendix 1 of this Circular. The two parties shall study and propose mechanism of revision of components of prices price for operation and maintenance by major repair expenses and other expenses for foreign currency based items;

b) Cost for operation and maintenance by workforce cost shall be revised according to changes to region-based minimum wage at the time of payment or according to CPI index announced by the General Statistics Office but not exceeding 2.5%/year.

2. Annually, based on total foreign currency loans, plan for repayment of foreign currency loans, actual figures about repayment of principals, exchange rate agreed by the two parties in the electricity pricing plan, exchange rate applied in the preceding year, the two parties shall carry out calculation of difference of exchange rates and propose payment plan to the Electricity Regulatory Authority of Vietnam for inspection and submit to the Ministry of Industry and Trade for consideration and decision on the payment plan.

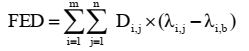

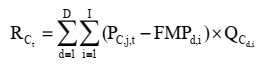

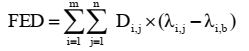

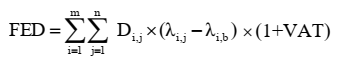

Foreign exchange difference (FED) (VND) shall be determined according to the following formula:

In which:

m: types of foreign currencies in the electricity pricing plan as agreed by the two parties (types);

n: number of repayment phases for principal foreign currency i in the calculation year (phases);

Di,j: the actual amount of principal debt in foreign currency i paid in phase j in the calculation year. The actual amount of principal debt in foreign currency i paid in the calculation year does not exceed the principal debt in foreign currency i in the equivalent year as per the parties' agreed electricity pricing plan;

li,j: exchange rate at repayment phase j for foreign currency i in the year (.../VND);

li,b: base exchange rate for foreign currency i as agreed by the parties in the electricity pricing plan (…/VND).

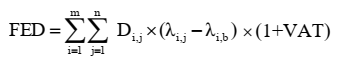

Article 15. Method to determine the power purchase agreement price for power plants at the time of payment

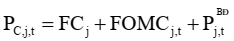

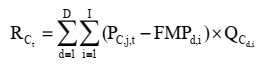

Power purchase agreement price of a power plant at the time of payment for electricity bills in month t, year j PC,j,t (VND/kWh) is determined according to the following formula:

In which:

: Fixed price in year j is determined according to Clause 1 of this Article (VND/kWh);

: Fixed price in year j is determined according to Clause 1 of this Article (VND/kWh);

: Price for operation and maintenance in month t, year j is determined according to Clause 2 of this Article (VND/kWh);

: Price for operation and maintenance in month t, year j is determined according to Clause 2 of this Article (VND/kWh);

: Variable cost in month t, year j is determined according to Clause 3 of this Article (VND/kWh).

: Variable cost in month t, year j is determined according to Clause 3 of this Article (VND/kWh).

1. Fixed price in year j  is determined according to Article 13 of this Circular.

is determined according to Article 13 of this Circular.

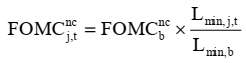

2. Price for operation and maintenance in month t, year j is determined according to the following formula:

In which:

: Components of the price for operation and maintenance by major repair cost and other expenses in year j (VND/kWh);

: Components of the price for operation and maintenance by major repair cost and other expenses in year j (VND/kWh);

: Components of the price for operation and maintenance by workforce cost in month t, year j (VND/kWh).

: Components of the price for operation and maintenance by workforce cost in month t, year j (VND/kWh).

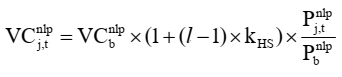

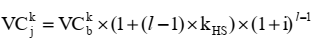

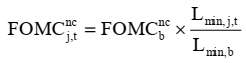

a) Components of the price for operation and maintenance by major repair cost and other expenses  are determined according to the following formula:

are determined according to the following formula:

In which:

: Price for operation and maintenance according to major repair cost and other expenses in the base year is determined according to the method specified in Clause 1, Article 6 of this Circular;

: Price for operation and maintenance according to major repair cost and other expenses in the base year is determined according to the method specified in Clause 1, Article 6 of this Circular;

i: Cost slippage rate of components of the price for operation and maintenance by major repair cost and other expenses specified in Appendix 1 of this Circular;

l: Ordinal numbers of payment years starting from the base year (for the base year l=1).

