THE STATE BANK OF VIETNAM

Circular No. 52/2018/TT-NHNN dated December 31, 2018 of the State Bank of Vietnam on prescribing the rating of credit institutions and foreign bank branches

Pursuant to the Law on State Bank of Vietnam dated June 16, 2010;

Pursuant to the Law on Credit Institutions dated June 16, 2010 and the Law on Amending and Supplementing certain Articles of the Law on Credit Institutions dated November 20, 2017;

Pursuant to the Government's Decree No. 16/2017/ND-CP dated February 17, 2017, defining the functions, tasks, powers and organizational structure of the State Bank of Vietnam;

Upon the request of the Chief Inspector and Bank Supervisor;

The Governor of the State Bank of Vietnam hereby promulgates the Circular prescribing the rating of credit institutions and foreign bank branches.

Chapter I

GENERAL PROVISIONS

Article 1. Scope of regulation

This Circular provides for the rating of credit institutions and foreign bank branches.

Article 2. Subjects of application

1. This Circular shall apply to the following entities and persons:

a) Credit institutions, including commercial banks (including those of which more than 50% of charter capital is owned by the State, joint-stock commercial banks, joint venture banks, wholly foreign-owned banks), cooperative banks, financial companies and financial leasing companies;

b) Foreign bank branches;

c) Organizations and individuals related to the rating of credit institutions and foreign bank branches.

2. This Circular shall not be applied to credit institutions and foreign bank branches falling into one of the following cases:

a) Credit institutions and foreign bank branches are going into special administration overseen by the State Bank of Vietnam (hereinafter referred to as State Bank);

b) Credit institutions and foreign bank branches have filed applications for business dissolution to the State Bank (in case of their voluntary dissolution) or have been subject to the written request for asset liquidation, establishment of a liquidation committee or a liquidation supervision team filed by the Banking Supervision Agency to the Governor of the State Bank (in case of withdrawal of their licenses) as per laws;

c) Their operation period has not reached 24 months from the date of commencement.

Article 3. Interpretation of terms

For the purposes of this Circular, the following terms shall be construed as follows:

1. Capital adequacy ratio refers to an indicator that is calculated under the provisions of the Circular No. 36/2014/TT-NHNN dated November 20, 2014 of the State Bank's Governor, prescribing the prudential limits and ratios for operations of credit institutions and foreign bank branches, and other legislative documents amending, supplementing or replacing this Circular (if any) (hereinafter referred to as Circular No. 36/2014/TT-NHNN). If credit institutions and credit institutions apply the Circular No. 41/2016/TT-NHNN dated December 30, 2016 of the State Bank's Governor, prescribing the capital adequacy ratios for operations of banks and foreign bank branches, and other legislative documents amending, supplementing or replacing this Circular (if any) (hereinafter referred to as Circular No. 41/2016/TT-NHNN) then the capital adequacy ratios must be defined according to Circular No. 41/2016/TT-NHNN.

2. Tier 1 capital ratio refers to an indicator defined in the following specific regulations:

a) If a credit institution or foreign bank branch applies the capital adequacy ratio defined in the Circular No. 36/2014/TT-NHNN, its tier 1 capital ratio shall be calculated according to the following formula:

Tier 1 capital ratio (%) | = | Standalone tier 1 capital | x | 100% |

Total standalone risk-weighted assets |

Standalone tier 1 capital and total standalone risk-weighted assets shall be determined as per Circular No. 36/2014/TT-NHNN.

b) If a credit institution or foreign bank branch applies the capital adequacy ratio defined in the Circular No. 41/2016/TT-NHNN, its tier 1 capital ratio shall be calculated according to the following formula:

Tier 1 capital ratio (%) | = | Tier 1 capital | x | 100% |

RWA + 12.5 x (KOR + KMR) |

Where:

- RWA: Total credit risk-weighted assets

- KOR: Capital required for operational risks

- KMR: Capital required for market risks

Tier 1 capital, RWA, KOR and KMR shall be defined under the provisions of the Circular No. 41/2016/TT-NHNN.

3. Debts restructured as potentially bad debts refers to debts which are not written off as bad debts at credit institutions and foreign bank branches as they are rescheduled and classification groups to which they belong remain unchanged.

4. Debts sold to VAMC as bad debts yet to be disposed of refers to bad debts of credit institutions and foreign bank branches which have already been purchased using special bonds as payment by the Vietnam Asset Management Company (VAMC) and have yet to be disposed of or recovered.

5. Customer with a large outstanding balance refers to a customer (except credit institutions and foreign bank branches) having the outstanding balance making up at least 5% of the equity of a credit institution and foreign bank branch.

6. Operating expense refers to an operating expense entry posted on an income statement as prescribed by laws on the financial reporting regime applied to a credit institution and foreign bank branch.

7. Gross operating income refers to an aggregate of net profit, net profit/loss earned/incurred from services, net profit/loss earned/incurred from foreign exchange business operations, net profit/loss earned/incurred from trading securities transactions, net profit/loss earned/incurred from investment securities transactions, net profit/loss earned/incurred from other operations, and income generated from capital contributions or share purchases, recorded on an income statement in accordance with laws on the financial reporting regime applied to credit institutions and foreign bank branch.

8. Average equity refers to an entry of the owner’s equity that is posted on a balance sheet as provided by law on the financial reporting regime applied to credit institutions and foreign bank branches and that is averaged over quarters of an accounting year.

9. Average total assets refers to an entry of aggregate assets that is posted on a balance sheet as provided by law on the financial reporting regime applied to credit institutions and foreign bank branches and that is averaged over quarters of an accounting year.

10. Net interest margin (NIM) refers to an indicator for the operational efficiency of a credit institution and foreign bank branch. This indicator shows the difference between the average deposit interest rate and the average loan interest rate of a credit institution and foreign bank branch. This indicator shall be calculated as follows:

Net interest margin (NIM) | = | Net interest income |

Average earning assets |

Where:

- Net interest income refers to an entry of net interest income posted on an income statement as prescribed by laws on the financial reporting regime applied to credit institutions and foreign bank branches.

- Average earning assets refer to all accounts and entries of deposits at the State Bank, deposits at other credit institutions and loans granted to other credit institutions (except risk provisions), loans granted to customs (except risk provisions), debt purchases (except risk provisions), and investing securities (except provisions for depreciation), which are recorded on a balance sheet in accordance with law on the financial reporting regime applied to credit institutions and foreign bank branches and averaged over quarters of an accounting year.

