THE STATE BANK OF VIETNAM ___________ No. 15/2022/TT-NHNN | THE SOCIALIST REPUBLIC OF VIETNAM Independence - Freedom - Happiness _________________ Hanoi, November 30, 2022 |

CIRCULAR

On refinancing on the basis of special bonds of the Vietnam Asset Management Company

_________________

Pursuant to the Law on the State Bank of Vietnam dated June 16, 2010;

Pursuant to the Law on Credit Institutions dated June 16, 2010, and the Law Amending and Supplementing a Number of Articles of the Law on Credit Institutions dated November 20, 2017;

Pursuant to the Government’s Decree No. 16/2017/ND-CP dated February 17, 2017, defining the functions, tasks, powers and organizational structure of the State Bank of Vietnam;

Pursuant to the Government's Decree No. 53/2013/ND-CP dated May 18, 2013, defining the establishment, organization and operation of Vietnam Asset Management Company; the Government's Decree No. 34/2015/ND-CP dated March 31, 2015, and Decree No. 18/2016/ND-CP dated March 18, 2016, amending and supplementing a number of articles of the Government's Decree No. 53/2013/ND-CP dated May 18, 2013, on the establishment, organization and operation of Vietnam Asset Management Company (hereinafter referred to as Decree No. 53/2013/ND-CP);

At the proposal of the Director of the Monetary Policy Department;

The Governor of the State Bank of Vietnam hereby promulgates the Circular on refinancing on the basis of special bonds of the Vietnam Asset Management Company.

Chapter I

GENERAL PROVISIONS

Article 1. Scope of regulation

This Circular provides regulations on refinancing in Vietnamese dong of the State Bank of Vietnam (hereinafter referred to as the State Bank) for credit institutions on the basis of special bonds issued by Vietnam Asset Management Company (hereinafter referred to as special bonds) in accordance with Decree No. 53/2013/ND-CP.

Article 2. Subjects of application

1. Vietnamese credit institutions prescribed in Clause 1, Article 4 of Decree No. 53/2013/ND-CP that own special bonds (hereinafter referred to as credit institutions).

2. Organizations, individuals involved in the refinancing on the basis of special bonds.

Article 3. Purposes of refinancing

The State Bank shall refinance on the basis of special bonds in order to support the operating capital of credit institutions in the process of handling non-performing loans under Decree No. 53/2013/ND-CP.

Chapter II

SPECIFIC PROVISIONS

Article 4. Conditions for special bonds used as a basis for refinancing and extension of refinancing

Special bonds used as a basis for refinancing and extension of refinancing must fully satisfy the following conditions:

1. Special bonds are legally owned by credit institutions and are being deposited at the State Bank Operations Centre.

2. Not being special bonds in the process of payment.

3. Not in the list of special bonds that the credit institution is requesting the State Bank to consider extending the term according to the State Bank's regulations on the purchase, sale and handling of non-performing loans of Vietnam Asset Management Company (hereinafter referred to as Asset Management Company).

4. On the date the credit institution makes the list of special bonds used as the basis for refinancing or extension of refinancing and the date the credit institution updates the list of special bonds prescribed in Clause 5, Article 10 of this Circular, the remaining term of the special bonds must be longer than the time limit for refinancing application or refinancing extension at least 06 months.

Article 5. Conditions for refinancing

The State Bank shall consider and decide on refinancing for credit institutions fully meeting the following conditions:

1. Being a credit institution that is not under special control or is handled for violations as prescribed in Article 15 of this Circular.

2. The credit institution has set aside risk provisions for its owned special bonds in accordance with law provisions or the written approval of the competent authorities within 12 months preceding the date the credit institution requests for refinancing loans.

3. Complying with prudential ratios specified in Clause 1, Article 130 of the Law on Credit Institutions (amended and supplemented) and regulations of the State Bank within 12 months preceding the date the credit institution requests for refinancing loans.