b) Components of the price for operation and maintenance by workforce cost in month t, year j  is determined as follow:

is determined as follow:

- In case the salary calculated in the electricity pricing plan is equal to the region-based minimum wage, the components of the price for operation and maintenance by workforce cost shall be determined according to the following formula:

In which:

: Price for operation and maintenance according to workforce cost in the base year is determined according to the method specified in Clause 2, Article 6 of this Circular;

: Price for operation and maintenance according to workforce cost in the base year is determined according to the method specified in Clause 2, Article 6 of this Circular;

: Region-based minimum wages at the time of payment in month t, year j (VND/month);

: Region-based minimum wages at the time of payment in month t, year j (VND/month);

: Region-based minimum wages in the base year (VND/month).

: Region-based minimum wages in the base year (VND/month).

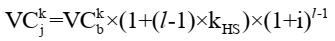

- In case where the total workforce cost TCnc is calculated according to the ratio of construction investment capital and equipment, then the cost for operation and maintenance by workforce cost shall be determined according to the following formula (VND/kWh):

In which:

: Price for operation and maintenance according to workforce cost in the base year is determined according to the method specified in Clause 2, Article 6 of this Circular;

: Price for operation and maintenance according to workforce cost in the base year is determined according to the method specified in Clause 2, Article 6 of this Circular;

i1: Cost slippage rate of components of the price for operation and maintenance by workforce cost, determined according to the ratio of consumer price index (CPI) announced by the General Statistics Office of Vietnam in December of year (j-1) compared to year (j-2), but not exceeding 2.5%/year;

l: Ordinal numbers of payment years starting from the base year (for the base year l = 1, i1 = 0).

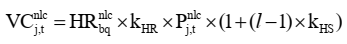

3. Variable cost of a thermal power plant in month t, year j  (VND/kWh) is determined according to the following formula:

(VND/kWh) is determined according to the following formula:

In which:

: Components of variable cost revised according to changes to cost of main fuel of the power plant in month t, year j is determined according to Point a of this Clause (VND/kWh);

: Components of variable cost revised according to changes to cost of main fuel of the power plant in month t, year j is determined according to Point a of this Clause (VND/kWh);

: Components of variable cost revised according to changes to cost of secondary fuel (oil) of the power plant in month t, year j is determined according to Point b of this Clause (VND/kWh);

: Components of variable cost revised according to changes to cost of secondary fuel (oil) of the power plant in month t, year j is determined according to Point b of this Clause (VND/kWh);

: Components of variable cost revised according to other changes of the power plant in year j is determined according to Point c of this Clause (VND/kWh).

: Components of variable cost revised according to other changes of the power plant in year j is determined according to Point c of this Clause (VND/kWh).

: Price for transport of main fuel of the power plant in month t, year j is determined according to Point d of this Clause (VND/kWh).

: Price for transport of main fuel of the power plant in month t, year j is determined according to Point d of this Clause (VND/kWh).

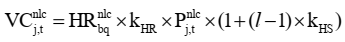

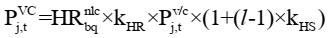

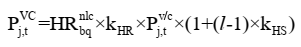

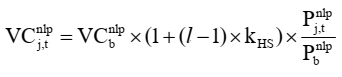

a) Components of variable cost revised according to changes to cost of main fuel of the power plant in month t, year j  is determined according to the following formula:

is determined according to the following formula:

In which:

: Average net heat loss rate is determined according to Clause 1, Article 7 of this Circular;

: Average net heat loss rate is determined according to Clause 1, Article 7 of this Circular;

kHR: Adjustment coefficient of the average net heat loss rate regarding actual conditions for operation under to the temperature of cooling water and environment as agreed by the two parties;

kHS: Proportion of performance attenuation in year j (%);

l: Ordinal numbers of commercial operation year of the power plant;

: Prices of main fuel for electricity generation at the time of payment in month t, year j, calculated by the weighted average according to volume of invoices under agreements for sale and purchase of fuel at the time of calculation.