11. Number of days it takes to collect interest refers to an indicator for the operational efficiency of a credit institution and foreign bank branch. This indicator shows the number of days required to collect interest recognized as income of a credit institution or foreign bank branch. This indicator shall be calculated as follows:

Interest amount to be collected over the number of days | = | Interest and associated fees | x | 365 |

Interest and other similar income | n |

Where:

- Interest and associated fees refer to an entry of interest and associated fees posted on a balance sheet as prescribed by laws on the financial reporting regime applied to credit institutions and foreign bank branches.

- Interest and other similar income refers to an entry of interest and other similar income recorded in an income statement as prescribed by laws on the financial reporting regime applied to credit institutions and foreign bank branches.

- n adopts the following values: n=4 if the number of days it takes to collect interest in a rating year is calculated based on data about such interest obtained over quarters of that year; n=2 if the number of days it takes to collect interest in a rating year is calculated based on data about such interest obtained over 6 months; n=4/3 if the number of days it takes to collect interest in a rating year is calculated based on data about such interest obtained over 9 months; n=1 if the number of days it takes to collect interest in a rating year is calculated based on data about such interest obtained over a year.

12. Average highly liquid asset refers to an asset with high liquidity which is determined under laws on the prudential ratios for operations of credit institutions and foreign bank branches (solvency ratio) and is averaged over ending business days of quarters in a rating year.

13. Customers having large deposit balances refers to 10 customers (except credit institutions and foreign bank branches) with large balances of deposits at credit institutions and foreign bank branches.

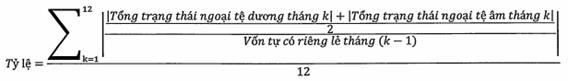

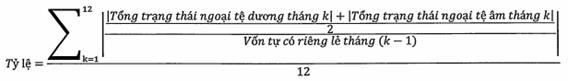

14. Ratio of total foreign currency positions to standalone average equity shall be defined as follows:

Where:

- k values range from 1 to 12, equaling to 12 months in a rating year. If k=1, the standalone equity in the month (k-1) will be the standalone equity determined at the end of December of the year preceding the rating year.

- Total positive foreign currency positions in the k month and total negative foreign currency positions in the k month shall be determined according to laws on foreign currency positions of credit institutions and foreign bank branches in the ending date of the k month.

- Standalone equity shall be determined according to laws on the prudential ratios for operations of credit institutions and foreign bank branches (standalone capital adequacy ratio).

15. Ratio of the difference between interest sensitive assets and interest sensitive liabilities to the equity shall be determined as follows:

Ratio | = | |Interest sensitive assets – interest sensitive liabilities| |

Equity |

Where:

- Interest sensitive assets refer to total on-balance sheet assets sensitive to interest rates (except non-interest-bearing assets) which are recorded in the explanatory notes on an income statement according to law on the financial reporting regime applied to credit institutions and foreign bank branches.

- Interest sensitive liabilities refer to total on-balance sheet liabilities sensitive to interest rates which are recorded in the explanatory notes on an income statement according to law on the financial reporting regime applied to credit institutions and foreign bank branches.

- Equity refers to an entry of the owner’s equity that is posted on a balance sheet as provided by law on the financial reporting regime applied to credit institutions and foreign bank branches.

16. Average fine for a violation refers to the average value of the maximum fine and the minimum fine in the fine bracket applied to violations committed by organizations as provided in a Decree prescribing the administrative fine in the currency and banking sectors.

Article 4. Principles and methods of rating of credit institutions and foreign bank branches

1. Rating must fully reflect the current business efficiency and risks of credit institutions and foreign bank branches, and must comply with laws.

2. Credit institutions and foreign bank branches shall be divided into equally-ranked groups, specifically including:

a) Group 1: Large-scale commercial banks (total average value of assets over quarters of the rating year is greater than VND 100,000 billion);

b) Group 2: Small-scale commercial banks (total average value of assets over quarters of the rating year is equal to or less than VND 100,000 billion);

c) Group 3: Foreign bank branches;

d) Group 4: Financial companies;

dd) Group 5: Financial lease companies;

e) Group 6: Cooperative banks.

3. Credit institutions and foreign bank branches shall be ranked according to the set of criteria. Each rating criterion must be subdivided into subgroups of quantitative and qualitative indicators. The subgroup of quantitative indicators is designed for measuring how healthy banking operations are, based on data on operations of a credit institution and foreign bank branch. The subgroup of qualitative indicators is designed for measuring the level of compliance with laws of a credit institution and foreign bank branch.

4. The weighting factor for both of these indicators and the weighting factor for a single indicator in each equally-ranked group shall be determined on the basis of importance of each subgroup of indicators and a single indicator for the level of healthiness of banking operations, inspection and supervision requirements.

5. Based on the score that a credit institution or foreign bank branch has achieved, it shall be ranked: Excellent (A), Good (B), Average (C), Fair (D) or Poor (E).

Article 5. Rating materials, data and information

1. Rating materials, data and information shall include the followings:

a) Materials, data and information that credit institutions and foreign bank branches deliver to the State Bank under laws on the reporting and statistical regime;

b) Results of surveillance, inspection, assessment and audit of competent regulatory authorities under laws (including State Bank, other state regulatory authorities and independent auditing companies);

c) Other materials, data and information that credit institutions and foreign bank branches submit to the State Bank under laws and upon the request of the State Bank.

2. Numerical data used for calculation of rating scores shall be comprised of:

a) Individual figures of credit institutions and foreign bank branches (except subsidiary companies and associate companies);

b) Figures released on December 31 each year by credit institutions and foreign bank branches, except figures of indicators which are calculated on average;

c) In case where the spontaneous rating is required to meet state management demands as provided in clause 3 of Article 21 herein, the State Bank's Governor shall make a decision on the scope of each material, datum or information that may be used for rating of credit institutions and foreign bank branches.

Article 6. Rating criteria system

1. The system of criteria intended for the rating of credit institutions and foreign bank branches shall be composed of the followings:

a) Capital (C);

b) Asset quality (A);

c) Management and administration (M);

d) Business efficiency (E);

dd) Liquidity (L);

e) Sensitivity to market risk (S).

2. Credit institutions and foreign bank branches may be scored according to criteria and subgroup of indicators prescribed in Article 7, 8, 9, 10, 11 and 12 herein.

Chapter II

SPECIFIC PROVISIONS

Section 1. RATING CRITERIA AND INDICATORS SUBGROUPS

Article 7. Capital

Capital of a credit institution or foreign bank branch shall be evaluated and scored according to the following subgroups of indicators:

1. Subgroup of quantitative indicators:

a) Capital adequacy ratio;

b) Tier 1 capital ratio.

2. Subgroup of qualitative indicators:

a) Compliance with laws on release, checking, possible revision, supplementation and reporting of internal rules on assessment of quality of assets and compliance with the prescribed minimum capital adequacy ratios;

b) Compliance with the prescribed minimum capital adequacy ratios;

c) Compliance with regulatory requirements concerning the actual value of charter capital and allocated funds;

d) Compliance with laws on the internal assessment of capital adequacy.