4. Special bonds used as the basis for refinancing fully satisfy the conditions specified in Article 4 of this Circular.

Article 6. Refinancing amount

1. The refinancing amount shall be calculated according to the formula specified in Clause 2 of this Article but must not exceed the amount requested for refinancing loans by the credit institution.

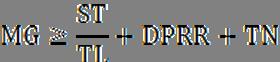

2. Formula to calculate refinancing amount:

In which:

ST refers to the refinancing amount

TL refers to the refinancing rate determined according to the provisions in Appendix No. 01 attached to this Circular.

MG refers to the total par value of special bonds in the list of special bonds used as the basis for refinancing.

DPRR refers to the total risk provision already set aside for special bonds in the list of special bonds used as the basis for refinancing.

TN refers to the total amount of debt recovery in the list of special bonds used as the basis for refinancing.

Article 7. Conditions for extension of refinancing

The State Bank shall consider and decide to extend the refinancing for credit institutions fully meeting the following conditions:

1. Being a credit institution that is not under special control or is handled for violations as prescribed in Article 15 of this Circular.

2. The credit institution has set aside risk provisions for its owned special bonds in accordance with law provisions or the written approval of the competent authorities within 12 months preceding the date the credit institution requests for extension of refinancing loans.

3. The credit institution is experiencing financial difficulty in repaying a loan.

4. Special bonds used as the basis for extension of refinancing fully satisfy the conditions specified in Article 4 of this Circular.

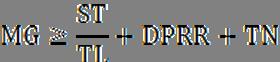

5. The total par value of special bonds used as the basis for extension of refinancing must ensure:

In which:

MG refers to the total par value of special bonds in the list of special bonds used as the basis for extension of refinancing.

ST refers to the amount the credit institution proposes to extend the refinancing.

TL refers to the refinancing extension rate determined according to the provisions in Appendix No. 01 attached to this Circular.

DPRR refers to the total risk provision already set aside for special bonds in the list of special bonds used as the basis for extension of refinancing.

TN refers to the total amount of debt recovery in the list of special bonds used as the basis for extension of refinancing.

Article 8. Interest rate

1. Interest rate for refinancing loans or extended refinancing loans on the basis of special bonds is the interest rate for refinancing loans on the basis of special bonds decided by competent authorities under Clause 4, Article 20 of Decree No. 53/2013/ND-CP at the time the refinancing amount is disbursed or extended.

2. The rate for overdue interest on refinanced loan principal is equal to 150% of the interest rate for refinancing amount at the time the refinancing amount is overdue.

3. The State Bank shall not apply interest for late payment interest on refinancing amount on the basis of special bonds.

Article 9. Term for refinancing and extension of refinancing

1. The term for refinancing on the basis of special bonds shall be decided by the State Bank, but must be less than 12 months and not exceed the remaining term of special bonds due at the earliest in the list of special bonds used as the basis for refinancing loans.

2. The time for each time of extension of refinancing shall be decided by the State Bank, but must not exceed the refinancing term and not exceed the remaining term of the special bond that is due at the earliest in the list of special bonds used as the basis for extending the refinancing; total period of refinancing and extension of refinancing must be less than 12 months.

Article 10. Dossiers of request for refinancing and extension of refinancing

1. A dossier of request for refinancing comprises:

a) A written request for refinancing, made according to Appendix No. 02 attached to this Circular;

b) 02 copies of the list of special bonds used as a basis for refinancing according to Appendix No. 04 attached to this Circular.

2. A dossier of request for extension of refinancing comprises:

a) A written request for extension of refinancing, made according to Appendix No. 03 attached to this Circular;

b) 02 copies of the list of special bonds used as a basis for extension of refinancing according to Appendix No. 04 attached to this Circular;

c) A report giving explanations to the request for extension of refinancing, which must contain at least the following contents: Difficult situation in terms of the solvency of the credit institution; satisfaction of Article 7 of this Circular by the credit institution; measures expected to be taken by the credit institution to overcome difficulties in solvency and repayment of refinancing loans.