: Prices of main fuel for electricity generation at the time of payment in month t, year j, calculated by the weighted average according to volume of invoices under agreements for sale and purchase of fuel at the time of calculation.

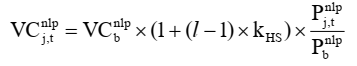

b) Components of variable cost revised according to changes to cost of secondary fuel (oil) of the power plant in month t, year j  is determined according to the following formula:

is determined according to the following formula:

In which:

: Components of variable cost revised according to changes to cost of secondary fuel (oil) of the power plant in the base year is determined according to Clause 2, Article 7 of this Circular;

: Components of variable cost revised according to changes to cost of secondary fuel (oil) of the power plant in the base year is determined according to Clause 2, Article 7 of this Circular;

kHS: Proportion of performance attenuation in year j (%);

l: Ordinal numbers of commercial operation year of the power plant;

: Prices of secondary fuel (oil) for electricity generation, including transportation charges to the power plant at the time of payment in month t, year j;

: Prices of secondary fuel (oil) for electricity generation, including transportation charges to the power plant at the time of payment in month t, year j;

: Prices of secondary fuel (oil) for electricity generation in the base year is determined according to Clause 2, Article 7 of this Circular.

: Prices of secondary fuel (oil) for electricity generation in the base year is determined according to Clause 2, Article 7 of this Circular.

c) Components of variable cost revised according to other changes in year j  are determined according to the following formula:

are determined according to the following formula:

In which:

: Components of variable cost revised according to other changes of the power plant in the base year is determined according to Clause 3, Article 7 of this Circular;

: Components of variable cost revised according to other changes of the power plant in the base year is determined according to Clause 3, Article 7 of this Circular;

i: Cost slippage rate of components of variable cost revised according to other changes in accordance with the ratio provided in Appendix 1 of this Circular.

kHS: Proportion of performance attenuation in year j (%);

l: Ordinal numbers of commercial operation year of the power plant.

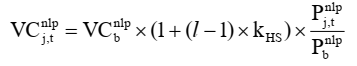

d) Main fuel transportation price of the power plant in month t, year j  (VND/kWh) is determined according to the following formula:

(VND/kWh) is determined according to the following formula:

In which:

: Average net heat loss rate is determined according to Clause 1, Article 7 of this Circular.

: Average net heat loss rate is determined according to Clause 1, Article 7 of this Circular.

kHR: Adjustment coefficient of the average net heat loss rate regarding actual conditions for operation under to the temperature of cooling water and environment as agreed by the two parties;

kHS: Proportion of performance attenuation in year j (%);

l: Ordinal numbers of commercial operation year of the power plant;

: Price for transportation of main fuel at the time of payment in month t, year j is calculated by the weighted average according to the volume of invoices of agreements for transportation of fuel and agreements of LNG storage, recycling, and distribution (if any) (excluding value-added tax). To be specific:

: Price for transportation of main fuel at the time of payment in month t, year j is calculated by the weighted average according to the volume of invoices of agreements for transportation of fuel and agreements of LNG storage, recycling, and distribution (if any) (excluding value-added tax). To be specific:

- With regard to coal-fired power plants: equal to the weighted average under agreements for coal transportation;

- With regard to natural gas power plants: equal to the weighted average according to charges for collection, transportation and distribution of gas as prescribed;

- With regard to thermal power plants using LNG: equal to the weighted average according to transportation agreements and agreements of LNG storage, recycling, and distribution (if any).

With regard to the agreement for sale and purchase of fuel already included prices for transportation, storage, recycling, and distribution of LNG, then the component of price for transportation of main fuel  is zero (0).

is zero (0).

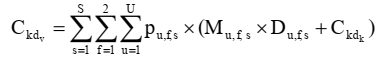

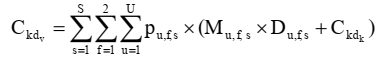

4. Total cost for starting in month t of power plant  (VND) is determined according to the following formula:

(VND) is determined according to the following formula:

In which:

u: Order of assembly of the power plant;

U: Number of operating units of the power plant;

f: Type of fuel (main fuel f =1, secondary fuel f = 2);

s: State of starting of an operating unit;

S: Number of states of starting of an operating unit;

pu,f,s: Number of starts of operating unit u, using fuel f in the state of starting s in the month;

Mu,f,s: Quantity of lost coal (kg) for coal-fired power or quantity of lost heat for gas-fired power (BTU) for gas turbine for a starting of the operating unit u, using fuel f, in the state of starting s;

Du,f,s: Unit price (fuel) for a starting of the operating unit u, using fuel f, in the state of starting s is calculated in VND/kg for coal and in VND/BTU for gas;

: Total of other costs for a starting is calculated in Vietnam dong.