Article 8. Asset quality

Quality of assets of a credit institution or foreign bank branch shall be evaluated and scored according to the following subgroups of indicators:

1. Subgroup of quantitative indicators:

a) Ratio of bad debts, debts sold to VAMC as bad debts yet to be disposed of and debts restructured as potentially bad debts to total liabilities plus debts sold to VAMC as bad debts yet to be disposed of;

b) Ratio of class-2 debts to total liabilities;

c) Ratio of outstanding credit balances of customers having large outstanding credit balances to outstanding credit balances owed to economic organizations and individuals;

d) Ratio of class 3 through class 5 off-balance sheet liabilities and commitments to class 1 through class 5 off-balance sheet commitments;

dd) Ratio of outstanding loan balances of members of people's credit funds to total loan balances;

e) Ratio of provisions for risks in trading securities or investment securities (except provisions for risks associated with special bonds used for selling debts to VAMC) to total balance of trading securities or investment securities (except the balance of special bonds used for selling debts to VAMC);

g) Ratio of provisions for depreciation in long-term investments to total balance of contributed capital for long-term investments.

2. Subgroup of qualitative indicators:

a) Compliance with laws on lending operations;

b) Compliance with laws on release, review, revision, modification and reporting of internal rules on extension of credit, management of borrowed funds and policies on loan loss provisions;

c) Compliance with laws on internal credit rating systems;

d) Compliance with laws on classification of assets, retained amounts and methods of retention of amounts for risk provisions and use of risk provisions for treatment of risks in operations of credit institutions and foreign bank branches;

dd) Compliance with laws on setting aside of amounts for and use of provisions for losses on financial investments and accounts receivables deemed uncollectible;

e) Compliance with laws on setting aside of amounts for and use of risk provisions for special bonds issued by asset management companies of Vietnamese credit institutions;

g) Compliance with laws on restrictions on restrictions on extension of credit and credit limits;

h) Compliance with laws on management of credit risk.

Article 9. Management and administration

The management and administration criterion of a credit institution or foreign bank branch shall be evaluated and scored according to the following subgroups of indicators:

1. Subgroup of quantitative indicators: Ratio of operating expenses to gross operating income.

2. Subgroup of qualitative indicators:

a) Compliance with laws on shareholders, shares and stocks;

b) Compliance with laws on limits to capital contribution and share purchase;

c) Compliance with laws on Managing Boards, Boards of Members, Control Boards and Steering Committees and other legislation on management and administration of credit institutions and foreign bank branches;

d) Compliance with laws on internal control systems, including supervision by the senior manager, internal control, internal audit and risk management (except credit risk management, liquidity risk management and market risk management) of credit institutions and foreign bank branches.

dd) Compliance with laws on independent audits;

e) Compliance with laws on communication and reporting regimes;

g) Compliance with laws on currency and other banks other than regulations already referred to in qualitative indicators as prescribed in Article 7, 8, 10, 11 and 12 herein and point a, b, c, d, dd and e of clause 2 of this Article.

Article 10. Business efficiency

The business efficiency criterion of a credit institution or foreign bank branches shall be evaluated and scored according to the following subgroups of indicators:

1. Subgroup of quantitative indicators:

a) Ratio of the profit before tax to the average equity;

b) Ratio of the profit before tax to total average assets;

c) Net interest margin (NIM);

d) Number of days it takes to collect interest.

2. Subgroup of qualitative indicators: Compliance with laws on financial regimes applied to credit institutions and foreign bank branches.

Article 11. Liquidity

The liquidity criterion of a credit institution or foreign bank branch shall be evaluated and scored according to the following subgroups of indicators:

1. Subgroup of quantitative indicators:

a) Ratio of average highly liquid assets to total average assets;

b) Ratio of short-term finances for mid-term and long-term loans;

c) Ratio of outstanding loan balance to total deposits;

d) Ratio of deposits of customers with large deposit balances to total deposits.

2. Subgroup of qualitative indicators:

a) Compliance with laws on the solvency ratio, the maximum ratio of short-term capital used as mid-term and long-term loans, and the ratio of outstanding loan balance to total deposits;

b) Compliance with laws on release, review, revision, modification, supplementation and reporting of internal regulations on management of liquidity and compliance with other laws on management of liquidity risk.

Article 12. Sensitivity to market risk

The criterion for measuring the sensitivity to market risk of a credit institution or foreign bank branch shall be evaluated and scored according to the following subgroups of indicators:

1. Subgroup of quantitative indicators:

a) Ratio of total foreign currency positions to the standalone average equity;

b) Ratio of the difference between interest sensitive assets and interest sensitive liabilities to the equity.

2. Subgroup of qualitative indicators:

a) Conformance to limits to total foreign currency positions under laws;

b) Compliance with laws on market risk management.

Section 2. SCORING AND RATING

Article 13. Scoring of specific indicators and subgroups of quantitative indicators

The score of each quantitative indicator in 06 rating criteria may be 1, 2, 3, 4 or 5; the score given to a subgroup of quantitative indicator ranges from 1 (equivalent to Poor) to 5 (equivalent to Excellent). Followings are specific regulations:

1. The score of a quantitative indicator shall be determined based on the value comparison between that indicator and the corresponding benchmark. The benchmark for scoring of a quantitative indicator shall be determined based on historical data of a credit institution or foreign bank branch. The score of each quantitative indicator shall be determined according to the following specific regulations:

a) The higher the value of a quantitative indicator gets, the lower the level of risk:

(i) The score will stand at 5 if the value of the indicator is either greater than or equal to the benchmark of 1;

(ii) The score will stand at 4 if the value of the indicator is either greater than or equal to the benchmark of 2, and is less than the benchmark of 1;

(iii) The score will stand at 3 if the value of the indicator is either greater than or equal to the benchmark of 3, and is less than the benchmark of 2;

(iv) The score will stand at 2 if the value of the indicator is either greater than or equal to the benchmark of 4, and is less than the benchmark of 3;

(v) The score will stand at 1 if the value of the indicator is less than the benchmark of 4.

b) The higher the value of a quantitative indicator, the higher the risk level:

(i) The score will stand at 5 if the value of the indicator is either less than or equal to the benchmark of 1;

(ii) The score will stand at 4 if the value of the indicator is either less than or equal to the benchmark of 2, and is greater than the benchmark of 1;

(iii) The score will stand at 3 if the value of the indicator is either less than or equal to the benchmark of 3, and is greater than the benchmark of 2;

(iv) The score will stand at 2 if the value of the indicator is either less than or equal to the benchmark of 4, and is greater than the benchmark of 3;

(v) The score will stand at 1 if the value of the indicator is greater than the benchmark of 4.

c) The nearer to 0 the value of a quantitative indicator, the lower the risk level:

(i) The score will stand at 5 if the absolute value of the indicator is either less than or equal to the benchmark of 1;

(ii) The score will stand at 4 if the absolute value of the indicator is either less than or equal to the benchmark of 2, and is greater than the benchmark of 1;

(iii) The score will stand at 3 if the absolute value of the indicator is either less than or equal to the benchmark of 3, and is greater than the benchmark of 2;

(iv) The score will stand at 2 if the absolute value of the indicator is either less than or equal to the benchmark of 4, and is greater than the benchmark of 3;

(v) The score will stand at 1 if the absolute value of the indicator is greater than the benchmark of 4.

d) Benchmark of 1, 2, 3 and 4 of each quantitative indicator applied to each equally-ranked group shall be subject to Article 14 herein.