3. Documents in the application dossier must be made in Vietnamese and signed by the legal representative of the credit institution. Such documents must be originals or duplicates granted from master books or certified copies or copies with the originals for comparison.

4. The credit institution shall send the application dossier by hand or via postal service as prescribed in Clauses 1 and 2 of this Article to the head office of the State Bank (department for receiving and returning results). After receiving a complete application dossier from the credit institution as prescribed, the State Bank shall carry out procedures for receiving and handling administrative procedures in accordance with regulations on handling administrative procedures of the State Bank.

5. In case of changing the special bond data in the list of special bonds in the application dossier, the credit institution shall update and send the updated dossier directly or via postal service to the head office of the State Bank (department for receiving and returning results). After receiving the updated dossier, the State Bank shall complete the handling of such administrative procedures and carry out procedures for receiving and handling new administrative procedures. The State Bank shall reuse the previous dossier and updated dossier (if any) of the credit institution to handle new administrative procedures.

Article 11. Procedure for considering refinancing and extension of refinancing

1. The credit institution having demand for refinancing or extension of refinancing shall send a set of application dossiers as prescribed in Article 10 of this Circular. In case of requesting for extension of refinancing, the credit institution must send the application dossier at least 45 working days before the due date of debt repayment. In case the application dossier of the credit institution is incomplete as prescribed, within 03 working days from the date of receipt of the dossier, the State Bank (department for receiving and returning results) shall send a written request to the credit institution for supplement and completion of the application dossier.

2. Within 02 working days from the date of receipt of the complete dossier from the credit institution, the Monetary Policy Department shall send a dossier to collect opinions from Banking Supervision Agency, the State Bank Operation Centre and the Asset Management Company.

3. Within 05 working days from the date of receipt of the Monetary Policy Department’s written request as prescribed in Clause 2 of this Article:

a) The State Bank Operation Centre shall: Give opinions on whether the credit institution satisfies the conditions specified in Clause 4, Article 5 of this Circular (in case the credit institution requests for refinancing) or Clause 4, Article 7 of this Circular (in case the credit institution requests for extension of refinancing) or not; confirm the sheet of balances of special bonds of the credit institution that are deposited at the State Bank Operation Centre as the basis for refinancing or extension of refinancing under Appendix No. 05 attached to this Circular and submit it to the Monetary Policy Department and the Banking Supervision Agency;

b) The Asset Management Company shall: Give opinions on whether the credit institution satisfies the conditions specified in Clause 4, Article 5 of this Circular (in case the credit institution requests for refinancing) or Clauses 4, 5, Article 7 of this Circular (in case the credit institution requests for extension of refinancing) or not; make a sheet of special bonds used as the basis for refinancing or extension of refinancing for the credit institution according to Appendix No. 06 attached to this Circular and submit it to the Monetary Policy Department and the Banking Supervision Agency.

4. Within 07 working days from the date of receipt of all opinions from the State Bank Operation Centre and the Asset Management Company as prescribed in Clause 3 of this Article, the Banking Supervision Agency shall submit written opinions to the Monetary Policy Department on the following contents:

a) Whether the credit institution satisfies the conditions specified in Clauses 1, 2, 3, Article 5 of this Circular (in case the credit institution requests for refinancing) or Clauses 1, 2, 3 Article 7 of this Circular (in case the credit institution requests for extension of refinancing) or not;

b) Specific opinions on the refinancing rate, the rate of extension of refinancing as prescribed in Appendix 01 attached to this Circular.