: Total of other costs for a starting is calculated in Vietnam dong.

The payment for starting cost of a thermal power plant shall comply with regulations on electricity market promulgated by the Ministry of Industry and Trade.

Chapter III

SEQUENCE OF NEGOTIATION AND INSPECTION OF POWER PURCHASE AGREEMENTS

Article 16. Application of a power purchase agreement template

1. With regard to new power plants and power plants carrying out the negotiation under Article 10 of this Circular, on the basis of the power purchase agreement template provided in Appendix 3 attached to this Circular, the buyer and the seller shall negotiate, reach an agreement and adds a number of terms suitable to practical conditions of the power plant (if necessary).

2. The buyer and the seller shall reach an agreement on, and take responsibility for reporting the Electricity Regulatory Authority of Vietnam the power purchase agreement negotiation results according to the order specified in Article 19 of this Circular.

Article 17. Sequence of negotiation on power purchase agreements

1. With regard to new power plants, the power purchase agreement between both parties must be signed before the date of commencement of construction of works.

2. The seller shall be responsible for sending dossier of request for negotiation on power purchase agreement to the buyer for negotiation and fulfillment of procedures for the signing of power purchase agreement.

3. Within 15 working days since the receipt of the sufficient dossier of request for negotiation on power purchase agreement from the project owner, the buyer shall be responsible for organizing negotiation with the seller on power purchase agreement. When the process of negotiation closes, the two parties must initial the draft power purchase agreement.

4. After initialing the draft power purchase agreement, the buyer and seller shall reach an agreement on, and take responsibility for preparing a dossier of reporting the Electricity Regulatory Authority of Vietnam to inspect the power purchase agreement.

Article 18. Dossiers of request for negotiation on power purchase agreement

1. A dossier of request for negotiation on power purchase agreement of new power plants includes but not limited to the following documents:

a) Written request for negotiation on power purchase agreement;

b) Draft power purchase agreement specified in Appendix 3 attached to this Circular and proposals for amendment and supplementation according to actual conditions of the power plant (if any);

c) Approval of investment policy or decision on investment policy or certificate of investment registration of the project;

d) Decision on project investment and construction accompanied by explanations and investment project appraisal report by independent consultants and other relevant documents;

dd) Decision on approving total initial investment amount of the project or total revised investment amount of the project that takes effect at the time of negotiation of electricity price and main contents in the basic design of projects related to the negotiation of power purchase agreement and basic design appraisal report;

e) Agreement on connection of the power plant to the national electric system according to the connection plan of the power plant; agreement on SCADA/EMS, dispatch information system; agreement on protection and automatic relay system;

g) Loan agreements or any document between the project owner and lending banks, plans or reality of disbursement of loans;

h) Agreement for supply of fuel to power plants specifying cost of fuel for generation of electricity, cost for transportation of fuel and cost for storage, recycling, and distribution of LNG and other charges, point of delivery and receipt of fuel, time limit for supply of fuel;

i) Documentary calculations about losses to transformer capacity and energy, transmission lines from the booster transformers to the point of connection with the national electric system and document calculations about electricity for self-consumption in the power plant;

k) Documents for calculation of net heat loss rate for thermal power plants;

l) Plan on electricity price for sale is determined according to Sections 1 and 3, Chapter II of this Circular;

m) Other relevant documents.

2. A dossier of request for negotiation on power purchase agreement of power plants already put into commercial operation includes but not limited to the following documents:

a) Written request for negotiation on power purchase agreement;

b) Draft power purchase agreement specified in Appendix 3 attached to this Circular;

c) Existing documents of power purchase agreement;

d) Technical documents of the plant, technical figures of SCADA/EMS, protection and automatic relay system, characteristic performance (P-Q) of the operating units till present time;

dd) Agreements for supply of fuel to power plants;

e) Electricity price plan is determined according to Sections 1, 2 and 3, Chapter II of this Circular;

g) Audited financial statement of the power plant of the most recent year up to the date of power purchase agreement negotiation.