2. The score of a subgroup of quantitative indicators in each criterion shall be determined by the sum of scores given to specific quantitative indicators multiplied by the weighting factors for these indicators. The weighting factors for quantitative indicators applied to specific equally-ranked groups shall be regulated in Article 15 herein.

3. As for quantitative indicators prescribed in point a and b of clause 1 of Article 7 herein, if credit institutions and foreign bank branches conform to prudential ratios referred to in Circular No. 41/2016/TT-NHNN, the score of a quantitative indicator prescribed in point a and b of clause 1 of Article 7 herein will be increased by 1 point after being determined as provided in point a and d of clause 1 of this Article.

Article 14. Scoring benchmarks for specific quantitative indicators

Benchmark of 1, 2, 3 and 4 for scoring of specific quantitative indicators in each equally-ranked group shall be determined according to the detailed chart below:

No. | Criteria/indicators | Unit of measure | Benchmark |

Benchmark 1 | Benchmark 2 | Benchmark 3 | Benchmark 4 |

1 | CAPITAL (C) | | | | | |

1.1 | Capital adequacy ratio | % | The higher the value of a quantitative indicator, the lower the risk level |

| Large-scale commercial banks | | 15,00 | 12,00 | 8,00 | 5,00 |

| Small-scale commercial banks | | 15,00 | 12,00 | 8,00 | 5,00 |

| Foreign bank branches | | 15,00 | 12,00 | 8,00 | 5,00 |

| Finance companies | | 20,00 | 16,00 | 9,00 | 6,00 |

| Financial leasing companies | | 20,00 | 16,00 | 9,00 | 6,00 |

| Cooperative banks | | 15,00 | 12,00 | 9,00 | 5,00 |

1.2 | Tier 1 capital ratio | % | The higher the value of a quantitative indicator, the lower the risk level |

| Large-scale commercial banks | | 12,00 | 10,00 | 7,00 | 4,00 |

| Small-scale commercial banks | | 12,00 | 10,00 | 7,00 | 4,00 |

| Foreign bank branches | | 12,00 | 10,00 | 7,00 | 4,00 |

| Finance companies | | 19,00 | 15,00 | 8,00 | 5,00 |

| Financial leasing companies | | 19,00 | 15,00 | 8,00 | 5,00 |

| Cooperative banks | | 12,00 | 10,00 | 7,00 | 4,00 |

2 | ASSET QUALITY (A) | | | | | |

2.1 | Ratio of bad debts, debts sold to VAMC as bad debts yet to be disposed of and debts restructured as potentially bad debts to total liabilities plus debts sold to VAMC as bad debts yet to be disposed of | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 1,00 | 1,50 | 3,00 | 5,00 |

| Small-scale commercial banks | | 1,00 | 2,00 | 3,00 | 5,00 |

| Foreign bank branches | | 1,00 | 2,00 | 3,00 | 5,00 |

| Finance companies | | 1,00 | 3,00 | 5,00 | 7,00 |

| Financial leasing companies | | 1,00 | 2,00 | 3,00 | 5,00 |

| Cooperative banks | | 1,00 | 2,00 | 3,00 | 5,00 |

2.2 | Ratio of class-2 debts to total liabilities | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 1,00 | 2,00 | 3,00 | 5,00 |

| Small-scale commercial banks | | 1,00 | 2,50 | 4,00 | 6,00 |

| Foreign bank branches | | 1,00 | 2,50 | 4,00 | 6,00 |

| Finance companies | | 1,00 | 3,00 | 6,00 | 8,00 |

| Financial leasing companies | | 1,00 | 2,50 | 4,00 | 6,00 |

| Cooperative banks | | 1,00 | 2,50 | 4,00 | 6,00 |

2.3 | Ratio of outstanding credit balances of customers having large outstanding credit balances to outstanding credit balances owed to economic organizations and individuals | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 10,00 | 15,00 | 20,00 | 25,00 |

| Small-scale commercial banks | | 10,00 | 20,00 | 30,00 | 40,00 |

| Foreign bank branches | | 10,00 | 20,00 | 30,00 | 40,00 |

| Cooperative banks | | 5,00 | 10,00 | 15,00 | 20,00 |

2.4 | Ratio of class 3 through class 5 off-balance sheet liabilities and commitments to total liabilities and class 1 through class 5 off-balance sheet commitments | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 1,00 | 2,00 | 3,00 | 5,00 |

| Small-scale commercial banks | | 1,50 | 2,50 | 3,50 | 7,00 |

| Foreign bank branches | | 1,00 | 2,50 | 3,50 | 7,00 |

| Finance companies | | 1,00 | 3,00 | 5,00 | 8,00 |

| Financial leasing companies | | 1,00 | 2,50 | 4,00 | 7,00 |

| Cooperative banks | | 1,00 | 2,50 | 3,50 | 7,00 |

2.5 | Ratio of outstanding loan balances of members of people's credit funds to total loan balances | % | The higher the value of a quantitative indicator, the higher the risk level |

| Cooperative banks | | 10,00 | 20,00 | 30,00 | 40,00 |

2.6 | Ratio of provisions for risks in trading securities or investment securities (except provisions for risks associated with special bonds used for selling debts to VAMC) to total balance of trading securities or investment securities (except the balance of special bonds used for selling debts to VAMC) | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 3,00 | 5,00 | 10,00 | 15,00 |

| Small-scale commercial banks | | 5,00 | 7,00 | 12,00 | 17,00 |

| Foreign bank branches | | 5,00 | 7,00 | 12,00 | 17,00 |

| Finance companies | | 5,00 | 7,00 | 12,00 | 17,00 |

| Cooperative banks | | 2,00 | 5,00 | 7,00 | 10,00 |

2.7 | Ratio of provisions for depreciation in long-term investments to total balance of contributed capital for long-term investments | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 3,00 | 7,00 | 11,00 | 15,00 |