5. Within 07 working days from the date of receipt of opinions from the units specified in Clauses 3 and 4 of this Article, the Monetary Policy Department shall summarize and, based on the objectives of monetary policy management, propose the handling of the credit institution's request for refinancing or extension of refinancing:

a) If the proposal is approved, the Monetary Policy Department shall send documents attached to the draft decision on refinancing or the draft decision on extension of refinancing to collect opinions from the State Bank Operation Centre, the Banking Supervision Agency and Asset Management Company;

b) If the proposal is rejected, the Monetary Policy Department shall comply with the provisions of Clause 8 of this Article.

6. Within 05 working days from the date of receipt of the written request for opinions from the Monetary Policy Department under Point a, Clause 5 of this Article, the Banking Supervision Agency, the State Bank Operation Centre and the Asset Management Company shall send written comments to the Monetary Policy Department:

a) The Banking Inspection and Supervision Department shall: Give opinions on the proposal of the Monetary Policy Department and the draft decision on refinancing or the draft decision on extension of refinancing for credit institutions;

b) The State Bank Operation Centre shall: Update to the latest time the data of the sheet of the balances of special bonds of the credit institution that are deposited at the Operation Centre as the basis for refinancing or extension of refinancing under Appendix No. 05 attached to this Circular; give opinions on the draft decision on refinancing or the draft decision on extension of refinancing for credit institutions;

c) The Asset Management Company shall: Update to the latest time the sheet of special bond used as the basis for refinancing or extension of refinancing for a credit institution according to Appendix No. 06 attached to this Circular; give opinions on the draft decision on refinancing or the draft decision on extension of refinancing for credit institutions.

7. Within 03 working days from the date of receipt of the updated dossier as prescribed in Clause 5, Article 10 of this Circular, the Monetary Policy Department shall send the updated dossier for opinions from the Banking Supervision Agency, the State Bank Operation Centre, and the Asset Management Company in accordance with Clause 3, 4 or 6 of this Article.

8. Within 07 working days from the date of receipt of opinions from the units specified in Clauses 4 or 6 of this Article, the Monetary Policy Department shall propose and submit to the Governor of the State Bank for consideration and decide to agree or disagree with the refinancing or extension of refinancing for the credit institution.

9. Within 60 days from the date of receipt of the complete dossier and updated dossier of the credit institution as prescribed in Article 10 of this Circular, the State Bank shall issue a decision on refinancing, a decision on extension of refinancing (enclosed with a list of special bonds used as a basis for refinancing or extension of refinancing) in case of approval, or send a written explanation stating the reason to the credit institution in case of disapproval.

Article 12. Payment for refinancing loans

1. Upon the due date of the refinancing loan, the credit institution shall pay all the principal debt and interest for the State Bank. In the case that the due date falls on a weekend or holiday, the deadline for refinancing loan shall be extended to the next working day.

2. The credit institution may prepay part or all of the refinancing loan.

3. Refinancing loans of a credit institution must be paid before the due date in the following cases:

a) Within the first five working days of the next quarter, the Asset Management Company shall, based on the agreement on debt repayment on behalf between the Asset Management Company and the credit institution in the debt purchase and sale contract with special bonds, use collected debt amounts that the credit institution is enjoyed in the quarter from the non-performing loan purchased by special bonds being used as the basis for refinancing, extension of refinancing to pay the principal of refinancing loan of the credit institution at the State Bank, and notify in writing to the State Bank Operation Centre and the credit institution on amounts paid for each special bond;

b) Within 05 working days from the due date of special bonds used as the basis for refinancing or extension of refinancing under the State Bank’s regulations on purchase, sale and handling with non-performing loan of the Asset Management Company, the credit institution shall pay refinancing loans (principal and interest) before the due date for the State Bank. The principal amount payable for each special bond shall be calculated according to the following formula:

PTi = MGi - ĐTi

In which:

PTi refers to the principal amount of the refinancing loan payable for special bond i;

MGi refers to the par value of the special bond after deducting the risk provisions and the debt recovery amount (the data corresponding to the special bond i in the special bond list attached to the refinancing decision or the decision on extension of refinancing);