Article 19. Sequence to inspect power purchase agreements

1. After ending the power purchase agreement negotiation, the two parties shall reach an agreement on, and take responsibility for reporting the Electricity Regulatory Authority of Vietnam to inspect the power purchase agreement, enclosed with the dossier specified in Article 18 of this Circular.

2. Within 05 working days since receipt of dossier of request for inspection of power purchase agreement, the Electricity Regulatory Authority of Vietnam shall be responsible for inspecting eligibility of the dossier and issuing a written request to the buyer and seller for providing additional documents as prescribed.

3. Within 30 working days since receipt of the legal dossier of request for inspection of power purchase agreement, the Electricity Regulatory Authority of Vietnam shall be responsible for inspection and providing advice on the power purchase agreement.

4. Within 30 working days since receipt of advice on inspection of power purchase agreement, the two parties shall be responsible for officially signing the power purchase agreement. Past the time limit specified in Clause 3 of this Article, if the Electricity Regulatory Authority of Vietnam fails to give advice on the power purchase agreement, the two parties shall be allowed to officially sign the power purchase agreement according to agreed terms and conditions. The buyer shall be responsible for sending 01 (one) copy of the signed power purchase agreement to the Electricity Regulatory Authority of Vietnam for filing and monitoring the implementation.

5. If the electricity price specified in Clause 4, Article 3 of this Circular as proposed by the seller is higher than the electricity generation price bracket promulgated by the Minister of Industry and Trade, the two parties shall be responsible for reporting, explaining and proposing plan to the Electricity Regulatory Authority of Vietnam for considering and reporting the Minister of Industry and Trade for settlement.

Article 20. Amendment and supplementation of power purchase agreements upon changes in laws and policies promulgated by competent State agencies

1. In case there is a change in laws or policies promulgated by a competent State agency that adversely affects the legitimate interests of the seller or the buyer, the two parties have the right to negotiate and renegotiate the electricity generation prices.

2. In case where the seller is assigned to invest in upgrading and renovating lines and transformers according to planning, the two parties have the right to reach an agreement and negotiate to add the typical connection price in order to ensure that the project owner can recover costs for construction, management, operation and maintenance in accordance with law provisions.

3. In case where power plants in operation need to invest in renovating and upgrading equipment to meet national technical regulations on environment, the seller and the buyer shall reach an agreement to add these costs to the electricity price of the power plants. The calculation of electricity price shall be implemented according to the electricity price calculation method as agreed by the seller and buyer in the signed power purchase agreement, and report to the Ministry of Industry and Trade and the Electricity Regulatory Authority of Vietnam for consideration.

4. In case the power plants have a plan for treatment and consumption of ash and slag approved by a competent authority to ensure standards on waste, emissions, and environmental protection, the seller and the buyer shall reach an agreement on adding these expenses to the ash and slag treatment price component, which is a typical price component for the treatment and consumption of ash and slag under the power purchase agreement, ensuring the following principles: (i) Scope of investment, process of operating ash and slag treatment constructions approved by the competent authority; (ii) The selection of units treating ash and slag of the plant must comply with law regulations, ensuring competition and transparency; (iii) The two parties must settle costs for treatment of ash and slag under the actual situation of the preceding year. Revenues from the sale of ash and slag of the plant shall be used to offset costs for treatment of ash and slag and to reduce electricity price of the power plant.

Chapter IV

IMPLEMENTATION PROVISIONS

Article 21. Responsibilities of the Ministry of Industry and Trade

1. To provide guidance on natural gas consumption mechanism in power purchase agreements in conformity with gas sale and purchase agreements or gas sale agreements approved by the competent State agency.

2. To decide on payment for difference of exchange rate among power plants.

Article 22. Responsibilities of the Electricity Regulatory Authority of Vietnam

1. To carry out inspection, give advice on power purchase agreement and supplements to power purchase agreements of power plants.