| Small-scale commercial banks | | 5,00 | 7,00 | 12,00 | 18,00 |

| Finance companies | | 5,00 | 7,00 | 10,00 | 15,00 |

| Cooperative banks | | 5,00 | 7,00 | 10,00 | 15,00 |

3 | MANAGEMENT AND ADMINISTRATION (M) | | | | | |

3.1 | Ratio of operating expenses to gross operating income | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 35,00 | 45,00 | 50,00 | 60,00 |

| Small-scale commercial banks | | 40,00 | 50,00 | 60,00 | 70,00 |

| Foreign bank branches | | 40,00 | 50,00 | 60,00 | 70,00 |

| Finance companies | | 25,00 | 35,00 | 45,00 | 55,00 |

| Financial leasing companies | | 25,00 | 35,00 | 45,00 | 55,00 |

| Cooperative banks | | 40,00 | 50,00 | 60,00 | 70,00 |

4 | BUSINESS EFFICIENCY (E) | | | | | |

4.1 | Ratio of the profit before tax to the average equity | % | The higher the value of a quantitative indicator, the lower the risk level |

| Large-scale commercial banks | | 15,00 | 13,00 | 10,00 | 8,00 |

| Small-scale commercial banks | | 14,00 | 12,00 | 8,00 | 6,00 |

| Foreign bank branches | | 14,00 | 12,00 | 8,00 | 6,00 |

| Finance companies | | 30,00 | 20,00 | 15,00 | 10,00 |

| Financial leasing companies | | 14,00 | 12,00 | 8,00 | 6,00 |

| Cooperative banks | | 5,00 | 4,00 | 3,00 | 2,00 |

4.2 | Ratio of the profit before tax to total average assets | % | The higher the value of a quantitative indicator, the lower the risk level |

| Large-scale commercial banks | | 1,50 | 1,10 | 0,80 | 0,60 |

| Small-scale commercial banks | | 1,30 | 1,00 | 0,70 | 0,50 |

| Foreign bank branches | | 1,30 | 1,00 | 0,70 | 0,50 |

| Finance companies | | 5,00 | 4,00 | 3,00 | 2,00 |

| Financial leasing companies | | 4,00 | 3,00 | 2,00 | 1,00 |

| Cooperative banks | | 1,00 | 0,70 | 0,40 | 0,20 |

4.3 | Net interest margin (NIM) | % | The higher the value of a quantitative indicator, the lower the risk level |

| Large-scale commercial banks | | 3,00 | 2,50 | 2,00 | 1,50 |

| Small-scale commercial banks | | 2,80 | 2,40 | 1,90 | 1,40 |

| Foreign bank branches | | 2,80 | 2,40 | 1,90 | 1,40 |

| Finance companies | | 20,00 | 15,00 | 10,00 | 5,00 |

| Financial leasing companies | | 8,00 | 5,00 | 3,50 | 2,00 |

| Cooperative banks | | 2,40 | 2,00 | 1,60 | 1,20 |

4.4 | Number of days it takes to collect interest | day | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 55,00 | 70,00 | 85,00 | 95,00 |

| Small-scale commercial banks | | 60,00 | 75,00 | 90,00 | 100,00 |

| Foreign bank branches | | 60,00 | 75,00 | 90,00 | 100,00 |

| Finance companies | | 20,00 | 25,00 | 35,00 | 50,00 |

| Financial leasing companies | | 25,00 | 30,00 | 40,00 | 55,00 |

| Cooperative banks | | 60,00 | 75,00 | 90,00 | 100,00 |

5 | LIQUIDITY (L) | | | | | |

5.1 | Ratio of average highly liquid assets to total average assets | % | The higher the value of a quantitative indicator, the lower the risk level |

| Large-scale commercial banks | | 20,00 | 15,00 | 9,00 | 5,00 |

| Small-scale commercial banks | | 18,00 | 14,00 | 8,00 | 4,00 |

| Foreign bank branches | | 25,00 | 20,00 | 15,00 | 10,00 |

| Finance companies | | 20,00 | 15,00 | 10,00 | 5,00 |

| Financial leasing companies | | 18,00 | 14,00 | 8,00 | 5,00 |

| Cooperative banks | | 16,00 | 13,00 | 8,00 | 4,00 |

5.2 | Ratio of short-term finances for mid-term and long-term loans | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 25,00 | 30,00 | 35,00 | 40,00 |

| Small-scale commercial banks | | 30,00 | 35,00 | 40,00 | 45,00 |

| Foreign bank branches | | 30,00 | 35,00 | 40,00 | 45,00 |

| Finance companies | | 40,00 | 70,00 | 90,00 | 100,00 |

| Financial leasing companies | | 40,00 | 70,00 | 90,00 | 100,00 |

| Cooperative banks | | 30,00 | 35,00 | 40,00 | 45,00 |

5.3 | Ratio of outstanding loan balance to total deposits | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 70,00 | 80,00 | 90,00 | 95,00 |

| Small-scale commercial banks | | 60,00 | 70,00 | 80,00 | 90,00 |

| Foreign bank branches | | 70,00 | 80,00 | 90,00 | 95,00 |

| Cooperative banks | | 60,00 | 70,00 | 80,00 | 90,00 |

5.4 | Ratio of deposits of customers with large deposit balances to total deposits | % | The higher the value of a quantitative indicator, the higher the risk level |

| Large-scale commercial banks | | 5,00 | 10,00 | 13,00 | 18,00 |

| Small-scale commercial banks | | 7,00 | 12,00 | 15,00 | 20,00 |

| Foreign bank branches | | 30,00 | 40,00 | 50,00 | 60,00 |

| Cooperative banks | | 7,00 | 12,00 | 15,00 | 20,00 |

6 | SENSITIVITY TO MARKET RISK (S) | | | | | |

6.1 | Ratio of total foreign currency positions to the standalone average equity | % | The nearer to 0 the value of a quantitative indicator gets, the better this ratio becomes |

| Large-scale commercial banks | | 10,00 | 15,00 | 20,00 | 25,00 |

| Small-scale commercial banks | | 10,00 | 15,00 | 20,00 | 25,00 |

| Foreign bank branches | | 10,00 | 15,00 | 20,00 | 25,00 |

6.2 | Ratio of the difference between interest sensitive assets and interest sensitive liabilities to the equity | % | The nearer to 0 the value of a quantitative indicator gets, the better this ratio becomes |

| Large-scale commercial banks | | 50,00 | 65,00 | 80,00 | 95,00 |

| Small-scale commercial banks | | 55,00 | 70,00 | 85,00 | 100,00 |

| Foreign bank branches | | 80,00 | 90,00 | 100,00 | 120,00 |

| Finance companies | | 55,00 | 70,00 | 85,00 | 100,00 |

| Financial leasing companies | | 80,00 | 90,00 | 100,00 | 120,00 |

| Cooperative banks | | 70,00 | 80,00 | 90,00 | 100,00 |

Article 15. Weighting factors for specific quantitative indicators

The weighting factors for quantitative indicators applied to specific equally-ranked groups shall be specifically determined as follows:

No. | Criteria/indicators | Weighting factors (%) |

1 | CAPITAL (C) | |

1.1 | Capital adequacy ratio | |

| Large-scale commercial banks | 50,00 |

| Small-scale commercial banks | 50,00 |

| Foreign bank branches | 50,00 |

| Finance companies | 50,00 |

| Financial leasing companies | 50,00 |

| Cooperative banks | 50,00 |

1.2 | Tier 1 capital ratio | |

| Large-scale commercial banks | 50,00 |

| Small-scale commercial banks | 50,00 |

| Foreign bank branches | 50,00 |

| Finance companies | 50,00 |

| Financial leasing companies | 50,00 |

| Cooperative banks | 50,00 |

2 | ASSET QUALITY (A) | |

2.1 | Ratio of bad debts, debts sold to VAMC as bad debts yet to be disposed of and debts restructured as potentially bad debts to total liabilities plus debts sold to VAMC as bad debts yet to be disposed of | |

| Large-scale commercial banks | 45,00 |

| Small-scale commercial banks | 45,00 |

| Foreign bank branches | 40,00 |

| Finance companies | 50,00 |

| Financial leasing companies | 50,00 |

| Cooperative banks | 40,00 |

2.2 | Ratio of class-2 debts to total liabilities | |

| Large-scale commercial banks | 15,00 |

| Small-scale commercial banks | 15,00 |

| Foreign bank branches | 25,00 |

| Finance companies | 30,00 |

| Financial leasing companies | 40,00 |

| Cooperative banks | 20,00 |

2.3 | Ratio of outstanding credit balances of customers having large outstanding credit balances to outstanding credit balances owed to economic organizations and individuals | |

| Large-scale commercial banks | 20,00 |

| Small-scale commercial banks | 20,00 |

| Foreign bank branches | 20,00 |

| Finance companies | 0,00 |

| Financial leasing companies | 0,00 |

| Cooperative banks | 10,00 |

2.4 | Ratio of class 3 through class 5 off-balance sheet liabilities and commitments to total liabilities and class 1 through class 5 off-balance sheet commitments | |

| Large-scale commercial banks | 10,00 |

| Small-scale commercial banks | 10,00 |

| Foreign bank branches | 10,00 |

| Finance companies | 10,00 |

| Financial leasing companies | 10,00 |

| Cooperative banks | 10,00 |

2.5 | Ratio of outstanding loan balances of members of people's credit funds to total loan balances | |

| Large-scale commercial banks | 0,00 |

| Small-scale commercial banks | 0,00 |

| Foreign bank branches | 0,00 |

| Finance companies | 0,00 |

| Financial leasing companies | 0,00 |

| Cooperative banks | 10,00 |

2.6 | Ratio of provisions for risks in trading securities or investment securities (except provisions for risks associated with special bonds used for selling debts to VAMC) to total balance of trading securities or investment securities (except the balance of special bonds used for selling debts to VAMC) | |

| Large-scale commercial banks | 5,00 |

| Small-scale commercial banks | 5,00 |

| Foreign bank branches | 5,00 |

| Finance companies | 5,00 |

| Financial leasing companies | 0,00 |

| Cooperative banks | 5,00 |

2.7 | Ratio of provisions for depreciation in long-term investments to total balance of contributed capital for long-term investments | |

| Large-scale commercial banks | 5,00 |

| Small-scale commercial banks | 5,00 |

| Foreign bank branches | 0,00 |

| Finance companies | 5,00 |

| Financial leasing companies | 0,00 |

| Cooperative banks | 5,00 |

3 | MANAGEMENT AND ADMINISTRATION (M) | |

3.1 | Ratio of operating expenses to gross operating income | |

| Large-scale commercial banks | 100,00 |

| Small-scale commercial banks | 100,00 |

| Foreign bank branches | 100,00 |

| Finance companies | 100,00 |

| Financial leasing companies | 100,00 |

| Cooperative banks | 100,00 |

4 | BUSINESS EFFICIENCY (E) | |

4.1 | Ratio of the profit before tax to the average equity | |

| Large-scale commercial banks | 30,00 |

| Small-scale commercial banks | 30,00 |

| Foreign bank branches | 30,00 |

| Finance companies | 30,00 |

| Financial leasing companies | 30,00 |

| Cooperative banks | 30,00 |

4.2 | Ratio of the profit before tax to total average assets | |

| Large-scale commercial banks | 30,00 |

| Small-scale commercial banks | 30,00 |

| Foreign bank branches | 30,00 |

| Finance companies | 30,00 |

| Financial leasing companies | 30,00 |

| Cooperative banks | 30,00 |

4.3 | Net interest margin (NIM) | |

| Large-scale commercial banks | 20,00 |

| Small-scale commercial banks | 20,00 |

| Foreign bank branches | 20,00 |

| Finance companies | 20,00 |

| Financial leasing companies | 20,00 |

| Cooperative banks | 20,00 |

4.4 | Number of days it takes to collect interest | |

| Large-scale commercial banks | 20,00 |

| Small-scale commercial banks | 20,00 |

| Foreign bank branches | 20,00 |

| Finance companies | 20,00 |

| Financial leasing companies | 20,00 |

| Cooperative banks | 20,00 |

5 | LIQUIDITY (L) | |

5.1 | Ratio of average highly liquid assets to total average assets | |

| Large-scale commercial banks | 25,00 |

| Small-scale commercial banks | 20,00 |

| Foreign bank branches | 20,00 |

| Finance companies | 40,00 |

| Financial leasing companies | 40,00 |

| Cooperative banks | 30,00 |

5.2 | Ratio of short-term finances for mid-term and long-term loans | |

| Large-scale commercial banks | 25,00 |

| Small-scale commercial banks | 30,00 |

| Foreign bank branches | 30,00 |

| Finance companies | 60,00 |

| Financial leasing companies | 60,00 |

| Cooperative banks | 30,00 |

5.3 | Ratio of outstanding loan balance to total deposits | |

| Large-scale commercial banks | 30,00 |

| Small-scale commercial banks | 30,00 |

| Foreign bank branches | 30,00 |

| Finance companies | 0,00 |

| Financial leasing companies | 0,00 |

| Cooperative banks | 20,00 |

5.4 | Ratio of deposits of customers with large deposit balances to total deposits | |