ĐTi refers to the principal amount of refinancing loan which has been prepaid before the due date in accordance with Point a of this Clause for special bonds i.

c) Within 07 working days from the date the special bond fails to meet the conditions specified in Clause 3, Article 4 of this Circular, the credit institution must pay the refinancing loans (principal and interest) for the State Bank, the principal amount of the refinancing loans must be paid according to the formula specified at Point b of this Clause;

d) In case a credit institution wishes to stop freezing special bonds being used as a basis for refinancing or extension of refinancing, the credit institution must prepay the refinancing loans (principal or interest) before the due date for the State Bank, the principal amount of refinancing loans must be paid according to the formula specified at Point b of this Clause;

dd) Within 05 working days from the date of receiving the document from the Asset Management Company about unilaterally terminating the debt purchase and sale contract with special bonds being used as a basis for refinancing or extension of refinancing according to the State Bank's regulations on the purchase, sale and handling of non-performing loan of the Asset Management Company, the credit institution must pay all principal and interest of the refinancing loans with special bonds that are unilaterally terminated from debt purchase and sale contracts;

e) In case of detecting a violation specified in Article 15 of this Circular, the credit institution must pay the principal and interest of the refinancing loans with violations to the State Bank within a maximum period of 10 working days from the date of sending the written notice of violation as prescribed at Point c, Clause 2, Point a, Clause 4, Article 18 of this Circular.

Article 13. Handling the credit institutions’ late payments

1. In case a credit institution fails to pay all debts on time in accordance with Clause 1, Article 12 or fails to fully pay debts in accordance with Points dd and e, Clause 3, Article 12 of this Circular, the State Bank and the Asset Management Company shall take the following measures:

a) The State Bank shall turn the refinancing amount to overdue monitoring according to the State Bank's regulations on methods of calculating and accounting for the collection and payment of interest in the deposit receipt and lending activities between the State Bank and the credit institution; apply interest rates on overdue refinancing principals as prescribed in Clause 2, Article 8 of this Circular;

b) The State Bank shall make deductions from the credit institution’s accounts at the State Bank, starting from the working day following the date of turning to overdue monitoring until the full amount of principal and interest payable by the credit institution is recovered and a written notice is sent to the credit institution of the account deduction for debt recovery;

c) The Asset Management Company shall use the debt recovery that the credit institution enjoys from the non-performing loans purchased with special bonds to pay the credit institution's refinancing loans to the State Bank;

d) The State Bank shall request the credit institution to pay debts from other sources (if any).

2. In case a credit institution fails to pay the payable amount as prescribed at Points b and c, Clause 3, Article 12 of this Circular, the State Bank and Asset Management Company shall take the following actions:

a) The State Bank shall apply an interest rate equal to 150% of the applicable interest rate for refinancing amount on the unpaid principal amount within the period from the date following the date the credit institution must make payment until the date the credit institution pays all the unpaid principal amount according to regulations;

b) The State Bank shall make deductions from the credit institution’s accounts at the State Bank, starting from the working day following the date the credit institution must make payment until all the amount payable by the credit institution is recovered and a written notice is sent to the credit institution of the account deduction for debt recovery;

c) The Asset Management Company shall use the debt recovery that the credit institution enjoys from the non-performing loans purchased with special bonds to pay the credit institution's refinancing loans to the State Bank;

d) The State Bank shall request the credit institution to pay debts from other sources (if any).

Article 14. Conversion of the refinancing amount to special loans

The conversion of the refinancing amount on the basis of special bonds into special loans shall follow the State Bank's regulations on special loans applicable to credit institutions placed under special control.

Article 15. Handling of violations

In case of detecting any credit institution providing false information or data in the application dossier for refinancing loans or extension of the refinancing loans on the basis of special bonds through information provided by the competent agency, or through inspection and examination, the State Bank shall not consider the credit institution's application for refinancing loans or extension of refinancing loans on the basis of special bonds for the one year, from the date on which the written notice of violation is issued in accordance with Point c, Clause 2, Point a, Clause 4, Article 18 of this Circular, and suspend the disbursement under decisions on refinancing on the basis of special bonds (if any).