2. To provide instructions and handle difficulties arising during the negotiation on power purchase agreement between the two parties.

3. Annually, to calculate power purchase agreement price specified in Appendix 1 of this Circular in reliance on opinions from the units on input parameters, make the submission to the Minister of Industry and Trade for consideration and decision on amendments or supplements (if any).

4. To settle disputes arising during the implementation of power purchase agreement in case the two parties reach an agreement on settling disputes at the Electricity Regulatory Authority of Vietnam.

5. To inspect, summarize and report to the Ministry of Industry and Trade for consideration and decision on payment of exchange rate difference cost of power plants after receiving the report of the Vietnam Electricity.

Article 23. Responsibilities of the Vietnam Electricity

1. Before January 31 every year, to assume the prime responsibility for, and coordinate with the seller and the buyer in, calculating exchange rate differences during the implementation of power purchase agreement in the preceding year under Clause 2, Article 14 of this Circular and make the report to the Electricity Regulatory Authority of Vietnam for inspection.

2. Annually, to carry out considerations and make proposals to the Electricity Regulatory Authority of Vietnam for revising input parameters for calculation of power purchase agreement price specified in Appendix 1 of this Circular and other subject matters of this Circular (if any).

Article 24. Responsibilities of the buyer

1. To negotiate and reach an agreement with the seller on the re-allocation of typical connection costs to the project owner of power plants connected with such transmission lines and transformer stations, and revise the typical connection costs (if any) in order to ensure that the buyer can recover costs for construction, management, operation and maintenance of lines and transformer stations in accordance with law provisions.

2. To negotiate on power purchase agreement with the seller; take responsibility for, and ensure the accuracy, reasonableness and validity of the provided figures and documents. To reach an agreement with the seller to report the Electricity Regulatory Authority of Vietnam for inspection of the power purchase agreement as prescribed.

3. Before January 15 every year, to assume the prime responsibility for, and coordinate with the seller in, calculating exchange rate differences during the implementation of power purchase agreement in the preceding year under Clause 2, Article 14 of this Circular and provide them to the Vietnam Electricity to report the Electricity Regulatory Authority of Vietnam for inspection.

Article 25. Responsibilities of the seller

1. To reach an agreement with the buyer on the negotiation and report the Electricity Regulatory Authority of Vietnam for inspection, and sign the power purchase agreement as prescribed before the date of commencement of construction of works; take responsibility for, and ensure the accuracy, reasonableness and validity of the provided data and documents.

2. To formulate investment projects to build lines and transformer stations to load capacity of a number of power plants when they are assigned to invest in construction by competent State agencies in accordance with national electricity development planning and provincial planning (if any). Power lines and transformer stations must ensure the operation and load of the full capacity and power output of the power plants in the region according to the approved planning.

3. To permit power plants in the approved national electricity development planning and provincial planning to connect to the power lines and transformer stations that are assigned to invest for electricity generation to the national electric system.

4. To negotiate and reach an agreement with the project owners of power plants on the allocation of typical connection costs and revise the typical connection costs (if any) in order to ensure that the project owners can recover costs for construction, management, operation and maintenance of power lines and transformer stations in accordance with law provisions.

5. To take responsibility for the management, operation and maintenance of power lines and transformer stations assigned to invest and build in accordance with law provisions.

6. To provide adequate information, take responsibility and ensure the accuracy, reasonableness and validity of figures and documents provided to relevant units and agencies during the negotiation and inspection of power purchase agreements.

7. The seller shall be responsible for organizing the selection of the fuel supplier and/or the fuel transporter in accordance with the law on bidding, other relevant legal regulations and be responsible before the law, ensuring fairness, competition and transparency, except for the following cases:

(i) The seller has signed a medium-term and long-term fuel supply agreement with the fuel supplier;

(ii) Agreements for the supply of natural gas fuel and charges for collection, transportation and distribution of natural gas shall comply with the regulations of the competent state agency.