| Large-scale commercial banks | 20,00 |

| Small-scale commercial banks | 20,00 |

| Foreign bank branches | 20,00 |

| Finance companies | 0,00 |

| Financial leasing companies | 0,00 |

| Cooperative banks | 20,00 |

6 | SENSITIVITY TO MARKET RISK (S) | |

6.1 | Ratio of total foreign currency positions to the standalone average equity | |

| Large-scale commercial banks | 50,00 |

| Small-scale commercial banks | 50,00 |

| Foreign bank branches | 50,00 |

| Finance companies | 0,00 |

| Financial leasing companies | 0,00 |

| Cooperative banks | 0,00 |

6.2 | Ratio of the difference between interest sensitive assets and interest sensitive liabilities to the equity | |

| Large-scale commercial banks | 50,00 |

| Small-scale commercial banks | 50,00 |

| Foreign bank branches | 50,00 |

| Finance companies | 100,00 |

| Financial leasing companies | 100,00 |

| Cooperative banks | 100,00 |

Article 16. Scoring of subgroups of qualitative indicators

1. The score given to a subgroup of qualitative indicators in each rating criterion may be determined on the basis of evaluating the degree of compliance with laws of a credit institution or foreign bank branch, and will mean Excellent if it is 5 and will mean Poor if it is either 0 or 1. The scoring is subject to the following regulations:

2. The score will be 5 if a credit institution or foreign bank branch complies with all laws and regulations at each indicator in the subgroup of qualitative indicators.

3. Credit institutions and foreign bank branches may obtain descending scores if they are in breach of legislative regulations referred to in indicators in the subgroup of qualitative indicators as prescribed in Article 7, 8, 9, 10, 11 and 12 herein. Violations committed by credit institutions and foreign bank branches may serve as a basis for scoring according to the following principles:

a) Violations detected in a rating year:

(i) As regards violations for which amounts of fine are regulated in the Decree prescribing administrative penalties in the currency and banking sector, the score of the subgroup of qualitative indicators shall vary, depending on the average amount of fine for a particular violation, specifically including:

- The score will be 4 if the average amount of fine for a violation is either less than or equal to VND 100 million;

- The score will be 3 if the average amount of fine for a violation is either less than or equal to VND 200 million, and is greater than VND 100 million;

- The score will be 2 if the average amount of fine for a violation is either less than or equal to VND 300 million, and is greater than VND 200 million;

- The score will be 1 if the average amount of fine for a violation is greater than VND 300 million.

(ii) In case of committing other violations, credit institutions or foreign bank branches will be given the score of 4;

(iii) In case of committing violations against different regulations (in the same subgroup of qualitative indicators) which result in them being giving different scores, credit institutions and foreign bank branches will have to get the lowest score amongst the above-mentioned scores;

(iv) After determination of scores of qualitative indicators based on regulations laid down in point a (i), a (ii) and a (iii) of this clause, credit institutions and foreign bank branches will be subject to the further score deduction on conditions that the subtrahend point is not greater than 0.9 according to the following principles:

- In case of being in breach of a legislative regulation multiple times, credit institutions or foreign bank branches will get 0.1 point deducted from total score as a penalty for each violation (applicable to the second or subsequent violation);

- In case of committing repeated violation against different legislative regulations (in the same subgroup of qualitative indicators), credit institutions or foreign bank branches will get 0.1 point deducted from total score as a penalty for each violation (applicable to the second or subsequent violation).

b) If violations detected before a rating year have not been corrected yet, they may serve as a basis for scoring in that year as provided in point a(i), a(ii), a(iii) and a(iv) of this clause till correction of these violations is completed;

c) Violations used as a basis for calculation of scores of qualitative indicators shall be defined as follows:

(i) Violations specified in reports on results of surveillance, inspection, assessment and audit of competent regulatory authorities under laws (including State Bank, other state regulatory authorities and independent auditing companies), or decisions to impose administrative penalties of competent regulatory authorities;

(ii) Violations reported by credit institutions and foreign bank branches of their own accord.

3. In case where credit institutions or foreign bank branches have yet to be or are not subject to one or more criteria in the subgroup of qualitative indicators referred to in Article 7, Article 8, Article 9, Article 10, Article 11 and Article 12 herein as provided in legislative regulations in force, scoring of such a criterion or criteria will be delayed or cancelled.

Article 17. Scores of specific criteria

Scores of specific criteria prescribed in Article 7, 8, 9, 10, 11 and 12 herein shall be equal to total of the score of subgroup of quantitative indicators and the score of the subgroup of qualitative indicators in the following criteria which is multiplied by the weighting factors for specific subgroups of quantitative and qualitative indicators. The weighting factors for quantitative and qualitative indicators shall be regulated in Article 18 hereunder.

Article 18. Weighting factors for specific criteria and subgroups of quantitative and qualitative indicators in each criterion

1. The weighting factors for specific criteria, the subgroup of quantitative indicators and the subgroup of qualitative indicators shall be specified as follows:

No. | Criteria/subgroups of indicators | Weighting factors (%) |

1 | CAPITAL (C) | 20,00 |

1.1 | Subgroup of quantitative indicators | 15,00 |

1.2 | Subgroup of qualitative indicators | 5,00 |

2 | ASSET QUALITY (A) | 30,00 |

2.1 | Subgroup of quantitative indicators | 25,00 |

2.2 | Subgroup of qualitative indicators | 5,00 |

3 | MANAGEMENT AND ADMINISTRATION (M) | 10,00 |

3.1 | Subgroup of quantitative indicators | 3,00 |

3.2 | Subgroup of qualitative indicators | 7,00 |

4 | BUSINESS EFFICIENCY (E) | 20,00 |

4.1 | Subgroup of quantitative indicators | 15,00 |

4.2 | Subgroup of qualitative indicators | 5,00 |

5 | LIQUIDITY (L) | 15,00 |

5.1 | Subgroup of quantitative indicators | 10,00 |

5.2 | Subgroup of qualitative indicators | 5,00 |

6 | SENSITIVITY TO MARKET RISK (S) | 5,00 |

6.1 | Subgroup of quantitative indicators | 2,00 |

6.2 | Subgroup of qualitative indicators | 3,00 |

2. As for finance companies, financial leasing companies and cooperative banks, the weighting factor for the criterion of Sensitivity to market risk, the weighting factor for the subgroup of quantitative indicators in the criterion of Sensitivity to market risk and the weighting factor for the subgroup of qualitative indicators in the criterion of Sensitivity to market risk shall be 5%, 5% and 0%, respectively.