Chapter III

RESPONSIBILITIES OF CREDIT INSTITUTIONS AND RELEVANT UNITS

Article 16. Responsibilities of credit institutions

1. To sufficiently, timely and accurately provide dossiers and documents on the refinancing and extension of refinancing on the basis of special bonds for the State Bank. To take responsibility before law for the accuracy and legality of such provided documents and dossiers.

2. During the application for refinancing or extension of refinancing, in case the credit institution no longer wishes to apply for refinancing or extension of refinancing, it shall promptly send a written report to the State Bank (via the department of receiving and returning results) so as the State Bank can suspend its consideration and handling of application for refinancing or extension of refinancing.

3. To enter into a refinancing contract with the State Bank Operation Centre in accordance with the State Bank Governor's Decisions on refinancing on the basis of special bonds for credit institutions.

4. To pay refinancing loans in accordance with this Circular and refinancing contracts.

5. Within 03 working days, from the date of payment for refinancing loans before the due date under Points b, c and d, Clause 3, Article 12 of this Circular, to make a report according to Appendix No. 07 attached to this Circular, and send it to the State Bank.

6. To perform other responsibilities as prescribed in this Circular and relevant laws.

Article 17. Responsibilities of the Asset Management Company

1. To give opinions on the refinancing or extension of refinancing on the basis of special bonds in accordance with this Circular.

2. To monitor special bonds used as a basis for refinancing or extension of refinancing based on the list of special bonds deposited by the State Bank Operations Centre under Point dd, Clause 3, Article 18 of this Circular; to provide the State Bank Operations Centre information to monitoring cases of payment of refinancing loans before the due date by credit institutions specified at Points b, c, d, dd, Clause 3, Article 12 of this Circular.

3. To comply with Point a, Clause 3, Article 12, Point c, Clause 1, Point c, Clause 2, Article 13 of this Circular.

4. To act as the focal point in coordinating with credit institutions and relevant units in taking debt handling measures and collaterals of the non-performing loan purchased with special bonds to pay the refinancing loans of credit institutions for the State Bank.

5. To notify in writing to the State Bank Operations Centre, the Banking Supervision Agency within 03 working from the date of occurrence of the following cases: The Asset Management Company unilaterally terminates the debt purchase and sale contracts that are used as the basis for refinancing or extension of refinancing; special bonds used as the basis for refinancing or extension of refinancing that are at the due date, or no longer satisfy conditions specified in Clause 3, Article 4 of this Circular.

Article 18. Responsibilities of units affiliated to the State Bank

1. The Monetary Policy Department shall

a) Act as the focal point in proposing the State Bank Governor to consider and make decisions on refinancing or extension of refinancing on the basis of special bonds in accordance with this Circular;

b) Act as a focal point in handling the arising concerns relating to the provisions of this Circular;

c) Coordinate with relevant units in advising the State Bank Governor about the refinancing interest rate on the basis of special bonds to propose the competent authorities for decision-making in accordance with Clause 4, Article 20 of Decree No. 53/2013/ND-CP.

2. The Banking Supervision Agency shall

a) Give opinions on the refinancing or extension of refinancing on the basis of special bonds in accordance with this Circular;

b) Act as the focal point and coordinate with relevant units in proposing the State Bank Governor the performance of provisions of Point d, Clause 1, Point d, Clause 2, Article 13 of this Circular;

c) In case of receiving a notice from the competent agency, or through inspection and examination, detecting any credit institution subject to micro-safety supervision and inspection by the Banking Supervision Agency violating regulations of Article 15 of this Circular, the Banking Supervision Agency shall send a written notice of violation to the credit institution as well as the Monetary Policy Department, the State Bank Operations Centre and the Asset Management Company. Such notice must contain at least information about the credit institution's violation and measures taken by the State Bank in accordance with this Circular;

c) Within its competence, examine, supervise and handle violations committed by credit institutions that are subject to the micro-safety supervision and inspection of the Banking Supervision Agency during the performance of this Circular.