In cases where it is impossible to select a fuel transporter through a bidding for special reasons (other than the cases specified at Points 7.i, 7.ii, and above-mentioned cases), the seller shall be responsible for making an agreement with the fuel supplier or the fuel transporter (depending on each case of fuel delivery and receipt specified in Article 26 of this Circular) according to the unit price issued by the competent authority. If there is no unit price issued by a competent agency, the seller shall reach an agreement with the fuel supplier or the fuel transporter (depending on each case of fuel delivery and receipt as prescribed in Article 26 of the Circular) according to the unit price calculated on the basis of the internal unit price of the selected fuel transporter, ensuring efficiency, competition and not higher than the unit price of other units doing the same method of transportation (if any), the price of fuel transported to the seller's warehouse must be not higher than the price of fuel (of the same type) at the seller's warehouse provided by another unit (if any).

Before signing in agreements for transportation of fuel not through a bidding, the seller must provide documents for the buyer as agreed by the two parties in the power purchase agreement. Within 20 days from the date on which the buyer provides sufficient documents, if the buyer fails to give opinions on the selection of fuel transporter, the seller and/or the fuel supplier (depending on the delivery conditions) is allowed to sign in such agreement for transportation of fuel according to the agreed contents.

The seller shall be responsible for signing agreement for purchase and sale or transportation of fuel in accordance with current regulations, ensuring the competitive and transparent price.

8. The seller shall take responsibility for the whole input parameters for the calculation of power purchase agreement prices and controlling, conducting bid with agreements of provision and transportation of fuel, ensuring the legal fuel source with a competitive and transparent price.

9. Before January 15 annually, the seller shall make the report to the Electricity Regulatory Authority of Vietnam on the implementation of power purchase agreement in the preceding year with the buyer, difficulties arising during the implementation of power purchase agreement, and propose handling solutions (if any).

10. Before January 15 annually, the seller shall take the initiative in cooperating with the buyer in calculating exchange differences during the implementation of power purchase agreement in the preceding year specified in Clause 2, Article 14 of this Circular and make the report to the Electricity Regulatory Authority of Vietnam for inspection.

Article 26. Responsibilities of the fuel providers and transporters

1. With regard to gas

(i) The domestic natural gas supplier or transporter shall sign gas sale and purchase agreements, gas sale agreements and gas transportation agreements in accordance with relevant law provisions. Accordingly:

- Domestically exploited natural gas price is price of gas exploited from gas fields.

- With regard to natural gas domestically exploited through a system of natural monopoly collection, transportation and distribution pipelines, the charges for gas collection, transportation and distribution must be approved by competent state agencies.

(ii) A unit providing or transporting gas fuel imported by pipelines and LNG shall provide gas in accordance with relevant law provisions. To be specific:

- In case the gas storage and distribution item is natural monopoly, the charges for gas storage, recycling and distribution must be approved by a competent state agency.

- In case of delivery at export port: The imported gas price is the price of gas at the time of gas delivery at the export port.

- In case of delivery at the Vietnam-based gas distribution station or LNG warehouse, the gas price shall include cost for imported gas or LNG purchase and reasonable costs related to the import (if any) such as import duty, financial costs, insurance, norm profits and other expenses related to the import of the fuel supplier.

2. With regard to coal

(i) In case of delivery of coal at port or warehouse of the seller, the selected coal supplier shall be responsible for:

- Organizing the selection of coal supplier in accordance with law provisions on bidding and relevant laws, ensuring equity, competition, transparency and taking responsibility before the law.

- If the coal supplier is unable to select the coal transporter through bidding for a special reason, the coal supplier shall be responsible for organizing the selection of the coal transporter on the principle similar to that applicable to the seller as specified in Clause 7, Article 25 of this Circular.

- Signing coal transportation agreement as prescribed with the selected coal supplier. Before signing the coal transportation agreement without bidding, the selected coal supplier shall be responsible for providing relevant documents to the seller.

(ii) In case of delivery of coal at port or warehouse of the coal supplier:

- The organization for coal transporter selection shall be carried out by the seller according to the principle specified in Clause 7, Article 25 of this Circular.

- The coal transporter selected by the seller shall sign the coal transportation agreement as prescribed with the seller. Before signing the coal transportation agreement without bidding, the selected coal transporter shall be responsible for providing relevant documents to the seller.