Article 19. Method for calculation of total rating score

1. Total rating scores of credit institutions and foreign bank branches shall be determined by the sum of points of specific criteria multiplied by the corresponding weighting factor of each criterion. The weighting factor for each criterion shall be regulated in Article 18 herein.

2. Certain points shall be deducted from total scores of credit institutions and foreign bank branches if the score of the subgroup of qualitative indicators in at least 4 criteria that they get is either less than or equal to 1. This deduction may happen in the following cases:

a) If total rating score is greater than 1, 1 point shall be deducted from such total rating score of credit institutions or foreign bank branches;

b) If total rating score is either less than or equal to 1, 0.1 point shall be deducted from such total rating score of credit institutions or foreign bank branches.

Article 20. Ranking

Credit institutions and foreign bank branches shall be ranked as follows:

1. Credit institutions or foreign bank branches shall be ranked A (Excellent) if their total score is either greater than or equal to 4.5.

2. Credit institutions or foreign bank branches shall be ranked B (Good) if their total score is less than 4.5 and greater than or equal to 3.5.

3. Credit institutions or foreign bank branches shall be ranked C (Average) if their total score is less than 3.5 and greater than or equal to 2.5.

4. Credit institutions or foreign bank branches shall be ranked D (Fair) if their total score is less than 2.5 and greater than or equal to 1.5.

5. Credit institutions or foreign bank branches shall be ranked E (Poor) if their total score is less than 1.5.

6. Notwithstanding provisions laid down in clause 4 of Article 20 herein, credit institutions or foreign bank branches shall be ranked D if they fall into cases specified in point a and b of clause 1 of Article 130a in the (amended) Law on Credit Institutions.

7. Notwithstanding provisions laid down in clause 5 of Article 20 herein, credit institutions or foreign bank branches shall be ranked E if they fall into cases specified in point a, b and c of clause 1 of Article 145 in the (amended) Law on Credit Institutions, and have yet to go into special administration overseen by the State Bank.

Section 3. RATING RESULTS

Article 21. Frequency rate, implementation deadlines and approval of rating results

1. By June 10 every year, Banking Supervision Agency shall appeal to the Governor of the State Bank to grant approval of rating results in the antecedent year.

2. By June 30 every year, Governor of the State Bank shall decide to grant approval of rating results in the antecedent year.

3. In case of sudden needs, Governor of the State Bank shall decide on deadlines for implementation of rating and approval of rating results which are other than those prescribed in clause 1 and 2 in this Article.

Article 22. Notice of rating results

1. Within duration of 15 days of receipt of approval of rating results from Governor of the State Bank, Banking Supervision Agency shall inform rating results to relevant credit institutions, foreign bank branches and State Bank branches in cities or provinces where main offices of credit institutions and foreign bank branches are located.

2. Contents of a notice of rating results:

a) The notice must inform credit institutions and foreign bank branches of rating results (including their ranks and total rating scores);

b) The notice must inform State Bank branches in cities or provinces of rating results (including ranks and total rating scores) of credit institutions and foreign bank branches whose main offices are located in cities or provinces.

3. Banking Supervision Agency shall assume responsibility to provide rating results of credit institutions and foreign bank branches for other entities affiliated to the State Banks to serve the state management demands within duties and powers of these entities after receipt of approval from the State Bank's Governor.

4. The State Bank shall provide rating results of credit institutions and foreign bank branches for other regulatory entities or authorities in accordance with laws.

5. Informing rating results of joint venture banks, wholly foreign-owned banks, foreign bank branches and non-banking credit institutions to foreign central banks and foreign financial supervision authorities shall be subject to the Memorandum of Understanding signed between the State Bank, foreign central banks and foreign banking supervision authorities.

Article 23. Management of rating results

1. Credit institutions and foreign bank branches shall not be allowed to provide rating results for any third party (including parent banks of foreign bank branches) in any form.

2. Banking Supervision Agency, State Bank branches in provinces and centrally-run cities, other affiliates of the State Bank and other regulatory entities or authorities having access to rating results of credit institutions and foreign bank branches as provided in clause 4 of Article 22 herein shall have to keep custody and make use of rating results in accordance with laws on protection of state secrets in the banking sector.

Chapter III

IMPLEMENTATION PROVISIONS

Article 24. Responsibilities of credit institutions and foreign bank branches

1. Credit institutions and foreign bank branches shall be entirely responsible for accuracy and authenticity of provided materials, data and information, and shall be responsible to give supplementary explanations and reports about issues related to rating upon the request of the State Bank.

2. The management of rating results shall be subject to clause 1 of Article 23 herein and provisions of other laws.

Article 25. Responsibilities and authority of Banking Supervision Agency

1. Preside over and cooperate with State Bank branches in provinces and centrally-run cities in carrying out the rating of credit institutions and foreign bank branches.

2. Counsel and appeal to Governor of the State Bank to grant the approval of rating results of credit institutions and foreign bank branches.

3. Counsel and appeal to Governor of the State Bank to apply controlling measures to credit institutions and foreign bank branches as per laws, based on rating results which have already been approved.

4. Keep custody of, inform and provide rating results to credit institutions and foreign bank branches in compliance with this Circular and provisions of relevant legislative documents.

Article 26. Responsibilities and authority of State Bank branches in provinces and centrally-run cities

1. State Bank branches in provinces and centrally-run cities shall cooperate with Banking Supervision Agency in carrying out the rating of credit institutions and foreign bank branches.

2. Counsel and appeal to Governor of the State Bank to apply controlling measures to credit institutions and foreign bank branches as per laws, based on rating results which have already been approved.

3. Keep custody of rating results of credit institutions and foreign bank branches in compliance with this Circular and provisions of relevant legislative documents.

Article 27. Effect

1. This Circular takes effect on April 1, 2019 and applies to the rating of credit institutions and foreign bank branches in 2019.

2. Decision No. 06/2008/QD-NHNN dated March 12, 2008 of the Governor of the State Bank, setting out Regulations on rating of joint-stock commercial banks, shall be superseded.

Article 28. Implementation

The Chief of the State Bank’s Office, Chief Inspector and Bank Supervisor, Directors of State Bank Branches of centrally-run cities and provinces, Heads of State Bank’s affiliates concerned, Chairs of Management Boards, Chairs of Members Boards, General Directors (Directors) of credit institutions and foreign bank branches shall, within their jurisdiction, take responsibility for implementing this Circular.

For the Governor

Deputy Governor

Doan Thai Son

Circular 52/2018/TT-NHNN DOC (Word)

Circular 52/2018/TT-NHNN DOC (Word) Circular 52/2018/TT-NHNN PDF (Original)

Circular 52/2018/TT-NHNN PDF (Original)