3. The State Bank Operations Centre shall

a) Give opinions on the refinancing or extension of refinancing on the basis of special bonds in accordance with this Circular;

b) Enter into a refinancing contract, freeze special bonds used as a basis for refinancing or extension of refinancing, disburse, extend or recover refinancing loans in accordance with this Circular, the State Bank Governor’s Decisions on refinancing or extension of refinancing on the basis of special bonds for credit institutions and relevant laws;

c) Take measures specified at Points a, b, Clause 1 and Points a, b, Clause 2, Article 13 of this Circular;

d) Unfreeze all special bonds in the list of special bonds attached to the Decisions on refinancing or extension of refinancing after the credit institutions pay all principal and interest of the refinancing loans. Unfreeze the corresponding special bonds after the credit institutions pay all principal and interest of the refinancing loans with special bonds specified at Points b, c, d, Clause 3, Article 12 of this Circular;

dd) Send the list of frozen and unfrozen special bonds to the Asset Management Company within 03 working days from the date of freezing and unfreezing special bonds; send a written notice to the Asset Management Company about the fact that the credit institutions fail to pay refinancing loans under Points b, c, dd, e, Clause 3, Article 12 of this Circular, so as the Asset Management Company implements provisions of Point c, Clause 1, Point c, Clause 2, Article 13 of this Circular;

e) Within the first seven working days of the month following the month with debt or the month arising change to the refinancing amount on the basis of special bonds, the State Bank Operations Centre shall report such to the State Bank Governor, at the same time, send the refinancing data made according to Appendix No. 08 attached to this Circular to the Banking Supervision Agency and the Monetary Policy Department.

4. The State Bank branches of provinces and cities shall

c) In case of receiving a notice from the competent agency, or through inspection and examination, detecting any credit institution subject to micro-safety supervision and inspection by the Banking Supervision Agency violating regulations of Article 15 of this Circular, the State Bank branch of province or city shall send a written notice of violation to the credit institution as well as the Monetary Policy Department, the Banking Supervision Agency, the State Bank Operations Centre and the Asset Management Company. Such notice must contain at least information about the credit institution's violation and measures taken by the State Bank in accordance with this Circular;

b) Within its competence, examine, supervise and handle violations committed by credit institutions that are subject to the micro-safety supervision and inspection of the State Bank branches of provinces and cities during the performance of this Circular.

5. The Information Technology Department shall

a) Act as the focal point and coordinate with the State Bank Operations Centre and relevant units in, designing the software program, installing such program and ensuring computer infrastructure for the operations of refinancing on the basis of special bonds for credit institutions in a stable, smooth, safe and secure manner;

b) Guide credit institutions to connect their networks with the State Bank to carry out the operations of refinancing on the basis of special bonds.

Chapter IV

IMPLEMENTATION PROVISIONS

Article 19. Effect

1. This Circular takes effect from January 17, 2023.

2. Circular No. 18/2015/TT-NHNN dated October 22, 2015, of the State Bank Governor, on refinancing on the basis of special bonds of the Vietnam Asset Management Company ceases to be effective from the effective date of this Circular.

Article 20. Organization of implementation

The Chief of Office, Director of the Monetary Policy Department, Heads of units affiliated to the State Bank; Asset Management Company and credit institutions shall implement this Circular./.

| FOR THE GOVERNOR THE DEPUTY GOVERNOR Pham Thanh Ha |

Circular 15/2022/TT-NHNN PDF (Original)

Circular 15/2022/TT-NHNN PDF (Original) Circular 15/2022/TT-NHNN DOC (Word)

Circular 15/2022/TT-NHNN DOC (Word)