Article 27. Amending and supplementing a number of articles of the Circular No. 57/2014/TT-BCT dated December 19, 2014 of the Minister of Industry and Trade prescribing methods, process of formulation and promulgation of the electricity generation price bracket

1. To amend Clause 3, Article 6 as follows:

“3. Investment unit cost is investment cost for 01 kW of average net capacity of the standard power plant calculated on the basis of total effective investment amount at the time of calculation of electricity generation price bracket and updating of foreign currency rates at the time of calculation. Cost components in an investment unit cost include:

a) Construction costs include costs for building works, work items; demolition and dismantling of old architectural materials; construction leveling; construction of temporary works; auxiliary works in service of construction; temporary houses at the site for living and construction operation;

b) Equipment costs include costs for purchasing technology equipment, training and operating the plant; assembling, testing and modifying; transporting insurance, tax and relevant fees;

c) Costs for compensation and ground clearance, costs for resettlement according to the competent State agency’s decision; costs for reinforcing the construction foundation;

d) Project management expenses include costs for organization and implementation of project management from the time of project establishment until the time of completion, acceptance and putting the construction into operation;

dd) Construction investment consultancy expenses include costs for survey consultancy, design, construction supervision, inspection consultancy and other consultancy expenses;

e) Other expenses include circulating capital while testing and accepting the plant, interest expenses and other costs related to the loan during the construction of the power plant and other necessary expenses;

g) Contingency costs include contingency costs for generated work volumes and for the price slippage factors during construction.”

2. To amend Point a, Clause 4, Article 6 as follows:

“a) The loan interest rate rd (%) is calculated by the weighted average interest rate of domestic and foreign currency loans according to the following formula:

rd = DF x rd,F + DD x rd,D

In which:

DF: Proportion of foreign currency loan in the total loan capital specified in Appendix 1 of this Circular (%);

DD: Proportion of domestic currency loan in the total loan capital specified in Appendix 1 of this Circular (%);

rd,F: The foreign currency loan interest rate is determined on the basis of the foreign currency loan interest rate for power plant projects that have undergone negotiation of electricity price for 5 years preceding the time of calculation of the electricity generation price bracket (%/year);

rd,D: The domestic currency loan interest rate is determined on the basis of the domestic currency loan interest rate for power plant projects that have undergone negotiation of electricity price for 5 years preceding the time of calculation of the electricity generation price bracket (%/year).”

3. To amend Article 8 as follows:

“Variable cost of the standard power plant for the year in which the price bracket (VC) is applied is the component to recover fuel costs and other variable costs of the standard power plant with the maximum number of operating hours at maximum capacity, determined by the following formula:

VC = HR x Pnlc x (1+f)

In which:

VC: Variable cost of the standard power plant (VND/kWh);

HR: Net heat loss rate calculated at the loading level specified in Appendix 1 attached to this Circular, calculated by kcal/kWh or kJ/kWh or BTU/kWh;

f: Percentage of total starting costs, fuel - auxiliary materials and other variable costs for electricity generation compared to main fuel costs and is specified in Appendix 1 attached to this Circular (%);

Pnlc: The main fuel price of the standard power plant, excluding transportation charge; for coal-fired power plants, such price includes losses, management fees, insurance (if any). In case the agreement for fuel supply cannot separate the fuel transportation charge, the main fuel price is determined to be equal to the price in the main fuel sale and purchase agreement; Pnlc is calculated in VND/kcal or VND/kJ or VND/BTU.”

4. To amend the net fuel loss rate and main fuel price in Appendix 2 as follows:

1 | Net heat loss rate | HR | kcal/kWh or kJ/kWh or BTU/kWh |

2 | Price of main fuel | Pnlc | VND/kcal or VND/kJ or VND/BTU |

Article 28. Transitional provisions

1. With regard to power purchase agreements signed before the effective date of this Circular, the two parties shall continue to perform the signed power purchase agreements until their expiration.

2. With regard to power projects already signed with power purchase agreements according to the methods provided in the Circular No. 56/2014/TT-BCT, Circular No. 51/2015/TT-BCT dated December 29, 2015 and new power projects starting before September 19, 2017, if the settled investment capital is approved, the two parties may request for re-calculating electricity prices according to the settled investment capital approved under Article 12 of this Circular.